Occidental Petroleum (NYSE: OXY), also known as Oxy Pete, has a terrific dividend-paying track record. The oil company has paid dividends every quarter since 1975 and has raised the dividend at least annually since 2002.

[ad#Google Adsense 336×280-IA]That’s impressive, and the Safety Net gives considerable weight to that kind of track record.

Unfortunately, the negatives far outweigh the positives at this point.

Oxy Pete, which sounds like a minor character in Breaking Bad, currently pays a $0.75 quarterly dividend, which is an attractive 4.1% yield.

The dividend was just raised in July from $0.72.

The increase – the second one in the past year – while admirable, seems ill-thought-out.

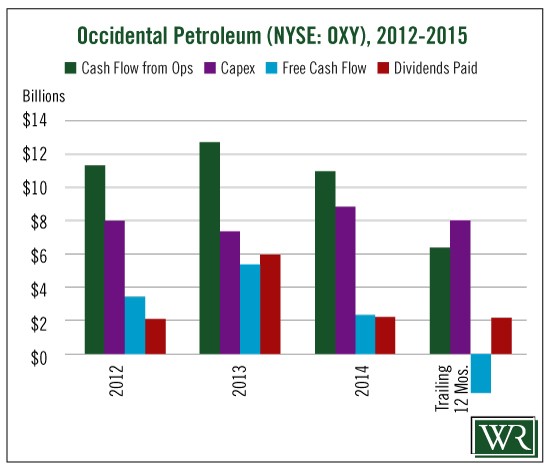

You can see from the chart above that over the past three years, free cash flow has covered the dividend, but over the past 12 months, as cash flow from operations plummeted on low oil prices, free cash flow has gone negative. So in other words, it costs money for Oxy Pete to run its business. To pay the dividend, the company has to dip into cash on hand.

You can see from the chart above that over the past three years, free cash flow has covered the dividend, but over the past 12 months, as cash flow from operations plummeted on low oil prices, free cash flow has gone negative. So in other words, it costs money for Oxy Pete to run its business. To pay the dividend, the company has to dip into cash on hand.

You never want to see that. The dividend should be covered by the amount of cash the company generates from running the business.

It’s also concerning that in the most recent quarterly conference call, CEO Stephen Chazen said that the company’s “principal goal for the year is to achieve cash flow neutrality where our operating cash flow covers both our capital spending and our dividend outlays at $60 per barrel.”

That has not been the case since the December quarter.

That has not been the case since the December quarter.

If oil prices come back above $60, Oxy Pete should be okay, though it may need to cut back on some spending.

Where Occidental Petroleum runs into trouble is that free cash flow has been declining, is negative and is expected to stay negative for at least another year.

Though most oil companies are in the same boat, I can’t consider the dividend safe unless free cash flow will soon cover the dividend.

I believe management is committed to the dividend, but a year from now, if we’re in the same situation with low oil prices, management may have no recourse other than to cut the dividend.

Dividend Safety Rating: F

Hoping your longs go up and your shorts go down,

Marc

[ad#wyatt-income]

Source: Wealthy Retirement