Interest rates are soaring, the market is panicking … and dividend stocks are yesterday’s news. Right?

Yes and no.

While some double-digit paying dogs should be sold immediately—market meltdown or no—there are other stocks (here I’m talking about top-notch dividend growers) that are ripe to be bought for 25%+ upside in the next 12 months.

There’s no doubt the 10-year Treasury yield’s recent run to 2.8%, an 18% rise since January 1, has slammed the brakes on the stock-market rally and hit high-yield plays like REITs particularly hard.

10-Year Rises, High-Yielders Wobble

If you hold high-yielders in your portfolio, you know what I’m talking about.

So should you be worried? No way—and that goes double if you’re investing for the long haul.

Which brings me back to the top-notch dividend plays I just mentioned; today I want to show you two (including a bargain real estate stock with a 5.5% yield and incredible dividend growth).

First, if you’ve followed my articles on Contrarian Outlook, you probably know what I’m going to say next: while a rise in rates may temporarily hit dividend payers, they’re actually a long-term plus because they signal a strong economy.

And that way more than cancels out the resulting higher borrowing (and other) costs these companies will face.

It’s been proven over and over, including when REITs pummeled the market in the-last rising-rate period, from 2004–06.

Some Dividends Are Still Sucker’s Bets

But we still need to be careful, because some companies pay out more than they bring in through earnings per share (EPS) or free cash flow (FCF). And others are so hobbled by debt—and feeble growth—that even the slightly higher (but still low, by historical standards) rates we’re seeing now could tip their payouts over the cliff.

We’ll look at 3 of these toxic stocks now. Then we’ll move on to those 2 dividend champs I mentioned earlier.

Toxic Dividend Stock #1: CenturyLink (12% yield)

I just don’t understand what the dividend crowd sees in CenturyLink (CTL), which is still beating the S&P 500 since January 1, even with the latest market rout:

An Undeserved Win

There’s one number driving this: 12%. That’s the absurd dividend yield this telecom stock pays. And as I told you on January 23, CenturyLink’s payout is having a classic Wile E. Coyote moment.

That’s because the company can’t count on rising sales (revenue dropped 8% in the third quarter), EPS (down 39%) or FCF (down 41.4%) to backstop its payout. No wonder it’s paying out a totally unsustainable 253% of trailing-twelve-month FCF and 373% of EPS as dividends!

My take? Don’t be taken in by CenturyLink’s eye-popping yield and deceptively cheap forward P/E of 12. This stock is cheap for a reason: its payout is on borrowed time.

Toxic Dividend #2: Tupperware Brands (5.0% yield)

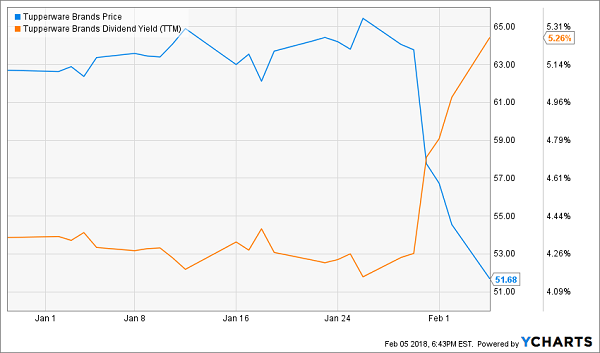

Tupperware Brands’ (TUP) dividend yield has lurched to 5.0%, but that’s not because the plastic-container peddler just gave investors a fat raise—it’s because the stock has cratered 20% since January 30!

Not the Payout Pop You Want

The reason? On top of the broader market wipeout, TUP’s Q4 earnings report left the herd cold: even though adjusted EPS jumped 10%, to $1.59, revenue fell 2%, meaning cost cuts, not sales growth, puffed up the bottom line.

The company’s forecast was also bland: the midpoint of expected 2018 EPS, $4.58, was just 4% higher than the $4.41 TUP earned last year! That’s just not enough to lift the dividend. And if TUP comes up short, a payout cut is definitely in play, given the 96% of FCF the dividend ate up in the last 12 months.

One thing that could whack TUP’s earnings forecast is its high exposure to volatile emerging markets (and their currencies): around 67% of sales. That’s just too risky for my taste—especially when there are fast-growing (and safe) payouts available, like the two I’ll show you further on.

Meantime, we need to talk about…

Toxic Dividend #3: Kraft-Heinz (3.2% yield)

Kraft-Heinz (KHC): To see how the game has changed for food stocks like KHC, look no further than the closest supermarket; people are clearly craving more natural food and less processed fare.

And Kraft-Heinz’s banners are way behind the curve.

Yesterday’s Brands

Source: kraftheinzcompany.com

Source: kraftheinzcompany.com

No wonder the consumer-staples giant is showing the same pattern we saw with Tupperware: rising earnings propped up by cost cuts, not growth. In Q3, Kraft-Heinz’s sales dipped 1.7%, while adjusted EPS soared 15%.

Which brings me to the dividend: in the last 12 months, Kraft-Heinz paid out a worrying 92% of earnings and 126% of FCF to shareholders!

Sure, Berkshire Hathaway (BRK.B) is a major KHC shareholder, but that’s not enough to offset the company’s weak growth, ho-hum 3.2% yield and the very real chance payout growth will stall—if not reverse—knocking down the share price when it does.

Which brings me to…

2 Cheap Dividend Champs to Put on Your Buy List

Now that we know what to keep out of our portfolio, let’s pivot to 2 dividend payers positioned to thrive as rates head higher, starting with one you really need to move on in the next couple days.

