While investors anxiously awaited quarterly results from magnificent seven-player Tesla (TSLA) after market hours on Tuesday, they shouldn’t overlook General Motors (GM) stock with the company blowing away its Q1 expectations [Tuesday] morning.

Spiking over +4% [Tuesday], General Motors stock has now soared +25% year to date to top its arch-rival Ford Motor‘s (F) +6% with Tesla shares down a greasily -41% amid slower sales growth and a recent recall in its much-anticipated cyber truck.

With that being said, General Motors raised its EPS guidance and now looks like an ideal time to buy.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Q1 Review

The highlight of General Motors’ first quarter according to CEO Mary Barra was a 10.6% EBIT margin thanks to operating discipline and an industry-leading full-size pickup fleet. This along with momentum in midsize pickups, SUVs, and profitability improvements in General Motors EV portfolio led to net income of $3 billion or $2.62 per share which crushed the Zacks Consensus of $2.08 a share by 26%.

Year over year, Q1 earnings climbed 18% from $2.21 a share in the comparative quarter. Plus, Q1 sales of $43 billion came in 4% better than expected and rose 7% YoY. Furthermore, General Motors has now surpassed its top and bottom line expectations for seven consecutive quarters.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

EPS Growth & Guidance

To the delight of investors and Wall Street alike, General Motors raised its fiscal 2024 EPS outlook to $9.00-$10.00 per share from $8.50-$9.50 a share. Notably, the current Zacks Consensus for General Motors’ FY24 EPS is pegged at $9.12 which would represent 19% growth from earnings of $7.68 per share in 2023.

General Motors also raised its guidance in other key areas such as adjusted EBIT, automotive operating cash flow, and adjusted automotive free cash flow.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

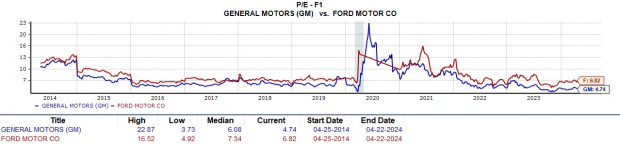

GM is Still Cheap

Despite the incredible YTD rally in General Motors stock, GM still trades at just 4.7X forward earnings which is a steep discount to the Zacks Automotive-Domestic Industry average of 13.7X and even below Ford’s 6.8X. Plus, over the last 60 days, EPS estimates are nicely up for General Motors’ FY24 and FY25 which supports the notion that GM is cheap.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

GM has largely comprised the components of a value stock but the iconic automaker is starting to convey the return to growth that Wall Street has been waiting for making now an ideal time to invest. To that point, General Motors stock currently sports a Zacks Rank #2 (Buy) and the Average Zacks Price Target of $50.54 a share still suggests 17% upside from current levels.

— Shaun Pruitt

Want the latest recommendations from Zacks Investment Research? [sponsor]Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks