The chances of an actual interest rate hike by the U.S. Federal Reserve just got real – and asset prices are on the move…

Team Yellen got a big reason to raise rates with Friday’s release of the October U.S. employment numbers. The report surpassed most estimates by adding 271,000 jobs; the consensus was for about 100,000 fewer than that.

This puts the unemployment rate at 5% – its lowest level since 2008.

[ad#Google Adsense 336×280-IA]Markets immediately reacted with lower bond prices, lower commodity prices, and in many cases, lower stock prices.

The Fed could announce a rate hike at the end of its next policy meeting on Dec. 16.

That would be especially good news for a certain U.S. industry I’ll talk about today.

One particular stock in this sector climbed 65% in a little over two years after the last rate hike.

But now you have the chance to make more – and in less time.

The easy options play I outline here could double your money in just weeks…

These Stocks Benefit Most from a Fed Rate Hike

The last U.S. rate hike was June 29, 2006, when Ben Bernanke and the Federal Open Market Committee (FOMC) raised the federal funds rate one-quarter point to 5.25%.

Markets peaked a little over a year later, climbing another 25%. The stocks that benefitted the most in that time were banks and brokerages.

A lot of these firms’ profits rely on higher interest rates. As the Treasury rate climbs, most businesses see the cost to borrow money increase, which puts a damper on profits. But when you are on the other side of that coin, like banks and brokerages, you see your profits actually increase.

And the banks and brokerages that stand the most to gain are ones that are a bit of both…

Charles Schwab Corp. (NYSE: SCHW) is just that. It’s a bank by default, with a few branches scattered among the United States. But its brokerage service is where it stands to rake in the profits.

Charles Schwab is one of the world’s fastest-growing brokerage houses. It added an average of 80,000-plus gross accounts every month in 2014.

Tack this upcoming Fed-driven jolt of money into an already growing company and that should equal a higher stock price for SCHW by the end of 2015.

So let’s take a look at one easy way of playing this rate hike to our advantage.

So let’s take a look at one easy way of playing this rate hike to our advantage.

How to Collect Quick Profits on SCHW

This is an opportunity when I like to use call options. A call option is the right to buy a stock at a specified price by a specified date.

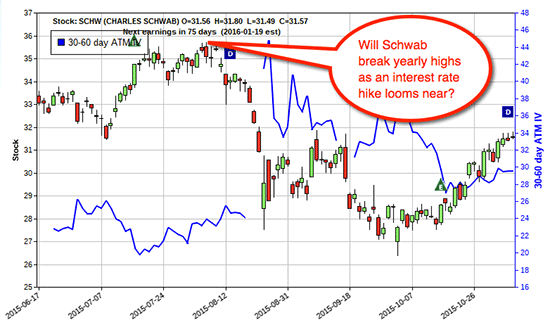

The following chart shows Friday’s trading activity for the SCHW 33 calls with an expiration date of Jan. 15, 2016. The cost of these calls (as of Friday’s quote) is mid-priced at $0.98.the federal reserve

Each of these contracts above represents 100 shares of stock. That means if you could buy these calls at $0.98 right now, you would pay $98 a contract – only $98 to rent this stock between now and Jan. 15, 2016. SCHW trades around $33 right now – or $3,300 for 100 shares.

Each of these contracts above represents 100 shares of stock. That means if you could buy these calls at $0.98 right now, you would pay $98 a contract – only $98 to rent this stock between now and Jan. 15, 2016. SCHW trades around $33 right now – or $3,300 for 100 shares.

You could purchase the stock, if you want to hold it long-term because you think rate hikes will just keep coming. But think like a short-term trader for moment (like I do, which is why options make sense to me)…

With this SCHW call option, you get the ability to control $3,300 worth of stock for just $98 for the next two months.

That’s much more appealing to me than buying the shares – and these three scenarios show what I mean:

SCHW Call Option Scenario No. 1: The Fed raises rates in December; SCHW moves up.

SCHW could move up to $35. The $33 calls would be worth a minimum of $2 per share, or more than double the $0.98 there they trade now. You would simply sell the call options to close the position and take your profits.

SCHW Call Option Scenario No. 2: The Fed does nothing; SCHW moves down.

That could trigger a fall in SCHW to $26.50, the lows in the chart above. The most you could lose in this case is what you paid for the options, or in the above case, $98 per contract. That looks good when you consider the stock purchaser at $33 would have a $7.50 loss per share on their hands – or $750 for 100 shares.

SCHW Call Option Scenario No. 3: The Fed either raises or keep rates steady, and SCHW moves sideways.

This is the unfortunate outcome, not because you would lose a lot, but because the stock did nothing, and the option lost its $0.98. This does tend to happen, which is the risk in holding an option.

But remember this…

The Fed rate hike would come in December, and the options above go out to mid-January. You don’t have to hold an option all the way to expiration. You can sell it whenever you want, and in the case above, that might mean before the Fed decision. A smart options trader would exit this trade regardless, still having something left in the trade.

Either way, banks and brokerages tend to rejoice when the Fed raises rates – now we can, too.

— Tom Gentile

[ad#mmpress]

Source: Money Morning