Pity the American bank stock investor. Since January, the KBW Nasdaq Bank Index has fallen 20% on fears of bank contagion. And many regional banks still trade for fractions of their pre-March levels. Shares of First Republic Bank (NYSE:FRC) — which once changed hands at $120 apiece — are now available for less than the cost of a movie ticket.

Long-term investors have been equally disappointed by this tragic movie. The same KBW Bank Index has returned negative 4% since January 2008. It has been a terrible 15 years for an industry that historically showered its shareholders with fat dividends.

Still, selective investors have profited in the more recent past. JPMorgan (NYSE:JPM) stock has risen around 200% since January 2008, beating the S&P 500. Smaller banks like BancFirst Corporation (NASDAQ:BANF) and First Citizens BancShares (NASDAQ:FCNCA) have done even better. Investors in the latter have seen almost 600% returns as of this writing.

Which Banks Are Good Investments?

High-quality banks can be excellent investments. Well-run financial institutions like the three above are Perpetual Money Machines — companies that earn high returns and reinvest their earnings at equally high rates. It’s a virtuous cycle where high profits create even more in the future, thanks to the power of compound interest. And financial institutions remain a critical part of any functioning economy; profitable players will eventually come out ahead.

The data backs this up. According to my quantitative Profit & Protection stock selection system, bank stocks in the top quintile of return on equity (ROE) — the most profitable — rise in value almost 25% faster than the average Russell 3000 firm. Such effects are even more substantial at insurance companies. Having an average-looking balance sheet also helps — the most leveraged banks underperform their slightly less-leveraged counterparts by around 0.5% per year, despite leverage being essential to juicing returns.

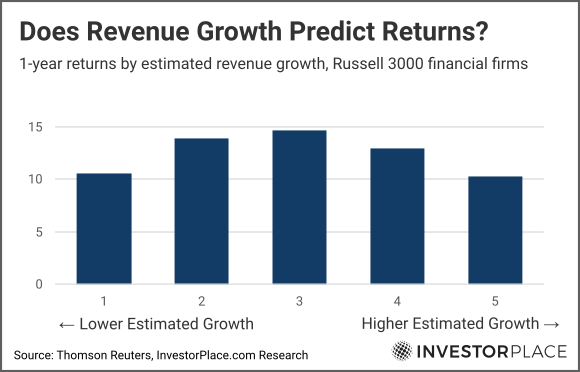

That also means medium-growth banks tend to outperform their faster-growing counterparts. The same Profit & Protection method finds that financial firms in the highest quintile of growth are some of the worst investments to buy. It’s an odd set of rules that don’t exist in the broader stock market.

That means experienced bank investors have generally stumbled on the same idea: The best bank stocks to buy (or at least the most consistent performers) are the profitable ones that prioritize safety over growth.

That means experienced bank investors have generally stumbled on the same idea: The best bank stocks to buy (or at least the most consistent performers) are the profitable ones that prioritize safety over growth.

What Are the Risks of Buying Bank Stocks?

Of course, there are several issues with buying bank stocks. They include:

- High Leverage. The banking business requires leverage to turn borrowed money into profits. The average U.S. bank only has a 10% equity cushion, according to data from Thomson Reuters.

- Accounting Opacity. Modern accounting rules struggle to capture the full extent of banking assets. Risky assets like credit default swaps and cryptocurrency can hide on a bank’s balance sheet for years with scant disclosure.

- Regulatory Risks. Higher capital requirements can dampen bank profits. The average bank return on equity (ROE) collapsed from around 14% to 10% since 2008, causing years of underperformance.

The most critical risk, however, is that bank assets are more like a probability distribution of values rather than a knowable figure. For instance, a bank’s book of credit card loans might have a historical default rate of 3%. But recording a $100 million portfolio of these loans at $97 million only captures one possible value — $100 million minus 3% of its value. The value could be higher; credit card default rates could suddenly drop to 2%, or even 1% in a strengthening economy. That would make the portfolio worth closer to $98 million or $99 million.

But default rates could also rise to 10%… 15%… 20% or more if a sudden recession hits. Suddenly, that same $100 million credit card portfolio is only worth $80 million or less. And because most banks operate with only a 10% capital cushion, shareholders can be instantly wiped out in a disaster.

The 25 Safest Bank Stocks in America Right Now

That makes it essential for long-term investors to buy high-quality banks with wide margins of safety. If a bank gets its asset valuations wrong, investors want to ensure that the firm can absorb the loss.

Some metrics are helpful as proxies. Strong returns on equity and moderate debt-to-equity ratios are signs of better capital cushions. A highly profitable bank could theoretically “earn” its way out of a significant loss and a low-leverage bank can quickly raise capital in a pinch.

Other metrics are more straightforward. High loan loss provisions relative to net write-offs indicate stronger capital buffers. And a smaller held-to-maturity portfolio tends to insulate institutions from rising interest rates.

No single metric is perfect, of course. An enterprising bank can hide bad loans by simply not recognizing defaults. (Many Japanese banks have this deep-rooted problem). And liabilities like cryptocurrency and large uninsured accounts are “invisible” to public investors due to the limitations of U.S. Securities and Exchange Commission (SEC) reporting. Nevertheless, these metrics still indicate the 25 safest bank stocks to buy now.

