With 10,000 people turning 65 every day, investing in care for seniors might seem like a good way to ensure your dividend will get paid.

[ad#Google Adsense 336×280-IA]Let’s see if that’s the case with Ventas (NYSE: VTR), a real estate investment trust that deals with senior housing and healthcare facilities.

The company’s portfolio includes 786 senior housing communities, 371 medical office buildings, 67 skilled nursing facilities, 46 specialty hospitals and others.

Ventas currently pays a $2.92 per share annual dividend.

It can easily afford the payments, since its funds from operations (a measure of cash flow for REITs) was $4.09 per share in 2015 and is expected to climb $0.02 in 2016.

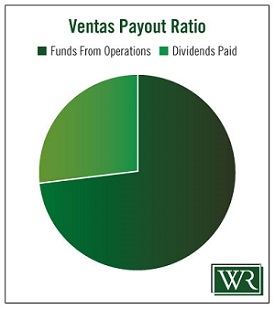

That gives Ventas a payout ratio of 71.3%.

That gives Ventas a payout ratio of 71.3%.

The payout ratio is the percentage of a company’s earnings or cash flow that is paid out in dividends. I like to see a payout ratio of 75% or lower. That way, even if the company has a tough year or two, the dividend should not be in jeopardy.

The company has an excellent record of raising its quarterly dividend every year since 2002.

That shows me management is committed to dividend growth.

There have been some special dividends and spinoffs that make the dividend look less consistent, but the quarterly dividend has been steadily rising for years.

There have been some special dividends and spinoffs that make the dividend look less consistent, but the quarterly dividend has been steadily rising for years.

The company has never cut the dividend.

Thanks to Ventas’ great dividend track record, comfortable payout ratio, rising cash flow and favorable demographics, I don’t see any reason to be worried about the company’s dividend.

Dividend Safety Rating: A

Good investing,

Marc

[ad#sa-income]

Source: Wealthy Retirement