As I mentioned last week, the game of Monopoly is a great way to illustrate how to invest – particularly in “wide moat” real estate investment trusts (“REITs”). As I explained:

Monopoly is very much about understanding the board. It’s about discipline, psychology, timing, and calculating potential returns. For instance, just because you can buy a property doesn’t mean you should…

You’re often much better off saving your money for another deed: one that provides higher rent potential.

Of course, as any Monopoly enthusiast knows, the board isn’t just about real estate. It also includes utilities and railroads – two important businesses that we also research here at Wide Moat.

So, let’s roll the dice and proceed to a solid utility and a railroad to boot.

America’s Largest Water Company

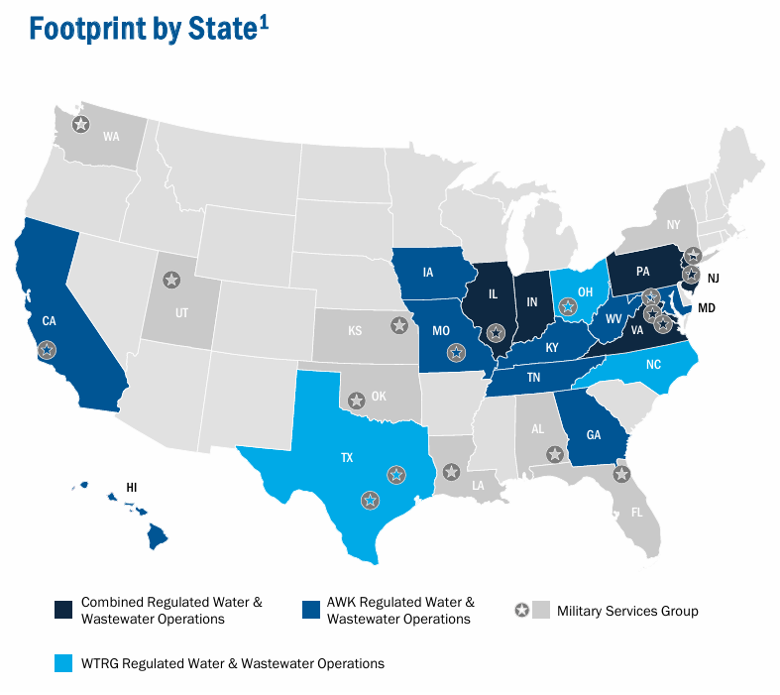

American Water Works (AWK) is the largest and most geographically diverse publicly traded water and wastewater utility company in the U.S. That’s true both in terms of operating revenue and customer count.

With a history dating back to 1886, American Water Works employs approximately 6,700 people and processes drinking water, wastewater, and related services for over 14 million people in 24 states.

Most of this is through regulated utilities. But the company also provides water and wastewater services to the U.S. government on military installations, as well as to municipalities.

Last October, American Water Works said it was entering into a merger with Essential Utilities (WTRG). If all goes well, those plans should wrap up by the end of the first quarter of 2027 – pending public utility commission approvals in at least seven states, shareholder approvals, and federal antitrust clearance.

If successfully combined, American Water Works will have:

- A market cap of around $40 billion

- An enterprise value of approximately $63 billion

- A rate base of approximately $34 billion (as of the end of 2024)

- Approximately 5.4 million water, wastewater, and natural gas connections

That makes for quite the holding.

Source: American Water Investor Deck

Source: American Water Investor Deck

This merger will give it greater scale, operational expertise, and regulatory diversification to help it make further system investments with a keen eye toward customer affordability.

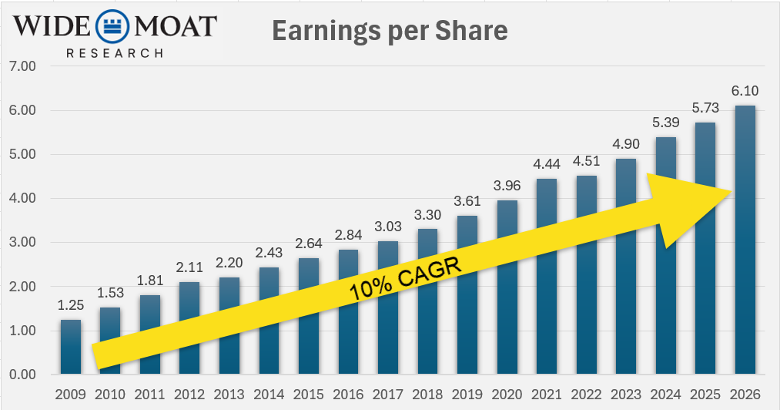

It will also support American Water’s long-term earnings per share (“EPS”) growth of 7% to 9% and base rate growth of 8% to 9%. The company has boasted a 10% compound annual growth rate (CAGR) for EPS since 2009, as shown below.