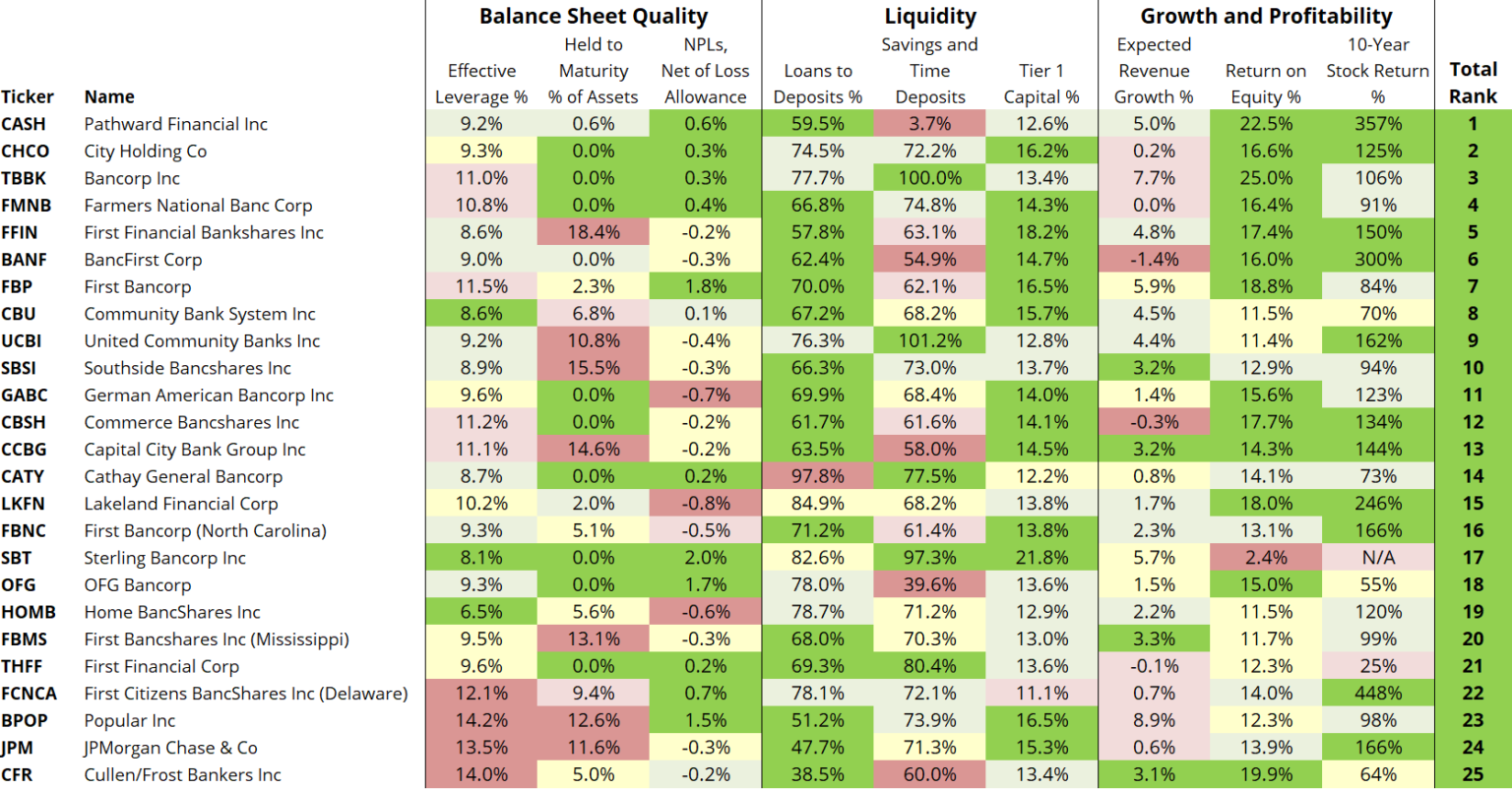

Below is my version of a recent Financial Times analysis of the U.S. regional banking sector. The chart expands on their methodology by applying Profit & Protection metrics that grade companies based on their long-run returns.

Readers will immediately notice similarities beyond the visual aids. Many companies are similar, with FirstBancorp (NASDAQ:FBNC) and First Financial (NASDAQ:FFIN) taking top spots. It turns out that healthy banks also make attractive long-term investments. And the color coding is the same, thanks to my lack of artistic ability.

Readers will immediately notice similarities beyond the visual aids. Many companies are similar, with FirstBancorp (NASDAQ:FBNC) and First Financial (NASDAQ:FFIN) taking top spots. It turns out that healthy banks also make attractive long-term investments. And the color coding is the same, thanks to my lack of artistic ability.

But there are also some notable differences. Many smaller banks take top spots. And so do larger firms like Puerto Rican bank Popular (NASDAQ:BPOP) and JPMorgan. The system is agnostic to size, since capital risk is a more critical issue.

