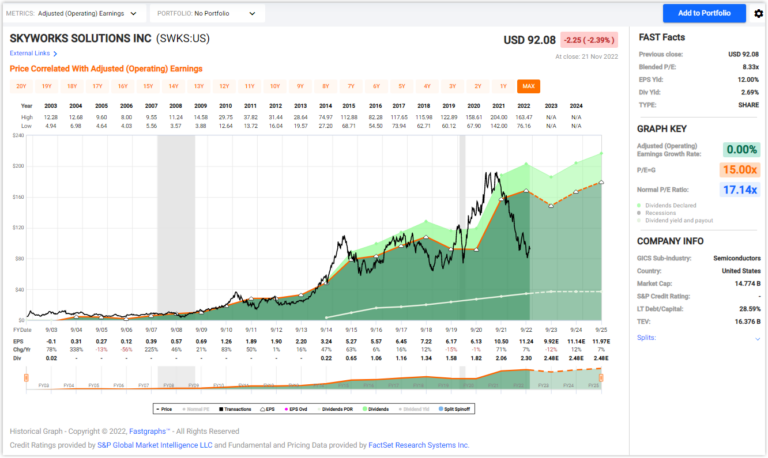

Although it is very difficult for many investors to acknowledge and/or believe that market overreactions happen, they do. Skyworks Solutions (SWKS) is expected to have a down year, notwithstanding the fact that it will be the third most profitable year in the company’s history. Nevertheless, investors and Mr. Market are pricing the stock as if it is going out of business.

Approximately one year ago at the request of subscribers I produced a video indicating that this company had become an interesting research candidate. In my view, the stock had fallen from extreme overvaluation and moved into reasonable valuation territory. Since that video was published, the economy has taken a turn for the worse and the market has been punishing tech stocks. Once the darling of the market they are now being treated as if they are plagues of the market.

In truth, I believe that this overreaction by the market has created a significant opportunity to invest in a high-quality dividend growth stock. As a result, Skyworks Solutions offers an above-average growing dividend yield and the opportunity to generate significant capital appreciation over the next several years. I believe the company’s growth prospects are well defined and intact. Therefore, prudent investors should look closely at this gift horse opportunity.

In truth, I believe that this overreaction by the market has created a significant opportunity to invest in a high-quality dividend growth stock. As a result, Skyworks Solutions offers an above-average growing dividend yield and the opportunity to generate significant capital appreciation over the next several years. I believe the company’s growth prospects are well defined and intact. Therefore, prudent investors should look closely at this gift horse opportunity.

— Chuck Carnevale

Source: FAST Graphs