Source: Wide Moat Research

Source: Wide Moat Research

As is the case for both American Water and Essential Utilities today, that latter growth is driven primarily by investment in existing systems and supplemented by acquisition programs. And AWK says it intends to maintain its 2% acquired-customer growth target after the merger.

In addition to the utility’s highly visible and consistent earnings-growth profile, its total shareholder returns benefit from a 7% to 9% dividend-per-share growth target supported by a healthy 55% to 60% dividend payout ratio.

American Water has raised its dividend for 17 consecutive years in yet another sign of its disciplined capital-markets strategy. S&P gives it an A rating and Moody’s a Baa1.

In terms of valuation, American Water shares now trade at around $131. Its price-to-earnings (P/E) ratio of 22.5x is at an approximate 10% discount when compared to its normal 25.3x.

Assuming it reverts to our fair-value estimate and meets growth expectations, it could post a 15% to 20% total return through 2026.

Source: FAST Graphs

Source: FAST Graphs

America’s First Transcontinental Railroad

Union Pacific (UNP) is one of America’s most recognized companies and provides a critical link in the global supply chain.

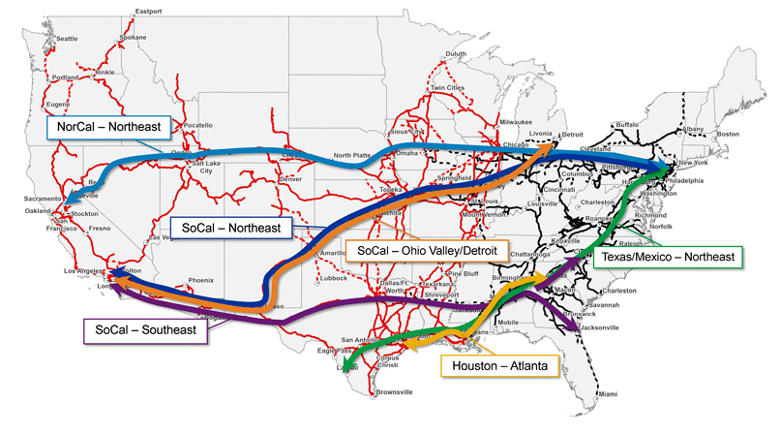

It connects 23 states in the western two-thirds of the country… operates from all major West Coast and Gulf Coast ports to Eastern gateways… connects with Canada’s rail systems… and is the only railroad serving all six major Mexican gateways.

Union Pacific serves roughly 10,000 customers while operating 32,880 route miles across North America. This allowed it to generate roughly $23 billion in revenue in 2024 from three commodity groups:

- Bulk (grain, fertilizer, food, etc.)

- Industrial (chemicals, forest products, metals, oil, and gas)

- Premium (finished automobiles)

This past November, Union Pacific and Norfolk Southern (NSC) gained shareholder approval for an $85 billion merger that – if allowed – would create the nation’s first coast-to-coast rail network. Their combined 2025 capital investment would have been around $5.6 billion, since the merger would remove barriers to support future growth for customers and markets nationwide.

It will also mean faster transit and new intermodal growth capable of supporting 1.4 million annual loads. And the proposed integrated network will include six new premium intermodal lanes with faster, more direct, single-line transits.

Southern California/Northeast lanes would be up to 252 miles shorter, saving up to 20 hours of transit time. And Southern California/Southeast lanes will save up to 95 hours.

Source: Union Pacific Investor Presentation

Source: Union Pacific Investor Presentation

The deal already has the support of the largest rail union, hundreds of shippers, and both companies’ shareholders.

Chemical manufacturers and competing railroad Burlington Northern Santa Fe – owned by Berkshire Hathaway (BRK-A)(BRK-B) – have raised concerns about whether the merger would hurt competition and lead to higher rates. But President Trump said the proposed $85 billion merger “sounds good to” him and called Union Pacific “a great railroad.”

