I review, research, and recommend (or dissuade, mostly dissuade) a lot of higher yield dividend stocks. I evaluate income stocks based on yield, cash flow to support the current yield (safety), and dividend growth potential.

I go over hundreds of earnings reports and conference calls every quarter, and out of all of those reports I have found a small number of stocks that continue to impress quarter after quarter.

[ad#Google Adsense 336×280-IA]These are the income stocks that should make up the core of a dividend-focused investment portfolio.

This is a hypothetical exercise. I strongly recommend against owning just three stocks in a portfolio.

I use approximately 20 stocks as an adequate number. But, it is also interesting to see what an investor could expect from just a few stocks.

Consider the new stock investor who has or wants to put just a few thousand dollars into the market to start.

The three stocks here would make a great starter portfolio for the investor who plans to add cash and buy more stocks as money permits. The goal in selecting the following stocks are to pick ones that have a higher degree of share price stability along with my over-riding criteria of dividend safety and dividend growth. Here is my hypothetical three stock income portfolio:

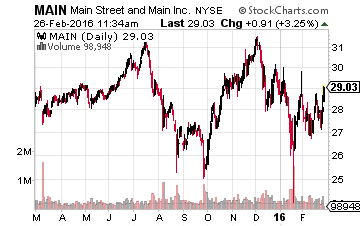

Main Street Capital Corporation (NYSE: MAIN) stands at the head of the class of business development companies (BDCs).

Main Street Capital Corporation (NYSE: MAIN) stands at the head of the class of business development companies (BDCs).

A BDC is a tax-advantaged business structure that is required to invest its assets by providing capital to small and mid-sized corporations.

Main Street Capital currently has about 200 client companies. The company primarily makes loans to client companies, but will also make small equity investments or take equity options as part of a client funding deal. MAIN share owners receive monthly dividends. Historically, the company has increased the dividend rate twice a year.

Main Street has also paid up to two special dividends per year as a payout of equity investment profits. MAIN currently yields 7.7% and investors can look forward to annual dividend growth of about 5%.

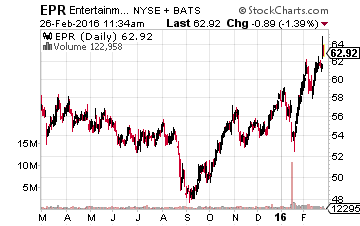

EPR Properties (NYSE: EPR) is a real estate investment trust that is diversified across three niche commercial real estate categories.

EPR Properties (NYSE: EPR) is a real estate investment trust that is diversified across three niche commercial real estate categories.

The company’s three property sectors are Megaplex theater and retail complexes, sports complexes including metro ski parks, water parks and golf entertainment complexes, and private and charter schools.

In December, EPR announced that New York State had awarded the company and a gaming company partner a gambling license for idle property that EPR owned not far outside New York City. EPR will immediately start to receive lease payments from the gaming partner and a percentage of winnings when the casino goes operational in a few years.

Other acreage on the property will be developed into a golf course and water park. As an investment, EPR also pays monthly dividends and currently yields 6.0%. Historically, the dividend has grown by 6% to 8% per year and I forecast continued payout growth at these levels.

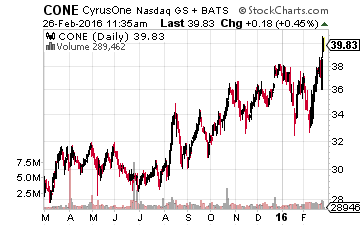

For the growth portion of our three stock portfolio, I selected CyrusOne Inc (NASDAQ: CONE).

For the growth portion of our three stock portfolio, I selected CyrusOne Inc (NASDAQ: CONE).

This company is part of the new breed of data center REITs.

CyrusOne is the fastest growing company in this fast growth commercial real estate sector.

The company just announced a 21% dividend increase for 2016. I project continued 15% to 20% dividend growth for at least the next several years.

With a fast growth REIT like CONE, you can expect 20% average share price growth plus the current 3.75% dividend yield.

Let’s summarize this hypothetical three stock portfolio. Average yield is 5.8%. That’s pretty nice in a world where the 10-year Treasury yields 1.7% and blue chip corporate dividend payors average less than 3%.

Also, three-quarters of the initial dividend income will come as monthly checks. The dividends from this portfolio should grow by 8% to 10% per year. The portfolio will generate a growing income with cash flow growth of four to five times the current inflation rate.

The danger with a three stock portfolio is that if/when one of them runs into trouble and has to reduce or stop paying dividends. I would not expect that from any of these quality companies, but we all know business operations can change. For a real, meaningful amount of income stock portfolio, you should diversify across at least 15 stocks. The three discussed here are a good start and can give you an idea of what a high-quality income stock should look like.

Finding stable companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and regular dividend growth is what has given me the most consistent gains out of any strategy that I have tried over my decades-long investing career.

— Tim Plaehn

[ad#ia-tim]

Source: Investors Alley