Park Hotels & Resorts (PK) is a Zacks Rank #1 (Strong Buy) that is a prominent publicly traded lodging REIT, boasting a diverse portfolio of leading hotels and resorts.

Park is posting continued beats on earnings and pays a dividend of 7%. Estimates are slowly trending higher and with the stock selling off in recent months, PK is starting to look attractive at current levels.

About the Company

Park Hotels & Resorts was a spin-off of Hilton Worldwide in 2017 and is headquartered in Tysons, Virginia. The company focuses on active asset management to enhance the value and performance of its properties.

Park’s portfolio currently consists of 43 premium-branded hotels and resorts with over 26,000 rooms primarily located in prime city center and resort locations.

The stock has Zacks Style Scores of “A” in Value, but “D” in both Growth and Momentum. The company has a market cap has a market cap of $3 billion and a Forward PE of 6. As mentioned above, the 7% dividend makes the stock a dividend value play for longer-term investors.

Q1 Earnings Beat

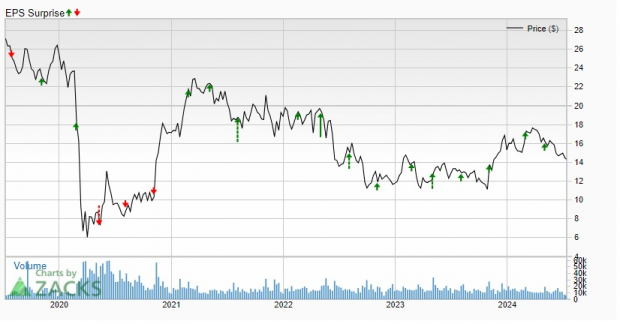

In late April, the company reported an 18% EPS beat. This was another earnings beat for the company that has posted a winning streak going back to 2020.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Park raised its 2024 outlook, not seeing FFO at $2.07-$2.15 up from the $2.02-$2.22 prior. EBITDA was raised to $655-695M, up from a prior range of $645-685M.

Total RevPAR was up 6.6% y/y and adjusted EBITDA margins were up 190bps from last year.

The company will report earnings on 7/31 and there looks to be positive momentum since the last earnings report.

Analyst Estimates Headed Higher

Analysts have slowly been hiking earnings estimates over the last 90 days.

For the current quarter, estimates have gone from $0.60 to $0.64, or 6%.

For the current year, estimates have been taken 4% higher, going from $2.10 to $2.20.

Looking longer term, there has been little movement, but estimates are going higher. Over the last 60 days, numbers have been taken from $2.26 to $2.30, or 2%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Evercore ISS raised PK to Outperform after earnings, with a price target set at $20.

The Technicals

The stock took off in late 2023, moving from $12 to $17. After some brief consolidation, it made new highs this past April at $18.

However, since those highs, the stock has slowly fallen back to the $14 area. For Fibonacci fans, this spot is the 61.8% retracement area. The $13.75-14.50 range is the Fib buy zone, which if it holds, could be a great long-term entry.

Even if this area doesn’t hold, the dividend likely supports the stock in the $12-13 range that held up in 2023.

Bottom Line

With rates going lower, dividend stocks might start to look more attractive to investors. These names have been discarded over the last year in favor of big tech. But with rates headed lower, that narrative could flip.

Current levels look attractive for an entry into PK for a long-term value play. While that story plays out, investors can collect a healthy dividend.

— Jeremy Mullin

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks