President Donald Trump and Chinese President Xi Jinping have agreed to disagree.

For now. Is this a big deal, little deal or no deal for our dividends?

The outcome wasn’t much of a surprise. Stocks have done their part by politely rallying.

My real concern is the lack of dividend deals left on the big board.

The S&P 500 is up almost 18% year-to-date. Sure, stocks were due for a bounce heading into the year (as we discussed in late December.)

But still, a relentless rally wipes out a lot of bargains.

Remember the sale on industrial cash cow Ingersoll Rand (IR)? The maker of heating, ventilation and air conditioning (HVAC) units (which it sells to the US and China) was unfairly punished by trade worries as recently as a few months back.

I wrote in this column as well as in my dividend growth service Hidden Yields:

While worries may have weighed on IR shares in 2018, they were misguided. IR smartly makes most of the products in the US that it sells in the US; it does the same in the Chinese market.

So how much of a value did the trade sabre rattling present? A lot. Shares haven’t “kept up” with their payout so there is significant upside unaccounted for. (Hint, hint: Investors are positioned to catch that upside thanks to the power of this stock’s dividend magnet.)

IR’s Dividend Magnet Will Pull Shares Higher

Boy did that magnet pull IR’s price higher. My Hidden Yields subscribers have enjoyed 20% gains since my March recommendation!

The company is still a good buy today, but no longer a short-term slam-dunk.

To find dividend deals for the back half of this year, we need to think outside the box.

To get there, we’ll start with the ever-changing packaging that is the Federal Reserve.

What to Buy with Stocks Soaring and the Fed Ready to Cut

The Fed is about to cut rates with a soaring stock market.

This rare event has happened several times before; it’s usually a great buying opportunity.

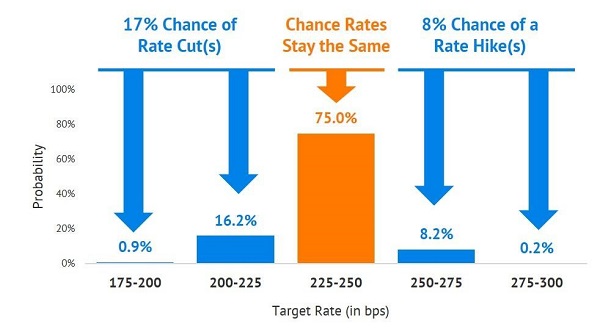

Just five months ago, the market was pricing in “no movement” from Fed Chair Jay Powell for the next calendar year. Here were the future rate bets in February:

The Fed’s Recent Tough Talk…

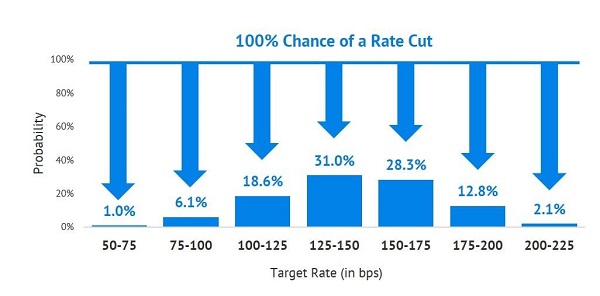

But thanks to “Powell’s pivot” (whether thanks to his newfound willingness to listen to the markets, or his desire to keep his job!) we have the market now pricing in three to four rate cuts over the next nine months (by April 2020):

… Quickly Turned to Pillow Talk!

The market has been ahead of the microphone attached to the Fed Chairman. In typical all-knowing fashion, it priced in his words before he’s actually uttered them!

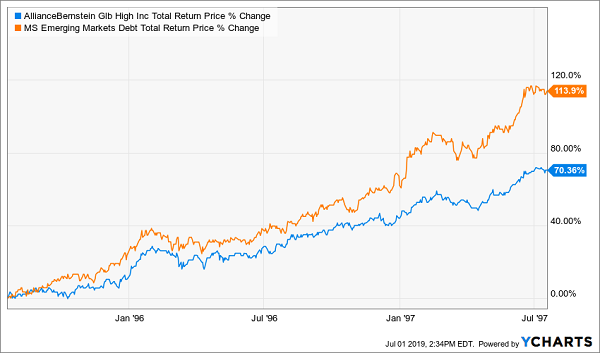

My quant friend Troy Bombardia (bullmarkets.co), points out that the last time the Fed cut rates while markets soared, the market caught a further updraft and popped 21% one year. For you trivia buffs, this “last instance” was the July 1995 rate cut. (You can get the whole story in Troy’s June 24 article here.)

