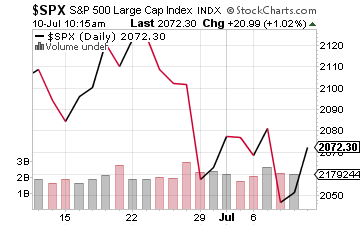

The stock market has produced a very bumpy ride over the last month or so, and even a look at the 3-month S&P 500 chart shows a lot of volatility. This is not the type of ride that high-yield stock investors are looking for. I want to cover how buying the right kind of income stock will over time, allow you to not worry when the market and your share prices look like these charts of the S&P 500.

My most basic dividend investing strategy is that a rising dividend rate will eventually generate share price gains through whatever market swings, corrections, and even bear markets occur in the shorter term.

My most basic dividend investing strategy is that a rising dividend rate will eventually generate share price gains through whatever market swings, corrections, and even bear markets occur in the shorter term.

The secret is to let that rising dividend payment stream work for you as you ignore those periods 3 month S&P when it hurts to look at the value of your brokerage account.

If you bought some dividend paying shares when prices were up and then the market dropped, it may take several years for the share prices to catch up.

But, over that time you will still collect an attractive and growing dividend yield.

But, over that time you will still collect an attractive and growing dividend yield.

Let’s look at a couple of examples from history to illustrate how sticking with your growing dividend stocks will pay off in the long run.

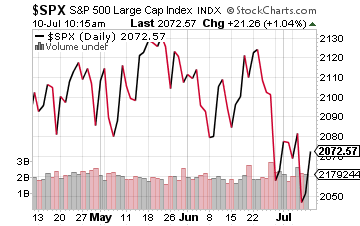

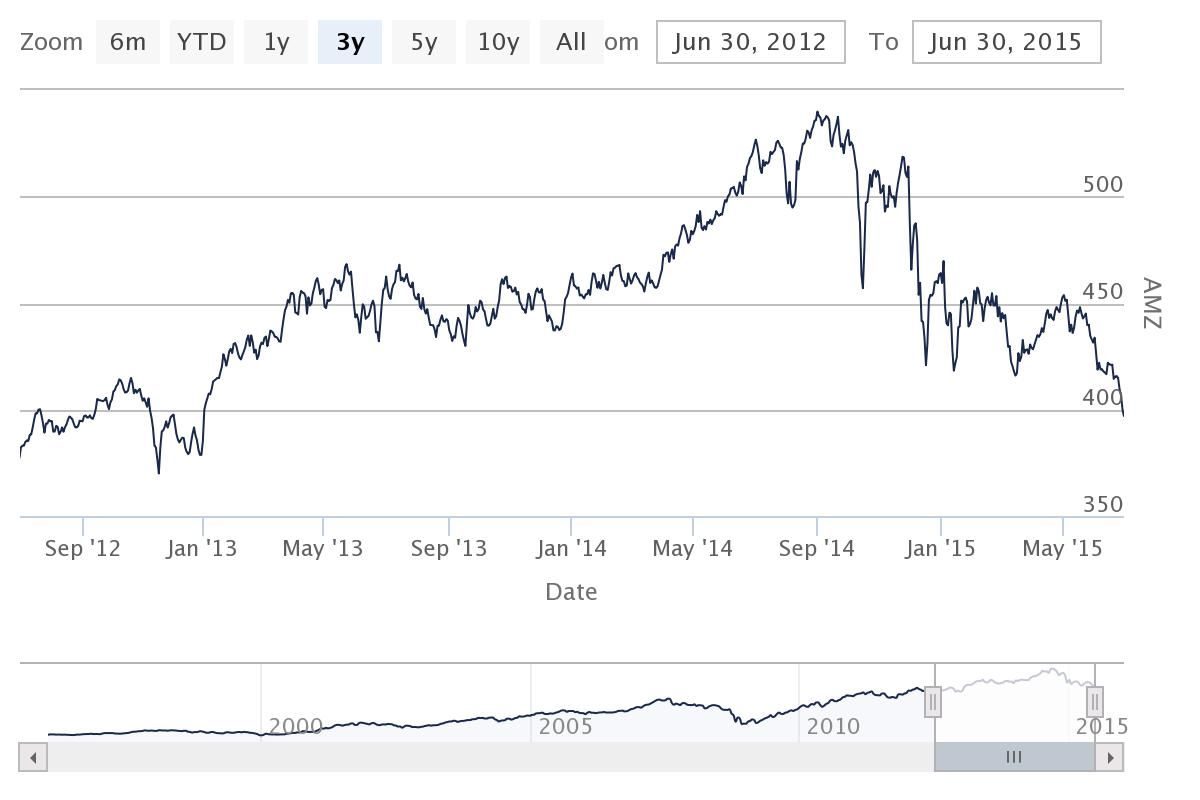

The Alerian MLP Index –AMZ– tracks 50 of the largest master limited partnerships.

