Company Overview

Zacks Rank #1 (Strong Buy) stock Pinterest ((PINS) is a social media platform that allows users to discover and save ideas for various interests and projects. The Pinterest platform revolves around visual discovery and bookmarking, and users can create personalized collections of images and videos known as “pins” on themed boards.

Pins range from recipes and fashion ideas to travel destinations and DIY projects. Users often market their items on Pinterest and sell them through DIY-focused e-commerce website Etsy (ETSY).

Pinterest is designed to inspire users by allowing them to discover and save content that aligns with their interests. It serves as a visual search engine, helping people find ideas and inspiration for various aspects of their lives, making it a unique platform for creative exploration and idea sharing.

Bottom Line Growth is Booming

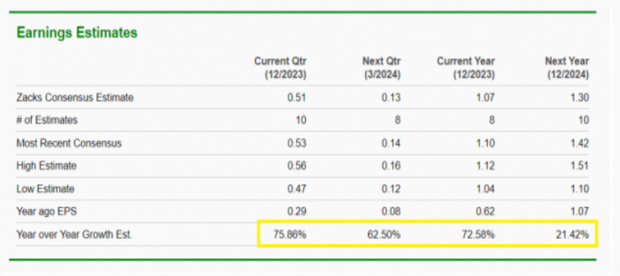

US equities are in the middle of a robust bull market. In my experience, bull markets favor growth stocks as momentum investors climb aboard, speculators are willing to take on more risk, higher multiples are favored, and investors become hyper-focused on innovation and growth opportunities rather than value and stability. With Zacks Consensus Estimates anticipating year-over-year earnings growth of more than 60% over the next three quarters, PINS fits the bill of a classic quality growth stock.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

New Partnerships Help Pin Down Monetization Concerns

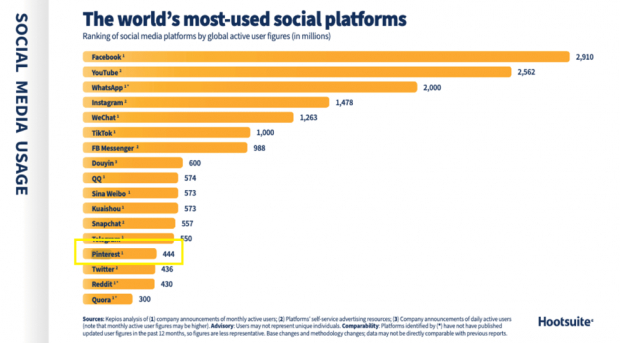

Few investors probably realize that Pinterest is one of the most popular social media platforms in the world. As of last year, Pinterest ranks as the 14th largest social media platform in the world and beats out other powerhouses such as Redditt in terms of global active users.

Image Source: Hootsuite

Image Source: Hootsuite

Furthermore, data from Black Swan shows that trends on Pinterest take off 20% faster in the first six months versus trends on other platforms, and those trends tend to sustain themselves 21% longer than other online trends. This begs the question, “If Pinterest is so popular, why has the stock been flat since its IPO in 2019?”

The answer to that question is lack of monetization. Though Pinterest garners a lot of traffic, the company has had difficulty monetizing the traffic – failing to meet the most critical demand of investors. However, on April 27th, 2023, Pinterest posted,

“Today we’re announcing that we’re opening up third-party ad demand on Pinterest. As user engagement with shoppable content on Pinterest continues to grow, we’re pleased to have selected Amazon (AMZN) as our first partner for third-party ads.”

Image Source: Pinterest

Image Source: Pinterest

Since the announcement, PINS is up more than 30% – proof that the partnership is a game-changer for the stock.

AI Will Spur Further Growth

We are in the infancy of what I call “The AI Revolution.” Social media firms like Pinterest will benefit dramatically from the rollout of AI. By incorporating sophisticated AI models to enhance relevancy and personalization, AI will likely bring long-term benefits to the company.

Chart View: Reward-to-Risk is Juicy

Last quarter, PINS shares soared nearly 20% on volume five times the norm – a sign that institutions were accumulating shares. Currently, PINS is retreating to the 10-week moving average for the first time since its massive breakout – an area of asymmetric reward-to-risk.

Image Source: TradingView

Image Source: TradingView

Bottom Line

With its unique focus on visual discovery and bookmarking, Zacks Rank #1 (Strong Buy) stock Pinterest stands out. The recent partnership with Amazon to open up third-party ad demand has been a game changer, and the addition of AI will further drive growth.

— Andrew Rocco

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks