If there was a way for you to make money 276 billion times per year – with little to no effort – would you be interested?

I don’t know anyone who wouldn’t be.

Even if that was just in pennies, that’s $2.76 billion.

Well, there’s a company that does. But it makes far more than pennies every time.

Like a tollbooth, it collects a fee every time someone uses its product. And this past year, its users racked up 276 billion transactions.

You know this company… but may not fully appreciate its full potential for your portfolio.

For the last several years, a lot of investors thought it would be left behind as new speculative fintech (financial technology) companies emerged. But they were wrong.

Today, I’ll show you why there’s no need to speculate on risky assets to get rich. Instead, you can earn income every time someone uses this company’s tollbooth business model.

Visa: One of the Most Lucrative Tollbooths

The tollbooth company I’m talking about is Visa (V).

Of all the credit card transactions in the U.S., Visa processes around 62% of them. And globally, that number is near 40%.

Last year, Visa made $17 billion in profits from 276 billion transactions. That means it minted money 8,800 times per second.

And here’s the best part… Visa shareholders get a cut of those profits, too.

But despite these profits, some investors have feared one trend was going to leave Visa in the dust…

The Fintech Trend That Didn’t Kill Visa

In the last couple of years, the term “buy now, pay later” (BNPL) was all the rage in the fintech space.

BNPL companies were supposed to be a disruptive force in the payments space, giving consumers and businesses an alternative option to credit cards.

Back in 2021, companies like Klarna and Affirm (AFRM) were in the news almost every week as they signed more and more deals with retailers.

AFRM went public in 2021 and quickly traded up from $50 per share to nearly $170.

But the BNPL trend turned out to be a fad.

AFRM is currently trading for just $22/share because it hasn’t proven it can generate reliable profits.

What’s more, data shows that roughly 80% of the BNPL payments were eventually made with debit cards… Meaning that Visa – and traditional payments companies like it – still ended up collecting fees from those transactions.

PayPal (PYPL) and Block (SQ) have also tried to shake up the payments space with digital peer-to-peer and business-to-business (B2B) services.

But just like AFRM, they struggled to generate sustainable profits.

PayPal still hasn’t managed to monetize its payments platform, Venmo, in a meaningful way.

Its earnings per share (EPS) fell by 10% in 2022. And PayPal’s share price is down by more than 25% in 2023.

Block, which has focused more on B2B software hasn’t performed much better.

Its EPS fell by 42% last year. And its share price is down by more than 22% in 2023.

In comparison, Visa’s share price is up by more than 17%.

Just this past quarter, Visa collected fees on nearly $3.2 trillion worth of global transactions.

And two weeks ago, Visa announced that its sales increased by 11% and its earnings are up by 18% from last year.

