A few weeks ago, I told you about my dad’s biggest retirement regret: waiting so long to actually do it.

This past week, we asked Wealthy Retirement readers about theirs.

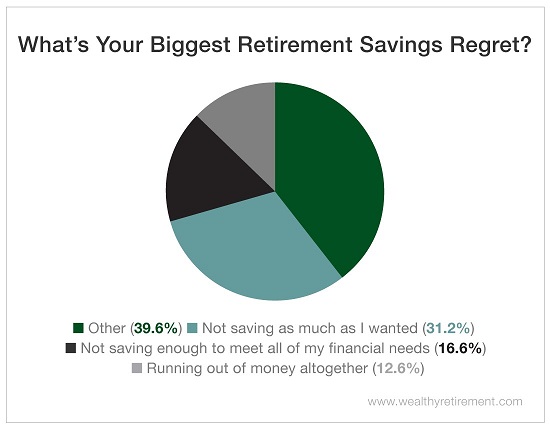

More than 32% said that they regret not saving as much as they’d wanted for their golden years. Nearly 17% said that they regret not saving enough to meet all of their financial needs.

Sadly, the results of our survey aren’t surprising.

Sadly, the results of our survey aren’t surprising.

In 2014, nearly one-third of baby boomers had no money saved in retirement plans.

The median savings for those who had saved something was around $200,000.

That’s not nearly enough money to fund a potentially 30-year retirement.

The closer we get to retirement, the more we regret our savings decisions (or lack thereof).

But having disappointing savings is a symptom of another regret – spending too much.

Spending gets in the way of saving.

A little instant gratification today means there’ll be a lot less available from our assets down the road than if we’d saved for retirement instead.

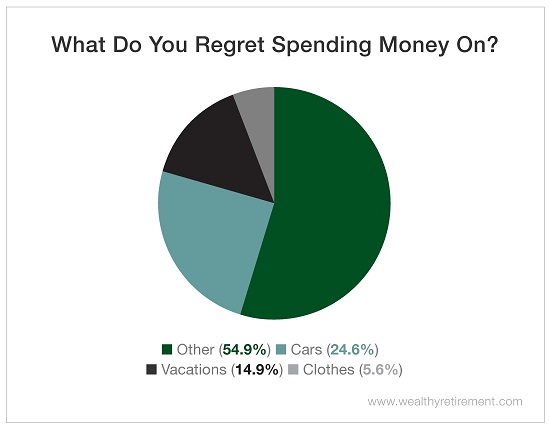

We spend money on a variety of needs and wants, but the wants are what we come to regret the most.

For example, nearly 25% of Wealthy Retirement readers said that they regret spending money on cars. For most, transportation is a need. Cars fulfill this need, but the cars we choose often fulfill a want.

The average new car payment reached an astronomical high of $523 per month last year. The average used car payment was $378 per month. Driving a new-to-you used car results in a savings of $145 per month, not including maintenance and insurance costs.

The average new car payment reached an astronomical high of $523 per month last year. The average used car payment was $378 per month. Driving a new-to-you used car results in a savings of $145 per month, not including maintenance and insurance costs.

Imagine if you’d invested that $145 for your retirement instead. Assuming a 6% annual return, you’d have an extra $24,311 in 10 years, an extra $67,847 in 20 years and an extra $101,192 in 30 years sitting in your retirement account.

Unfortunately, the zoom zoom of a new car is much more tempting and exciting than watching our account balance grow. That’s why financial regret is so common – but luckily, it doesn’t have to ruin your retirement dreams.

Remember: The quicker you take action, the better off you’ll be when you retire.

If you haven’t saved enough and retirement is right around the corner, relax. You still have time to increase your retirement income.

You may need to work a little longer than planned. This will help you pad your retirement savings in two ways.

- It will give you more time to contribute to your retirement accounts. Working those extra years will give you more time to max out your retirement contributions.

- It’ll increase your monthly Social Security check.

If you put off taking Social Security until 66 (full retirement age for many of our readers), your monthly Social Security check will be 30% higher than if you had retired at age 62.

But if you can work and save until you are 70 years old, you’ll be in even better shape. Your Social Security check will be 70% higher than if you’d taken Social Security at age 62.

Good investing,

Kristin

Motley Fool Stock Advisor's average stock pick is up over 350%*, beating the market by an incredible 4-1 margin. Here’s what you get if you join up with us today: Two new stock recommendations each month. A short list of Best Buys Now. Stocks we feel present the most timely buying opportunity, so you know what to focus on today. There's so much more, including a membership-fee-back guarantee. New members can join today for only $99/year.

Source: Wealthy Retirement