We recently started a series called “Penny Stock of the Day”. These ideas are geared for traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Coherus BioSciences, Inc. (NASDAQ: CHRS)

Today’s penny stock pick is the biopharmaceutical company, Coherus BioSciences, Inc. (NASDAQ: CHRS).

Coherus BioSciences, Inc. focuses on the research, development, and commercialization of cancer treatments primarily in the United States. The company develops UDENYCA, a biosimilar to Neulasta, a long-acting granulocyte-colony stimulating factor; LOQTORZI, a novel PD-1 inhibitor; and Casdozokitug, an investigational recombinant human immunoglobulin isotype G1 (IgG1) monoclonal antibody targeting interleukin 27.

It is also developing CHS-114, an investigational highly specific human afucosylated IgG1 monoclonal antibody selectively targeting CCR8, a chemokine receptor highly expressed on Treg cells in the tumor microenvironment (TME); and CHS-1000, an antibody targeting human ILT4 designed to improve anti-PD-1 clinical benefit by transforming an unfavorable TME to a more favorable TME.

In addition, the company’s licensed immuno-oncology programs include NZV930, an antibody designed to inhibit cluster of differentiation 73; and GSK4381562, an antibody targeting CD112R for the treatment of solid tumors.

Further, it offers YUSIMRY, a biosimilar to Humira for the treatment of patients with inflammatory diseases characterized by increased production of tumor necrosis factor (TNF) in the body, including rheumatoid arthritis, juvenile idiopathic arthritis, psoriatic arthritis, ankylosing spondylitis, Crohn’s disease, psoriasis, and ulcerative colitis.

It collaboration agreement with Junshi Biosciences for the co-development and commercialization of toripalimab; an agreement with Surface and Adimab LLC; license agreements with Bioeq AG and Genentech, Inc., as well as Vaccinex, Inc.; and out-licensing agreement with Novartis Institutes for Biomedical Research, Inc. and GlaxoSmithKline Intellectual Property No. 4 Limited. The company was formerly known as BioGenerics, Inc. and changed its name to Coherus BioSciences, Inc. in April 2012.

Website: https://www.coherus.com/

Latest 10-k report: https://investors.coherus.com/static-files/cc0ccbbe-195b-4661-b258-861654aa95d7