We don’t expect to see this trend stop…

It Doesn’t Get Much More Reliable Than Visa

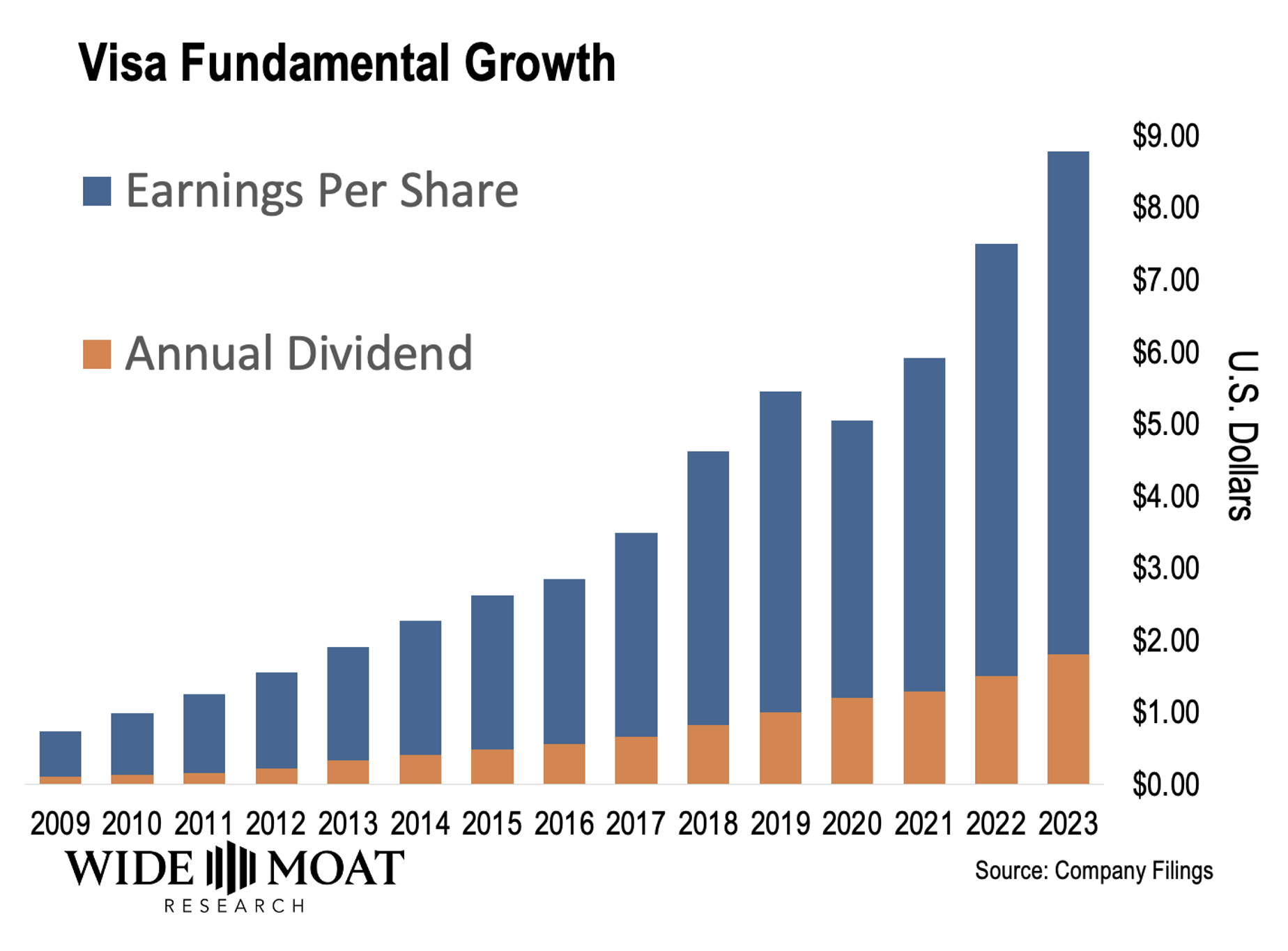

Visa has grown its earnings at double-digit rates in 13 of the last 15 years.

And it’s likely to keep compounding its earnings at a 10-15% rate for the next five years (at least).

And it’s likely to keep compounding its earnings at a 10-15% rate for the next five years (at least).

Even the threat of an upcoming recession isn’t likely to damage Visa’s growth prospects.

During the Great Recession, Visa increased its EPS by 30%. So even if we hit another recession, people will continue using its services.

And right now, Visa could pay off all its debt and still have more than $2 billion of cash left over.

Now, it’s important to note that Visa’s dividend yield is on the lower end at just 0.9%. But as you can see from the chart above, it’s grown that dividend nonstop.

Its average annual dividend growth rate was 18.6% for the last decade. And based on our research, it’ll continue to grow at a 15%-plus annual rate for years to come.

I’ve never seen a company growing its dividend at this pace that didn’t outperform the market.

Over the last 15 years, Visa’s total return is north of 20%. That’s more than double the S&P 500’s 10.2% annual returns over the same period.

And I expect this outperformance to continue moving forward.

Happy SWAN (sleep well at night) investing,

Brad Thomas

Editor, Intelligent Income Daily

All you have to do is own a small handful of these unique stocks… [sponsor]

And you could make more money in 2023 than you would by trading, chasing the latest “hot” stock, or doing anything your broker tells you. Get the details here – including the name of my #1 stock.

Source: Wide Moat Research