Is history set to repeat? Powell is turning on the short-term money faucet, but where will the money flow that it hasn’t already? My bet is emerging markets (EM).

But I’m not buying risky overseas stocks. Why would I when I can invest in safe, underappreciated overseas bonds? With a single-click of the mouse, you can hire a top-notch fixed income manager who will handpick an EM bond portfolio for you for free.

Income investors who followed this strategy in July 1995 enjoyed a summer of BBQ bragging. Their stock jock friends couldn’t compete with these 92% average total returns and 10%+ annual cash yields!

How to Average 92% Returns (in 2 Years!) with Safe Bonds

These two funds yield more than 6% today on average, and you can buy them for just 89 cents on the dollar. In other words, you can bank $0.11 free for every $1 in high paying bonds you buy! Which is plenty to cover fees and bake in some price appreciation potential as this discount window closes.

How is this possible? Well, these closed-end funds (CEFs) have fixed sets of shares. They can trade at, above or below the value of their underlying assets. The trick is to find great funds at meaningful discounts.

It’s easier said than done, especially today. For example, many of PIMCO’s popular bond funds trade at premiums. In fact, investors are currently paying $1.37 for a dollar of assets in PIMCO’s Strategic Income Fund (RCS). Maybe it’ll work out for them, but high-priced CEFs are similar to high-flying stocks with big price-to-earnings ratios. What’s to say RCS won’t fetch a “mere” 9% premium someday? That’d be a 25% price haircut from today’s levels.

We don’t have this problem with EM bond funds today, thanks to them being out of favor in recent years. I don’t expect the deal to last forever, though. Every day the market ticks higher increases the odds of these hidden income gems being discovered by the mainstream financial media.

— Brett Owens

How to Retire on 8% Dividends (Paid Monthly!) [sponsor]

EM bond funds also tend to pay monthly, making them timely plays in my “8%+ Monthly Payer Portfolio.” (My service dedicated to helping investors retire on monthly dividend checks.)

What else looks good given Powell’s pivot? Let’s also discuss my two favorite preferred stock plays, each which delivers safe yields of more than 7%. This means you can take a modest $500,000 nest egg and turn it into roughly $3,300 in monthly dividend income.

This big-dividend strategy delivers a monster average annual yield of 7.6%. If that’s all the portfolio did, you’d already be well ahead of 95% of retirement investors. But that doesn’t even include the additional average upside in these winners that will expand your nest egg.

Thanks to these 8% monthly dividends with price upside, my 8% Monthly Payer Portfolio has delivered 10.9% returns per year since inception.

With these returns you can live off a $500,000 portfolio forever. To get started, just follow these two simple steps:

- Sell your “buy and hope” stocks: The financial media has pushed so-called “safe plays” like Procter & Gamble (PG), Kraft (KHC) and Coca-Cola (KO) onto investors for years. But these companies don’t deliver the kind of yield you need to maintain your current quality of life in retirement.

- Buy my 8 favorite monthly dividend payers.

That’s really, truly it.

This portfolio includes some other amazing dividend stocks, too, including:

- An 8.6% payer that’s set to rake in huge profits from an artificially depressed sector,

- The brainchild of one of the top fund managers on the planet that pays an incredible 9.1%,

- And a rock-steady 7.2% dividend trading at a massive discount to NAV.

Get these and the other monthly dividend picks, including two rock-solid preferred-stock plays and unlock $3,300 in monthly income right now – for free! Click here to receive each and every pick in my 8% Monthly Payer Portfolio–complete with tickers, buy prices and full analyses–at absolutely NO COST to you.

Source: Contrarian Outlook