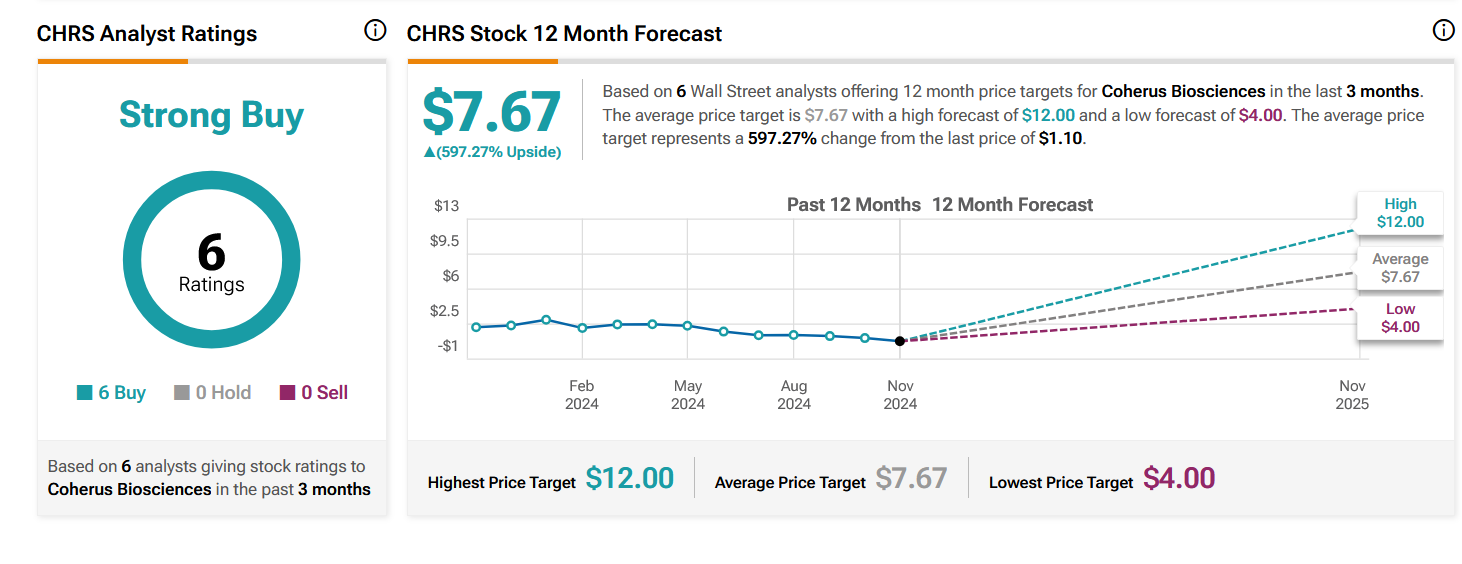

Analyst Consensus: As per TipRanks Analytics, based on 6 Wall Street analysts offering 12-month price targets for CHRS in the last 3 months, the stock has an average price target of $7.67, which is nearly 597% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The company has multiple product catalysts in 2025. CHRS recently launched Loqtorzi in treating nasopharyngeal carcinoma. Last year’s acquisition of Surface Oncology also expanded Coherus’ pipeline of experimental cancer therapies.

- The company had sold its CIMERLI® ophthalmology franchise to Sandoz Inc. for approximately $170 million.

- CHRS has been mobilizing multiple partnerships for financial management.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Downtrend Channel Breakout: The daily chart shows that the stock has broken out of a downtrend channel, which is shown as purple color lines. This is a possible bullish indication.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MA: The stock is currently above its 50-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This is a possible bullish indication.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for CHRS is above the price of $1.15.

Target Prices: Our first target is $2.50. If it closes above that level, the second target price is $3.30.

Stop Loss: To limit risk, place a stop loss at $0.45. Note that the stop loss is on a closing basis.

Our target potential upside is 43% to 90%.

For a risk of $0.70, our first target reward is $1.35, and the second target reward is $2.15. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

