Is it time to tariff-proof our dividends (again)?

Let’s look at our favorite payers with respect to a potential trade war.

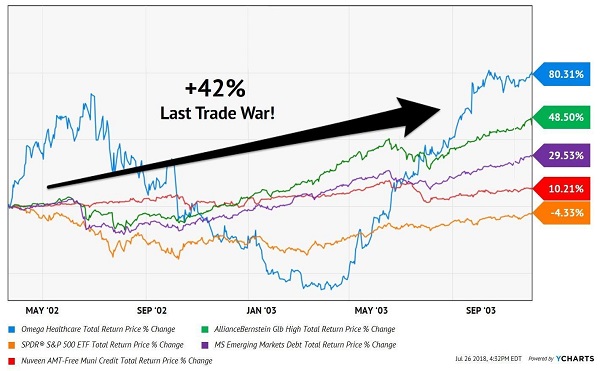

Could tariffs derail the 7.2% gravy train I’ve put together for you? Let’s rewind to the last time protectionism flared in America, 17 years ago, to see how some of our stocks and funds performed during the last trade tiff.

On March 20, 2002, President George W. Bush whacked steel imports with tariffs ranging from 8% to 20%. The duties stayed in effect until December 4, 2003. The European Union was unamused and hit back with tariffs of its own.

So what happened to the S&P 500 during the last tariff tantrum? It dropped 4.3% during the 21-month period (orange line in the chart below).

But many stocks did fine, and many of our Contrarian Income Report holdings simply hummed along. In fact, four of our stocks and funds saw the trade drama firsthand–and simply shrugged it off for an average return of 42.1% including dividends!

No Withdrawal Favorites Had No Problem with Tariffs

This four-pack generates its income (and 6.2% yields) from skilled-nursing facilities, high quality municipal bonds and underappreciated overseas credit. It won’t matter what happens between the US and China. These stocks and funds won’t have their cash flows interrupted, which means their dividends and prices will be just fine.

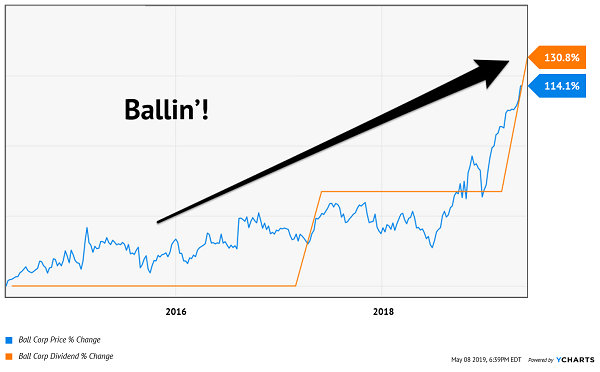

Same goes for “sneaky megatrend” play Ball Corp (BLL). Walk down any beverage aisle and you’ll notice that cans are becoming increasingly popular. More and more firms are trying to substitute recycle-friendly aluminum for plastic bottles. Cans are also getting a boost in emerging markets as they replace generic glass bottles.

The king of cans is swimming in cash, and its leadership is looking to its dividend as a share-price flotation device. They just hiked the dividend by an astounding 50%!

Ball’s Dividend Bumps Another +50%

Shares impressively climbed during these two trade-worry weeks, a sign that cans should carry the day for a higher Ball price.

How about fellow industrial cash cow Ingersoll Rand (IR)? The firm manufactures heating, ventilation and air conditioning (HVAC) units and sells them to the US and China.

While worries may have weighed on IR shares in 2018, they were misguided. IR smartly makes most of the products in the US that it sells in the US; it does the same in the Chinese market.

So how much of a value did the trade sabre rattling present? A lot. Shares haven’t “kept up” with their payout so there is significant upside unaccounted for. (Hint, hint: Investors are positioned to catch that upside thanks to the power of this stock’s dividend magnet:)

IR’s Dividend Magnet Will Pull Shares Higher

Bottom line, I wouldn’t get too worked up over this pullback. We were due for it because:

- Markets had rallied nonstop since Christmas. This resulted in

- Overwhelming positive sentiment, which is usually a dead-on contrarian indicator at its extremes.

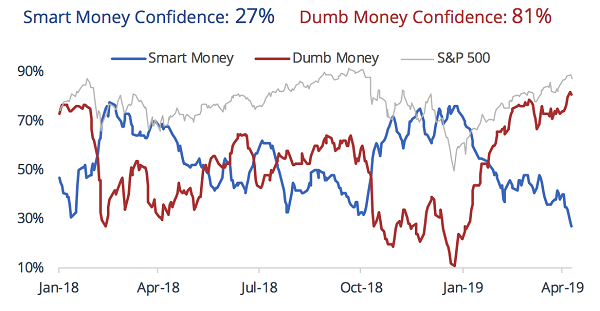

And extreme it was! I wrote about the importance of pullback-proofing our portfolios several weeks ago:

“Dumb money” hasn’t been this confident of further market gains since January 2018! Dumb was dumber back then, because stocks promptly collapsed:

Source: Sundial Capital

(By the way, many individual investors would be categorized as “dumb money” because they get greedy when markets are hot and tend to buy high. The best professionals, on the other hand, smartly buy the dips. They are contrarians like us!)

Remember, stock prices can fly all over the place in the short run (days, weeks and months). If broader sentiment is too rosy they may fall in unison. Trade war worries may unfairly slap down shares, as we saw in the case of IR.

But over the long run (years), fundamentals drive stock prices. And what’s more fundamental than dividends?

— Brett Owens

Introducing the “2008-Proof” Income Portfolio Paying 7.5% [sponsor]

The “cash or bear market” no-win quandary inspired me to put together my 5-stock “2008-Proof” portfolio, which I’m going to GIVE you today.

These 5 income wonders deliver 2 things most “blue-chip pretenders” don’t, such as:

- Rock-solid (and growing) 7.5% average cash dividends (more than my portfolio’s average).

- A share price that doesn’t crumble beneath your feet while you’re collecting these massive payouts. In fact, you can bank on 7% to 15% yearly price upside from these five “steady Eddie” picks.

With the Dow regularly lurching a stomach-churning 1,000 points (or more) in a single day during pullbacks, I’m sure a safe—and growing—7.5% every single year would have a lot of appeal.

And remember, 7.5% is just the average! One of these titans pays a SAFE 8.5%.

Think about that for a second: buy this incredible stock now and every single year, nearly 9% of your original buy boomerangs straight back to you in CASH.

If that’s not the very definition of safety, I don’t know what is.

These five stout stocks have sailed through meltdown after meltdown with their share prices intact, doling out huge cash dividends the entire time. Owners of these amazing “2008-proof” plays might have wondered what all the fuss was about!

These five “2008-proof” wonders give you the best of both worlds: a 7.5% CASH dividend that jumps year in and year out (forever), with your feet firmly planted on a share price that holds steady in a market inferno and floats higher when stocks go Zen.

Source: Contrarian Outlook