When I reviewed Kroger (KR) in May 2018, I made the following concluding remarks:

At the end of the day, it’s hard to pull the trigger to invest in a supermarket chain. While Kroger has rewarded shareholders with tremendous returns over the last decade, profitable growth is likely to be more challenging over the next 10 years due to increased competition, stagnant new store growth, and evolving consumer shopping preferences.

Kroger seems like more of a mature, defensive cash cow, but its low dividend yield does not reflect that status. For now, investors may be better off invested in other quality dividend stocks that have greater pricing power, healthier balance sheets, stronger moats, faster dividend growth profiles, and numerous opportunities to increase their long-term earnings power.

More than a year later, Kroger’s stock has shed another 15%, and my thoughts haven’t changed much. Like many retailers, grocery chains are being forced to implement omnichannel strategies if they wish to survive in the digital age.

Consumers increasingly demand convenience from grocers. In-store shopping must now be complemented by curbside pickup and home delivery options, or a supermarket risks losing some of its customer base. Meanwhile, Amazon has built a strong lead in the fast-growing online grocery market with its Amazon Fresh and Prime Pantry services.

“When you look at the retail environment, it’s like driving on the Autobahn. It’s incredibly exciting. But there’s a lot going on, and it’s going on fast. Kroger is transforming our growth model. We will grow market share through both strengthening our seamless [omnichannel] ecosystem and through growing complementary businesses and partnerships that generate alternative profit streams.” – Kroger CEO Rodney McMullen

I view Kroger as one of the best-managed supermarket chains, but even it has struggled to adapt. The company delivered mid-single digit same-store sales growth throughout most of 2014 and 2015, but in recent years growth decelerated to about 1% to 2% due in part to rising competition. Meanwhile, Kroger’s store count (excluding acquisitions) has remained stagnant for more than a decade.

Demographics haven’t helped the grocer environment either.

The U.S. population grew less than 1% last year, its slowest pace in more than 80 years.

Food consumption tracks population growth, so this demographic stagnation makes the competition for existing customers all the more intense.

To protect its business, Kroger has stepped up its digital efforts and investments in retail technologies.

The company’s annual capital investments hover around $3 billion and will help Kroger provide grocery pickup and delivery programs to all households within the company’s reach by the end of 2019.

Meanwhile, Kroger’s digital sales, which include curbside pickup, have increased from $0 in 2014 to a $5 billion run rate today. Management hopes to increase that pace to $9 billion. For context, Kroger’s total revenue is approximately $121 billion.

Kroger’s investments should help keep the company relevant with consumers, but this spending has many investors concerned. Specifically, will digital and store investments generate a healthy ROI by improving Kroger’s growth, or are they just another cost of doing business in the cutthroat grocery world that will suppress the firm’s long-term profitability?