You may have heard that the Surface Transportation Board (“STB”) rejected the merger application. But that was only because it was incomplete.

Both companies have until February 17 to notify the STB whether they plan to submit a revised application. And they can refile any time before June 22.

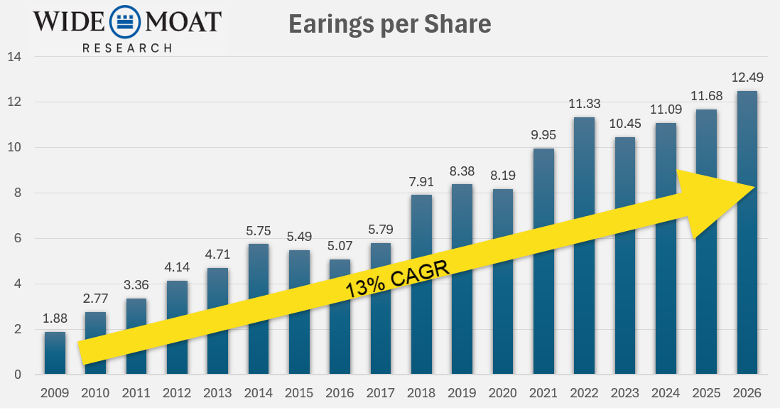

As seen below, Union Pacific has a good record of earnings growth despite a negative year here and there. Its dividend record, meanwhile, is one of the strongest in the industrial sector, with 18 straight years of increases.

Source: Wide Moat Research

Source: Wide Moat Research

We’re talking about a CAGR of 14.64%, which is unusually strong for a mature railroad.

In the third quarter of 2025, Union Pacific generated $7.1 billion in cash from operations… while returning $5.1 billion in dividends and maintaining free cash flow of $1.9 billion. The railroad maintains a fortress balance sheet with adjusted debt to EBITDA (earnings before interest, taxes, depreciation, and amortization) of 2.6x and A ratings from Moody’s, S&P, and Fitch.

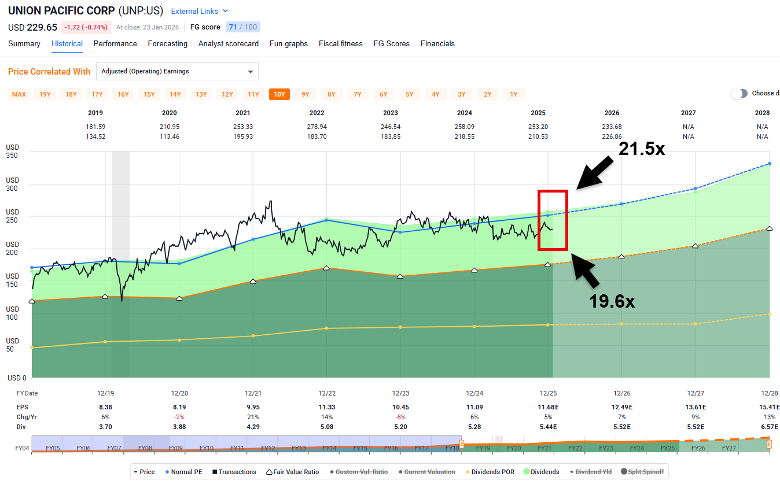

Analysts forecast growth of 7% in 2026, 9% in 2027, and 13% in 2028. Yet it’s trading at around $230 with a P/E multiple of 19.6x, below its norm of 21.1x.

Assuming Union Pacific reverts to our fair-value estimate and meets growth expectations, it could post a 15% to 20% total return through 2026.

Source: FAST Graphs

Source: FAST Graphs

While I NEVER recommend companies based on M&A alone, I do believe these two companies will be successful in their merger plans, which will further compound their growth thesis.

Both are “wide moat” companies that allow investors to reasonably estimate future cash flows. And they both trade at a reasonable margin of safety.

Regards,

Brad Thomas

He issued warnings for RNG before it crashed 89%, BYND before it crashed 90%, TDOC before it crashed 84%, and FVRR before it crashed 86%. Now, he's stepping forward to name the popular stock that could go down as one of the worst-performing tickers of the year. It could be the most dangerous stock of 2026. Click here for its name and ticker, 100% free.

Source: Wide Moat Research