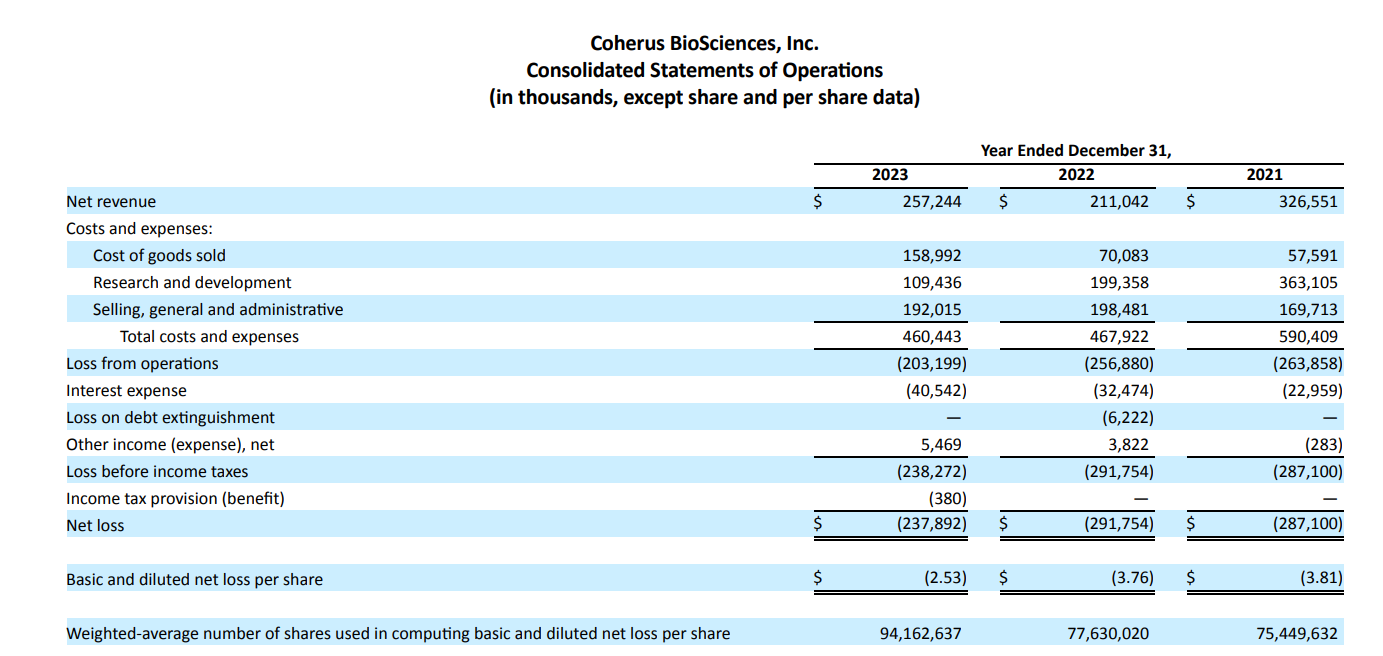

- The company has a history of net losses. CHRS incurred net losses of $237.9 million, $291.8 million, and $287 million in 2023, 2022, and 2021, respectively.

- The company has ongoing legal proceedings. In late April of 2022, the Company received a demand letter from Zinc Health Services, LLC, asserting that Zinc was entitled to approximately $14.0 million from the Company for claims related to certain sales of UDENYCA from October 2020 through December 2021.

- CHRS has significant debt. The company’s debt totaled nearly $479 million as of Sept. 30, 2023.

- The company operates in highly competitive pharmaceutical markets. Numerous companies, universities, and other research institutions are engaged in developing, patenting, manufacturing, and marketing of products competitive with those that the company is developing.

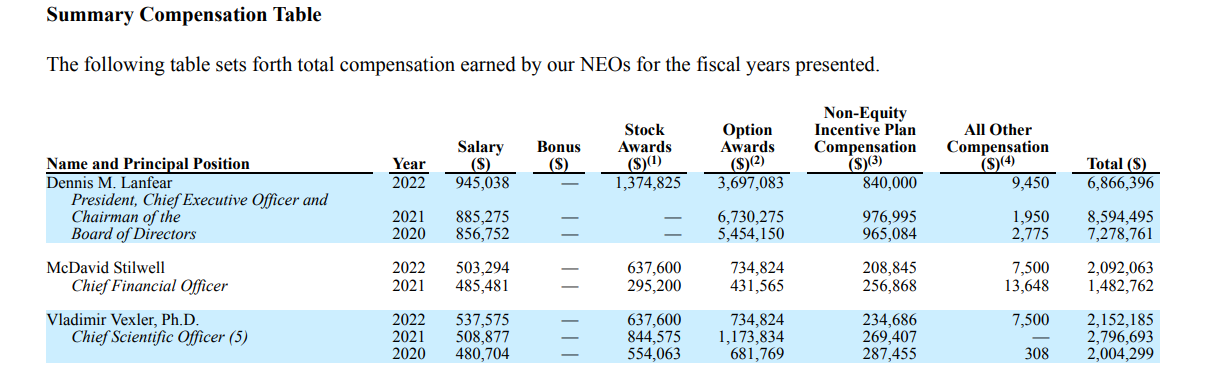

- Despite being a loss-making company, the executives are being paid significant compensation.

- The company’s principal stockholders and management own a significant percentage of the stock and will be able to exert significant control over matters subject to stockholder approval.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

The legendary stockpicker who built one of Wall Street's most popular buying indicators just announced the #1 stock to buy for 2026. His last recommendations shot up 100% and 160%. Now for a limited time, he's sharing this new recommendation live on-camera, completely free of charge. It's not NVDA, AMZN, TSLA, or any stock you'd likely recognize. Click here for the name and ticker.

Source: Trades of the Day