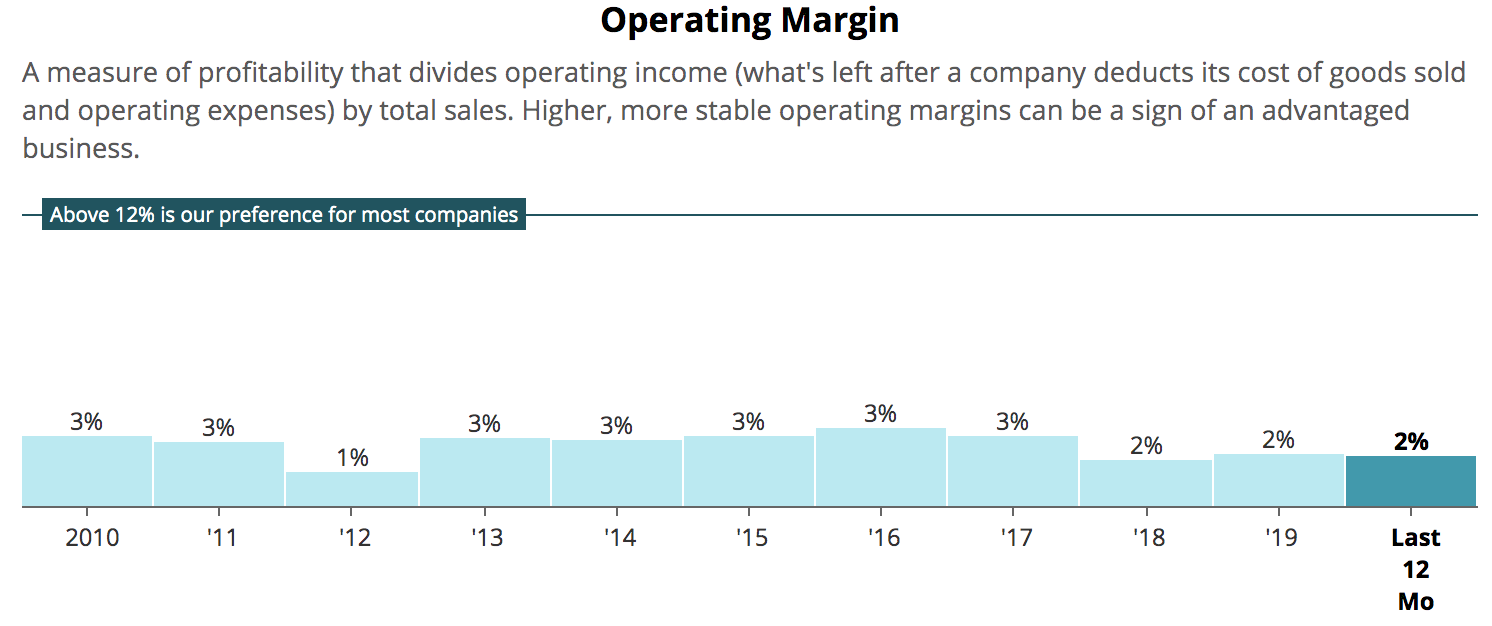

It’s too soon to say, but the supermarket’s operating margin has declined since 2016 as slowing same-store sales growth and ramping digital efforts weighed on profitability. If Kroger’s investments fail to improve revenue growth in the years ahead, then this could be the new normal for the company, and its shares look “cheap” for a reason.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

Management seems to view Kroger’s core supermarket business as more of a cost center these days, relying instead on “alternative profit streams” such as advertising and financial services to power the company’s long-term growth.

Here’s how Coresight Research described CEO McMullen’s strategy following an October 2018 investor conference:

McMullen emphasized that focusing on Kroger’s grocery business for growth is like “looking in the rearview mirror” while driving forward. He said that the company cannot rely on growth models from the past anymore and must look to alternative profit streams for the future.

Kroger’s alternative profit streams are centered around media (e.g. advertising opportunities), personal finance services (e.g. Kroger-branded credit cards), and customer data insights (e.g. help brands better market to Kroger customers).

Handling approximately 11 million transactions a day across its grocery stores, pharmacies, and fuel stations, Kroger sees opportunity to leverage its scale and customer insights to transform its business model.

If Kroger believed its digital and store investments could fuel solid same-store sales growth and margin expansion over time, it seems unlikely management would put so much emphasis on the company’s alternative businesses.

Kroger possesses some unique assets (transaction data, foot traffic, etc.) that have potential to support higher-margin activities such as marketing and advertising services, but I like investing in companies for their core businesses, not for alternatives that may or may not work out in the long term.

Management expects Kroger’s alternative profit streams to deliver an incremental $100 million in operating profit this year. The company generated $2.6 billion in operating profit last year, so this alone would represent about 4% growth, helping offset some of the pressure from digital investments.

Whether or not this type of growth can continue is anyone’s guess, but shareholders should realize and be comfortable with the fact that Kroger’s thesis will increasingly center around the success of its “alternative profit streams” rather than the profitable growth of its grocery stores.

From a financial perspective, Kroger’s supermarkets seem likely to remain cash cows, albeit at potentially lower margins going forward. The company’s payout ratio is also healthy (about 30%), and its balance sheet remains in decent enough shape to earn an investment grade credit rating from Standard & Poor’s.

In other words, Kroger’s dividend continues to look secure with modest growth potential as management attempts to revitalize the firm’s long-term outlook for profitable growth.

Overall, there’s nothing necessarily wrong with owning Kroger. The company seems likely to remain relevant and is positioned to protect its market share. However, the grocery business is a brutal one, with fierce competitors, price-sensitive customers, razor-thin margins, high fixed costs, perishable inventory, low market growth, and increasing disruption caused by online grocery sales.

For those reasons, I prefer to invest my money elsewhere. There are many quality companies in other industries that also have dividend yields near 3% but maintain clearer paths to long-term growth and have more within their control.

— Brian Bollinger

Sponsored Link: Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

Source: Simply Safe Dividends