Since bottoming on March 23, 2020, the S&P 500 has risen 57.5% – setting an all-time high in the process. Money has been flowing into the market, but the big question on the table is: Where?

Technology might be the first area that comes to your mind, but as I’m about to show you with today’s sector analysis, there are a few others that have led the market’s meteoric recovery.

And one stands out to me as the hottest sector of 2020.

It shot to the moon this year and will keep going. So I dug deeper to find this sector’s top five stocks you can grab to take advantage of this now…

This Sector’s Growth Won’t Stop

You know the age-old adage, “Birds of a feather flock together”? Well, the same can be said for stocks in the same sector – and this is where we will find our profit opportunity.

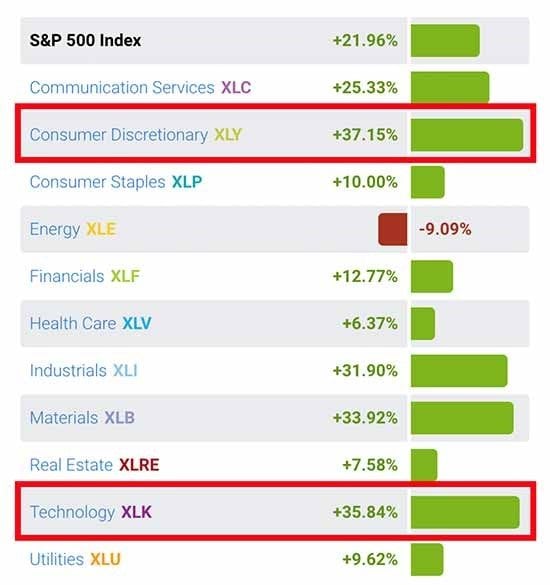

The Select Sector SPDR’s website offers a free and reliable sector analysis, so let’s take a look. Here is a six-month view of the Sector SPDRs:

Taken from www.sectorspdr.com

Taken from www.sectorspdr.com

As you can see, every sector except energy has risen over the past six months. This should come as no surprise considering how far the market has moved since March.

The top two most bullish sectors are the Select Sector SPDR Trust Consumer Discretionary ETF (NYSE: XLY) and the Select Sector SPDR Trust Technology (NYSE: XLK), rising 37.15% and 35.84%, respectively.

If you consider the “stay at home” impact of COVID-19, it just makes sense. People are on the Internet buying stuff that they really don’t need – i.e., discretionary stuff.

According to a report from CNBC, 64% of Americans have changed their spending habits since February, and I think we can all say that we’ve contributed to that.

I’m not a betting man, but I’d put money on the fact that you’ve probably purchased some things to make your “stay and work from home” situation a little easier to swallow. Maybe a new pair of sweatpants to make WFH on the couch a little cozier, or some games to keep the kiddos entertained. Maybe you got ambitious and finished that spare bedroom you’ve been meaning to get to. I bet one or two of you even hopped on the bread-making train and put in an Amazon order for some baking trays and mixing bowls.

I know I am at the point that I have my credit card numbers memorized – a point I certainly never thought I’d get to.

This type of spending is the basic driving force behind these two sectors.

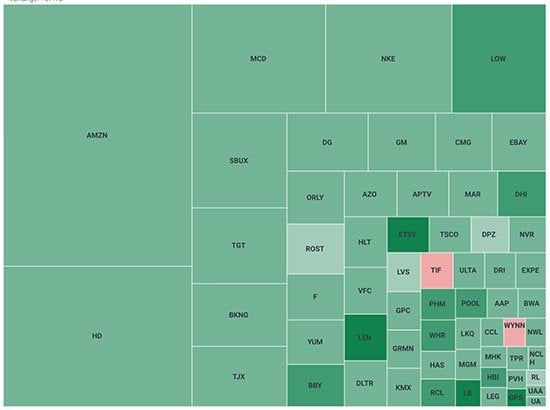

Let’s look under the covers at the leading sector, Consumer Discretionary, using a sector heat map:

Taken from www.sectorspdr.com

Taken from www.sectorspdr.com

Bigger boxes mean bigger market caps and vice versa. The darker green, the more bullish the stock.

So, although Amazon.com Inc. (NASDAQ: AMZN) is the biggest company in the sector and has performed well over the past six months, it has not performed as well as these others…

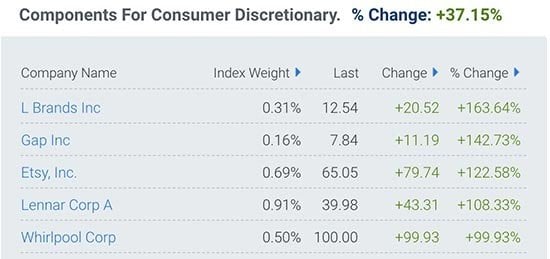

Consumer Discretionary’s Top-Five Performing Stocks

Each of these five stocks has at least doubled over the past six months.

Each of these five stocks has at least doubled over the past six months.

And we can expect more upside from here in these leaders of the leading pack. Bottom line, buying any of these stocks is a great move.

L Brands Inc. (NYSE: LB) is a global woman’s apparel and beauty products retail holding company that includes brands like Victoria’s Secret, Bath & Body Works, La Senza, and Henri Bendel.

LB has risen 163.64% over the past six months and is leading the discretionary pack. It’s likely that it’ll continue to lead and is currently only trading at about $32 a share!

The top five also include clothing retailer Gap Inc. (NYSE: GPS), which has benefited from increased online shopping sales, and homebuilder Lennar Corp. (NYSE: LEN), which has skyrocketed from increased home sales.

Want more diversity?

Trade the XLY. Although it hasn’t risen as much as the top five, it’s not subject to sudden moves that individual stocks can suffer, and it’ll continue to rise as money is funneled into the hottest sector of 2020.

This same trading logic can be used in the Tech sector, which is just as bullish as Consumer Discretionary.

— Tom Gentile

Source: Money Morning

Taken from www.sectorspdr.com

Taken from www.sectorspdr.com