Dividend Champ #1: Brookfield Property Partners (5.5% yield)

I recommended Brookfield Property Partners (BPY), owner of malls, office towers, warehouses and apartments the world over, in a September article for 3 reasons:

- A healthy dividend (5.5% as I write).

- Strong payout growth, with the dividend up 18% since BPY was spun off from Brookfield Asset Management (BAM) in 2013; and

- Low volatility. You can practically set your watch by this one!

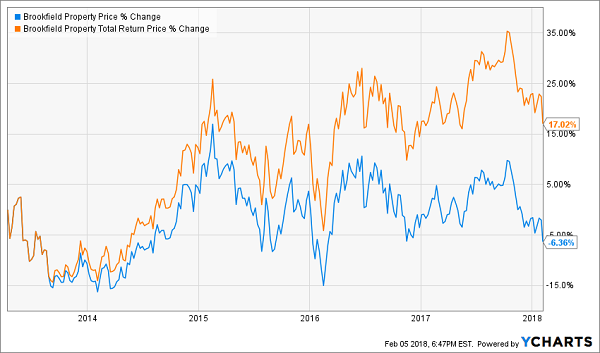

A Steady Course

Don’t take this to mean you would have lost money with Brookfield! Because when you add in that nice dividend, you get this:

BPY’s True Gain

I know what you’re thinking: that rise still trails the S&P 500, which was up some 85%in that time. But keep in mind that BPY’s return was in cash, while folks holding your average S&P 500 name were stuck with a pathetic sub-2% payout.

Besides, that disrespect is what’s behind our opportunity. Because BPY (technically a partnership, not a REIT) trades at 72% of book value (or what it would be worth if it were broken up and sold off today).

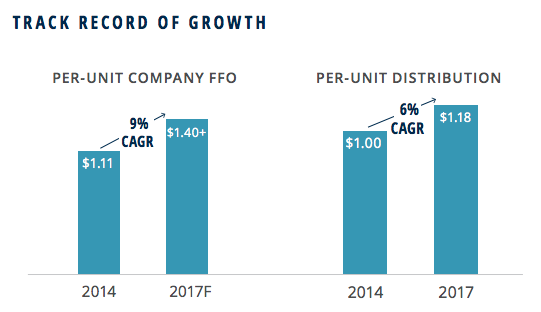

That’s ridiculous for the company’s top-notch portfolio, which is throwing off high-single-digit growth in funds from operations (FFO, a better measure of BPY’s performance than EPS) and a soaring dividend payout!

Management knows the score: they’re calling for 8% to 11% yearly FFO growth through 2021, and yearly dividend hikes of 5% to 8% to match. With BPY’s next payout increase set to be announced February 8, the time to buy is now.

Dividend Champ #2: Ecolab (1.2% Yield)

Ecolab (ECL) isn’t the sexiest company out there: it peddles water-treatment products, cleaners and lubricants, as well as services that help cut use of water and other resources. It has clients in dozens of industries, from manufacturers to food makers.

The stock’s yield is also a yawner for most dividend fans, at just 1.2%.

But if either so-called weakness keeps you away, you’re making a mistake.

For one steady demand for Ecolab’s products mean the company is a free-cash-flow machine, with FCF more than doubling in the last decade:

A Cash Cow

And don’t be fooled by that low dividend yield; it masks a payout that’s surged higher every single year for the last 25 years. It’s nearly doubled in the last 5 years alone, including a hefty 11% hike in December.

Those payout hikes will continue, thanks to growing sales as the global economy takes off. Ecolab saw higher revenue across all 3 of its divisions—Global Energy, Global Industrial and Global Institutional—in Q3.

Wall Street thinks the party’s just starting, too, and for once, I agree. The average analyst estimate calls for EPS of $5.34 for 2018, up nearly 14% from a forecast $4.69 in 2017. (ECL reports Q4 earnings February 20).

Throw in a ridiculously low payout ratio of 33% of earnings (and 41% of FCF), and further dividend growth is a lock. And that, in turn, will drive more of the market-crushing share-price gains ECL shareholders love:

Stock Price Climbs the Dividend Ladder

— Brett Owens

How to Make an Easy 12% a Year Forever [sponsor]

Dividend growth like you’d get from Ecolab (and even faster) is precisely what’s behind the portfolio I want to show you now: it’s a set of 7 ultra-conservative stocks I personally handpicked to deliver you 12% in safe, annual returns for life.

That’s 3 times more income than most retirement experts say you need!

So what stocks am I talking about?

You won’t find weak pundit favorites like Kraft-Heinz in this “12% for Life” portfolio. Instead, you get these 3 picks (and 4 MORE, to boot!):

- A stock that has already boosted its dividend payments more than 800% over the past 4 years and has at least another decade of double-digit growth left!

- A “double threat” income-and-growth stock that rose more than 252% the last time it was anywhere near as cheap as it is right now!

- A 9%-plus payer that raises its dividend more than once a year—and will double its payout by 2021 at its current pace!

This portfolio is perfect for retirement because it gives you the best aspects of numerous types of investment strategies—income, growth and nest-egg protection!

And as I said, it provides 3 times more income than most retirement experts say you need!

Let me steer you toward double-digit returns you can depend on. Click here and I’ll GIVE you 3 Special Reports that reveal how to earn 12% for life. You’ll get the names, tickers and my complete analysis of these 7 incredible dividend growers FREE!

Source: Contrarian Outlook