With the latest inflation report showing a month-over-month jump of 0.8% in August 2025 — which annualizes to nearly 10% if it continues — it’s no wonder investors are worried about protecting their purchasing power.

Inflation quietly eats away at the value of every dollar, and if you’re not prepared, it can leave your portfolio falling behind.

So what’s the best way to fight back?

It isn’t fixed income. A bond paying you the same $1,000 a year in interest becomes less valuable with each tick higher in prices. At 10% inflation, your “income” is shrinking in real terms every single year.

The smarter way to keep up — and even pull ahead — is to focus on select dividend growth stocks.

Why Dividend Growth Matters

Unlike fixed-income investments, dividend growth stocks don’t just pay us a set amount each year. They raise their payouts. When a company hikes its dividend at a rate above inflation, our income and our buying power actually increase over time.

Take Microsoft (MSFT), one of my personal favorite holdings. In September 2024, it raised its dividend by 10.7%, right in line with the pace of today’s annualized inflation. And it isn’t a one-off:

- Over the past 5 years, Microsoft has boosted its payout by an average of 10.2% per year.

- Over the past 10 years, the average annual increase is 10.3%.

That consistency — double-digit dividend growth year after year — makes Microsoft exactly the kind of stock that can help us outpace even a hot inflation cycle.

And Microsoft isn’t alone. Energy major Chevron (CVX), for example, has raised its dividend every year for 37 straight years. Its most recent hike was 4.9% — not quite at today’s annualized inflation rate, but still nearly double the government’s official year-over-year figure of 2.7%.

Safety in Stormy Markets

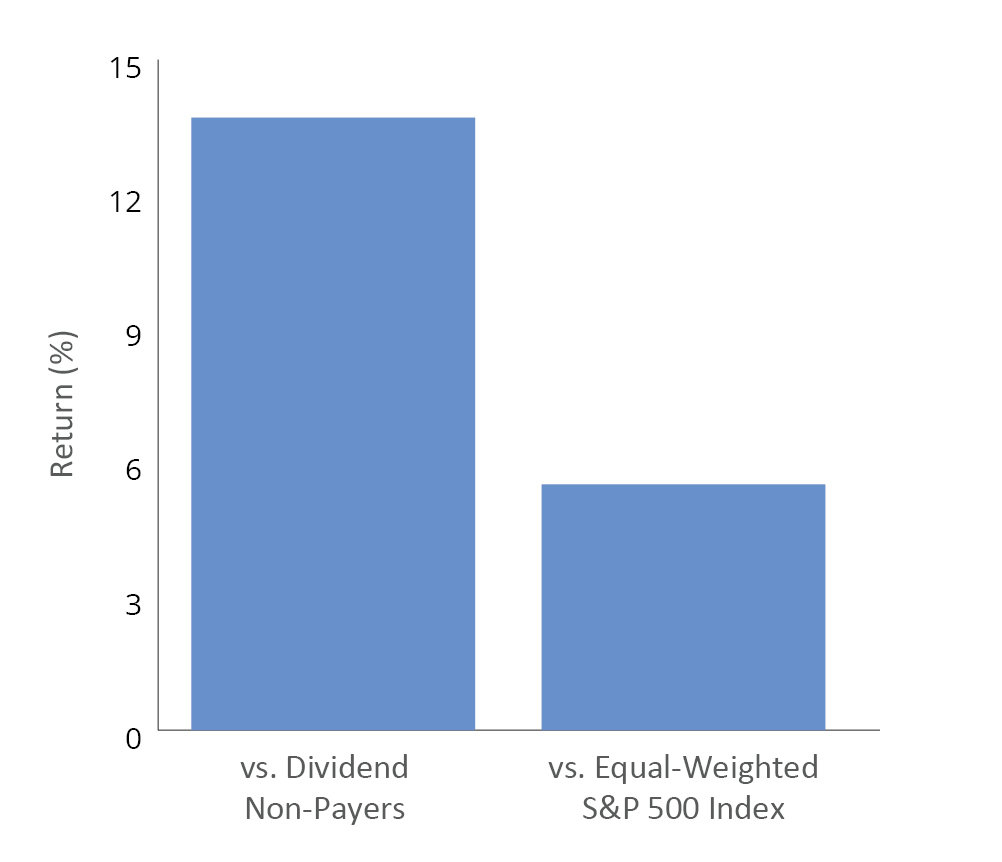

Historical performance shows that dividend-paying stocks tend to hold up better and deliver superior returns compared to non-payers. For example, during significant market drawdowns of more than 10%, dividend payers in the S&P 500 outperformed non-dividend payers by about 13.7%, and beat the equal-weighted S&P 500 by 5.45%.

Dividend growth stocks also tend to be more resilient when markets correct. The S&P 500 Dividend Aristocrats Index — which tracks companies that have raised their payouts for 25+ straight years — is about 10% less volatile than the broader market.

That means we collect steady, rising income and enjoy smoother returns.

So when everyone else is panicking about inflation, we’re calmly collecting growing dividends. We’re not chasing price swings—we’re building a fortress of rising income that inflation struggles to breach.

Want to find these inflation-fighting dividend growers? Look for companies with a proven track record of dividend hikes, a healthy payout ratio, and strong cash flows. These are the hallmarks of stocks that can keep growing your income no matter what the economy throws at you.

The Takeaway

With inflation running hot — and month-over-month data suggesting it could annualize near 10% if the trend continues — we need a real hedge. These stocks are one of the best answers: they generate income, they raise it every year, and they help protect our purchasing power when almost everything else is falling behind.

Good investing!

Greg Patrick

P.S. Not every stock we buy raises its dividend faster than inflation every year. But many do — and over time, that consistency has a powerful compounding effect. That’s exactly what we’re building in our Income Builder Portfolio with $1,000/month.

Source: Dividends & Income