This is a group of companies where most are steady growers of their distributions to investors.

However, most MLPs operate in the energy sector and prices have dropped a lot since crude oil peaked early last Fall. Since its high in late August 2014, the AMZ has declined by 26% through July 9, 2015. The current AMZ value is about where the index was at the start of 2013.

Investors owning representative MLP shares for more than a year and a half are at a higher portfolio value than when they invested. Also, MLP investors have been collecting a 6% average and growing yield. Based on total return including distributions, the AMZ is 19% above its value at the start of 2013.

MLP investors who bought last fall are now looking at a lot of red in their brokerage accounts, but history shows that the growing income stream from MLPs will bring back these investors into positive share price territory within a few years. Even those who bought at the recent peak. And again, they will collect very attractive cash distributions while they wait.

MLP investors who bought last fall are now looking at a lot of red in their brokerage accounts, but history shows that the growing income stream from MLPs will bring back these investors into positive share price territory within a few years. Even those who bought at the recent peak. And again, they will collect very attractive cash distributions while they wait.

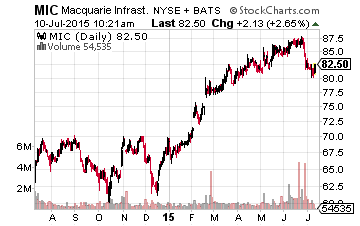

Another example is one of the initial recommendations from my Dividend Hunter newsletter.

Another example is one of the initial recommendations from my Dividend Hunter newsletter.

Over just the last two weeks, the Macquarie Infrastructure Corp (NYSE:MIC) share price has dropped by 7.5%.

That type of decline will make any investor nervous.

Yet not those who bought MIC when I first recommended the stock in my June 2014 issue of The Dividend Hunter.

At that time, the MIC share price was $61.48 with a 6% yield. Since then, MIC has increased its dividend every quarter and the quarterly payout is now 14% higher than when I first recommended the stock.

[ad#Google Adsense 336×280-IA]With the current $81 share price, MIC investors have realized a 35% total return, and shares bought in Jun 2014 now carry a 7% yield on cost.

Longer term MIC investors should not be disturbed by a short-term 7.5% share price drop.

They know the dividend will continue to increase every quarter, and at some point the share price will set new highs.

I still have MIC with an accumulate recommendation for my subscribers.

With the recent declines in the stock market indexes, REIT, BDC and MLP values, it is a good time to put cash to work in well-chosen high-yield shares.

If you already own shares and have experienced share price declines, make sure you own dividend paying stocks that will grow those dividends over time and pull you out of the current hole. In the meantime, enjoy those cash dividends, and don’t fret over shorter term market fluctuations.

— Tim Plaehn

Sponsored Link: High yield / high dividend growth investments that you should buy are an integral part of the income strategy with my newsletter, The Dividend Hunter. And there are currently several in my Monthly Paycheck Dividend Calendar, an income system used by thousands of dividend investors enjoying a steady stream of cash.

The Monthly Dividend Paycheck Calendar is set up to make sure you’re a minimum of 5 and in some months 8, 9, even 12 paychecks per month from stable, reliable stocks with high yields.

And it ensures that your dividend stock income stream will be more stable and predictable as you’re getting payments every month, not just once a quarter like some investors do.

The Calendar tells you when you need to own the stock, when to expect your next payout, and how much you could make from stable, low risk stocks paying upwards of 8%, 9%, even 11% in the case of one of them. I’ve done all the research and hard work; you just have to pick the stocks and how much you want to get paid.

The next critical date is Tuesday, July 28th (its closer than you think!), so you’ll want to take before that date to make sure you don’t miss out. This time we’re gearing up for an extra $3,669.50 in payouts by Labor Day, but only if you’re on the list before the 28th. Click here to find out more about this unique, easy way of collecting monthly dividends.

Source: Investors Alley