Long-term returns also matter a great deal. Pathward Financial (NASDAQ:CASH) takes the top spot for its high long-term returns, despite having slightly worse liquidity than its peers.

Is First Republic Bank a Good Investment?

The system is also relatively downbeat about riskier stocks, such as First Republic Bank and other teetering firms. FRC ranks 221 out of 222 banks, while PacWest Bancorp (NASDAQ:PACW) comes in at 183.

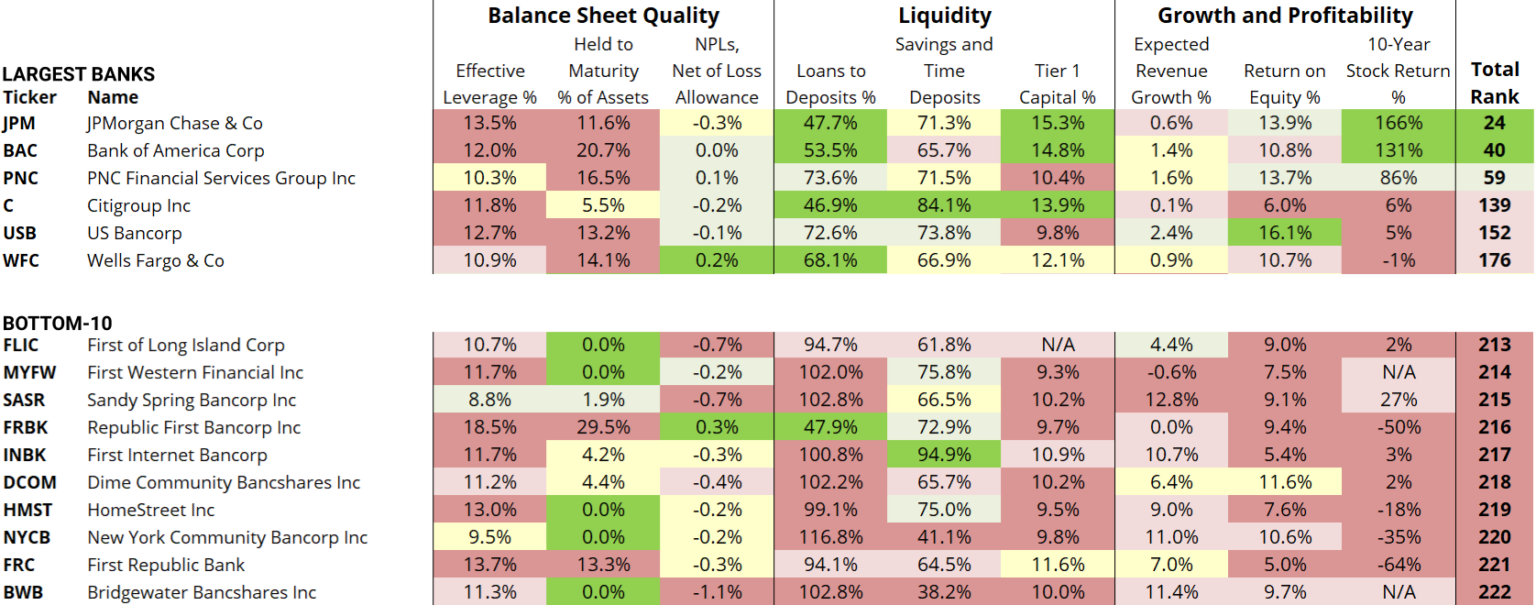

Failed banks, such as Silicon Valley Bank parent SVB Financial (OTCMKTS:SIVBQ) and Signature Bank (OTCMKTS:SBNY) would have also scored poorly using figures reported before the March crisis. The pair rank solidly in the bottom quintile of all American banks.

That means there’s still plenty of risk in the U.S. banking system. Some of America’s largest banks score astonishingly poorly, with Wells Fargo (NYSE:WFC) teetering in the bottom 25% of all banks. Even U.S. Bancorp (NYSE:USB), once known for its fast growth, is struggling to show returns.

Should Investors Buy Bank Stocks Now?

Should Investors Buy Bank Stocks Now?

Investors have plenty of opportunities to profit from bank stocks. Many of the top 25 safest banks in America trade for a discount relative to their January prices. Ranked seventh, First Bancorp has lost 14% this year and trades for under 8.5X price-to-earnings (P/E). Cathay General Bancorp (NASDAQ:CATY) trades for even cheaper.

Meanwhile, some of the riskiest banks continue to trade for elevated valuations. Ranked 220th, New York Community Bank (NYSE:NYCB) spiked 40% in March after agreeing to purchase assets of the failed New York-based Signature Bank. But investors need to remember that combining two risky banks doesn’t necessarily make a single safe one. And the large amount of held-to-maturity assets at the largest U.S. banks means there’s still plenty of unrealized losses that will eventually bite.

As always, my Profit & Protection stock-picking system urges investors to understand what has worked in the past and to stick with winning formulas for success. You might not get a 100% win rate. But even getting a small edge can make a massive difference over time.

— Thomas Yeung

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place