Did you come through this week’s market volatility with flying colors?

I sure hope so.

We’ve talked about how you handle big down days many times and, today, that’s what we’re going to talk about again.

This is important stuff because what you do when the markets get a bad case of the jitters can significantly boost your profits.

To be fair, I get that a downdraft is scary.

You’re not alone if you feel that way – in fact, I feel the same angst you do.

There’s always a fear that there’s something worse ahead… another shoe to drop… a shark lurking unseen beneath you in the financial ocean.

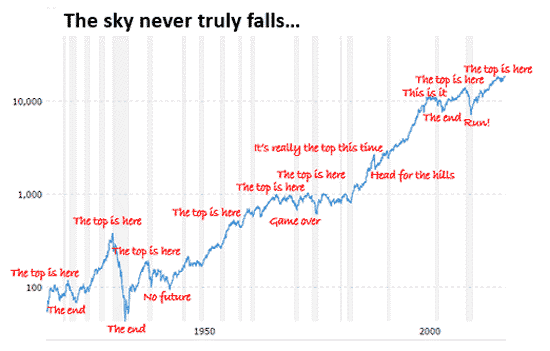

That’s rarely the case.

More often than not, any downdraft is short-lived for two reasons:

- It’s related to a short-term change in market conditions; and,

- Today’s trading computers rapidly adjust.

That means capital will come rushing back in when things calm down, as long as there aren’t any systemic risks.

I get asked frequently how you can know the difference between short-term market risks and longer-term systemic risks. That’s a great question with a simple answer that can make or break your profits.

Short-term risks are typically situational. They are typically driven by data points like a change in interest rates, rumors, or even somebody with “fat fingers” – a trading expression meaning they’ve entered a large order by mistake that gets executed before it can be corrected or removed.

The litmus test is simple.

If whatever’s happened does not disturb the long-term business case for the stocks you own and the recommendations we follow, then it’s a short-term disturbance and a great buying opportunity.

Long-term risks are systemic, meaning they’re system-wide and impact everything. Examples include the complete breakdown of derivatives trading that led to the global financial crisis in 2008. War, a bioweapon, or plague would do it, too.

In this case – meaning early last week – traders and the computers that support them with hundreds of billions on the line had to adjust to a change in longer-term interest rates. That means huge buy and sell programs came online automatically to rebalance in accordance with the risk-reward programs that drive them.

The sell-off was exacerbated by Amazon.com Inc.’s (Nasdaq: AMZN) joint healthcare announcement with Berkshire Hathaway Inc. (NYSE: BRK.B) and JPMorgan, Chase & Co. (NYSE: JPM) because that, in turn, caused still more rebalancing. Companies like Cigna Corp. (NYSE: CI), CVS Health Corp. (NYSE: CVS), and UnitedHealth Group Inc. (NYSE: UNH) are all broadly held – which means billions of dollars came into play when they came under extreme pressure almost instantly.

Three Ways to Position Yourself for Profits Immediately

The best way to prepare for a pullback is to do so when the markets are in “rally mode” – meaning headed sharply higher. That’s when you’re going to want to take action.

First, prepare your trailing stops so that you don’t have to think about whether or not to sell something in the heat of the moment as a means of protecting your profits and your capital. Then, sit back and let the markets handle that for you automatically.

This is a win-win. If your stops are not hit, you’re still “in to win” for more profits. If they are hit, then congratulations – you’ve got a fresh pile of profits to reinvest in the next great investment opportunity.

Second, keep a list of companies you want to buy at lower prices if you are given the chance. I’m thinking Amazon at $1,000 (it trades at $1,390 as I type), Alphabet at $900 (trading at $1,181.48)… you get the idea. Buy the stuff you want when it gets put “on sale.”

You can stage those orders ahead of time by entering lowball orders or even selling cash-secured puts – both of which are favorite Total Wealth Tactics.

It’s important that you stay strong and remove your emotions from the equation. I know it can be scary to buy in as everyone else hits the sell button, but that’s exactly what you need to do for maximum profits.

“Buy low and sell high” is how you win!

We follow the Six Unstoppable Trends we do because they are each backed by trillions of dollars that will get spent practically no matter what happens in the markets, what Wall Street does, or even what’s happening in Washington. Anything else… well, good luck.

And, third, reorient your thinking.

Pullbacks would last days or even weeks in the old days, but today they can last a matter of hours or even just minutes. Estimates vary but roughly 70% or more of all trading activity is now computerized, which means that you may not get the chance to act unless you’ve prepared ahead of time.

So what’s next?

The big money has already moved right back into three key areas we talk about all the time – big tech, big defense, and big medicine – and continues to pile in.

The common denominator is game-changing technology. Everything – from artificial intelligence (AI) to cloud computing – comes into play because those are the things that boost top-line sales, improve bottom line results and, of course, create growing earnings.

Prices are sure to follow along just like they always do.

In closing, I regularly hear from investors all over the world who tell me that buying into a huge decline is risky. And that’s entirely true… just not like most people think…

Missing out on upside is far riskier.

Besides, there’s nothing that says you have to buy in all at once. Dip your feet in the water first if you like. Heck, even just your little toe is a good start!

— Keith Fitz-Gerald

Source: Money Morning