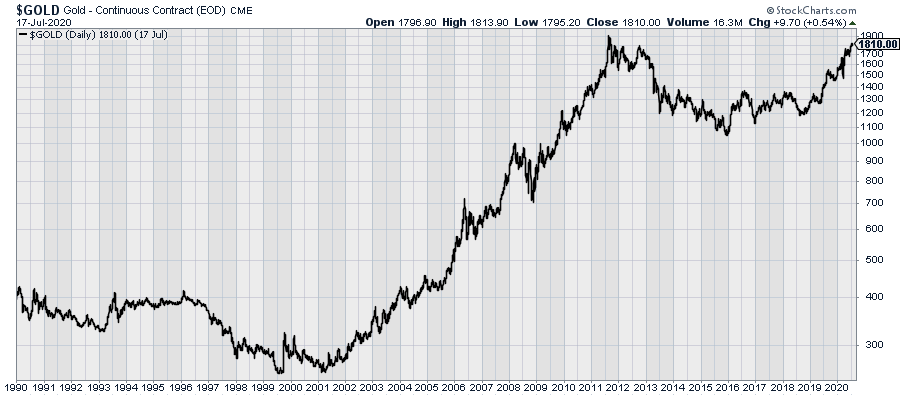

For nearly two years, gold’s been on quite a run. In fact, the precious metal is getting close to an all-time high. That hasn’t happened in nearly a decade.

Investing in gold is a tricky business. Historically it seems that gold likes to run one of two ways: it’s either very hot or very cold, and there’s little in between.

Gold tends to thrive as the world is falling apart. For example, gold shot up in 1979-80 as inflation, the Cold War, and the Iran hostage crisis took center stage.

And conversely, good times for the world are bad for gold.

For example, from September 2011 until late 2015, gold plunged from over $1,900 per ounce down to $1,050.

While I wouldn’t exactly call those years “good times,” they were much better than the period immediately before it, when the economy slowly emerged from the worst economy since the Great Depression.

Interestingly, gold’s latest upswing began in 2018, before the novel coronavirus made landfall. As late as November 2018, gold was going for about $1,200 per ounce. Just recently, gold cracked $1,800 within striking distance of its all-time high.

Looking at the startling jobless and coronavirus numbers, it’s easy to see that bad times are upon us… so gold is thriving.

However, in adjusted terms, gold is still far from its all-time high. Gold would have to get to $2,300 per ounce to match its peak from 40 years ago.

Gold’s Eternal Allure

There are several factors that make gold a fascinating topic. For example, the metal never rusts. You can take the gold out of an Egyptian pyramid and have your dentist stick it in your cavity (though they might want to clean it first). It’s also non-toxic, which helps.

Here are a few more gold facts:

- Gold is incredibly soft—it can be pounded down to a few millionths of an inch thickness. One ounce can be stretched for 50 miles. It’s also very heavy. Despite what you may believe from The Treasure of the Sierra Madre (“Badges? We ain’t got no badges!”), gold dust wouldn’t have just blown away.

- Gold has been found on every continent on earth, and has strong religious connections. It’s mentioned in the Bible more than 400 times.

- Plato mentions the gold/silver ratio to be 12, meaning when he lived, one ounce of gold could be traded for 12 ounces of silver. The current ratio is around 80.

- Recent historical evidence suggests that Isaac Newton was mainly an alchemist. The physics stuff he did was just playing around on the side and was probably an offshoot of his efforts to makes gold. Strands of his hair that are still intact today show traces of lead and mercury.

- Gold is also a really good conductor. Despite its high prices, gold is used in many electronics.

- There’s more gold at the New York Fed, located way below 33 Liberty Street, than in Fort Knox.

- Speaking of Fort Knox, Ian Fleming’s 1959 book, Goldfinger, and the subsequent 1964 film starring Sean Connery, revolves around a crazy idea—to blow up all of the U.S. gold at Fort Knox, making it radioactive and worthless… thus making titular Bond villain Auric Goldfinger’s gold worth more.

But here’s the odd part about Goldfinger: he didn’t need to stage all that drama to make money. If he had just held on to his gold for 20 more years, it would have been worth 25 times as much.

Back then, investing in gold wasn’t so easy. Nowadays, it’s much easier thanks to exchange-traded funds (ETFs). The main gold ETF is SPDR Gold Shares (GLD).

Historically, the key driver of gold has been real interest rates. By “real,” I mean after inflation. When adjusted inflation falls near zero, or even negative, that’s when gold has done well. When real rates are high, that’s when gold has faltered.

So what are the real rates now? On March 15, in response to the coronavirus pandemic, the Federal Reserve slashed interest rates to near 0%. Officially, the target range is 0% to 0.25%. Adjusting for inflation, that brings the real rate to less than 0% (although we had a brief three-month run of actual deflation).

So it’s not that the pandemic is, in any sense, good for gold. It’s that the policy response to the virus makes for a better environment for gold to rally.

With rates so low, I suspect the gold rally will continue. I wouldn’t be surprised to see gold break $2,000 before Labor Day. Shares of GLD have a place in any portfolio but it should be a modest weighting. When the gold cycle turns, it and be fast and brutal.

— Eddy Elfenbein

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley