Following Alphabet’s (GOOGL) blowout first quarter results last week, and the announcement of its first-ever dividend, now appears to be a promising time to invest in the Magnificent Seven titan.

To that point, Alphabet’s stock currently sports a Zacks Rank #1 (Strong Buy) and is the Bull of the Day as earnings estimate revisions have soared for the cloud and search engine provider.

Strong Performance Overview: Alphabet’s strong Q1 results were attributed to Google Search, Cloud, and stronger advertising growth on YouTube. Alphabet also emphasized that it is well-positioned for the next wave of artificial intelligence through its platform Gemini which is a generative AI multimodal with understanding across audio, video, and text code.

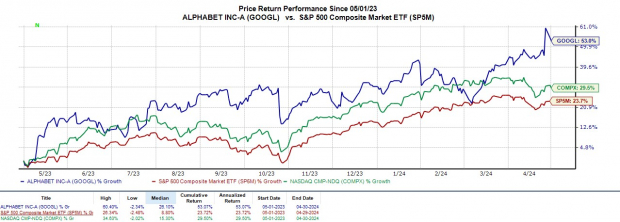

This has now led to a +17% year-to-date surge in Alphabet’s stock which has impressively topped the S&P 500’s +8% and the Nasdaq’s +4%. Furthermore, GOOGL has noticeably outperformed the broader indexes over the last year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Soaring EPS Estimates

Earnings estimates for Alphabet’s fiscal 2024 and FY25 have soared in the last week after the tech giant reported Q1 earnings of $1.89 per share which increased 61% year over year and crushed the Zacks Consensus of $1.49 a share by 27%.

Largely attributing to Alphabet’s strong buy rating is that FY24 earnings estimate revisions have risen 10% since the company’s exhilarating Q1 report from estimates of $6.79 a share to $7.49 per share. Plus, FY25 EPS estimates are up 10% in that last week as well, rising from projections of $7.78 a share to $8.61 per share.

Alphabet’s annual earnings are now projected to rise 29% this year with another 15% EPS growth expected in FY25.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Magnificent Seven Value

Adding value to shareholders and peaking their optimism, Alphabet announced a quarterly dividend of $0.20 per share with the first payout set for June 17 to shareholders on record as of June 10. Notably, five of the Magnificent Seven stocks now offer dividends with Alphabet joining Microsoft (MSFT) , Apple (AAPL) , Nvidia (NVDA) , and Meta Platforms (META) in this regard.

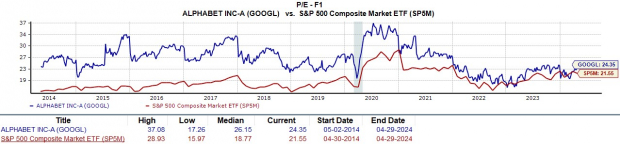

However, what also stands out about Alphabet is that outside of Meta Platforms, it is the most reasonably valued of the Mag Seven in terms of P/E valuation at 24.3X forward earnings and close to the S&P 500’s 21.5X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Alphabet continues to rightfully retain its title as a “Magnificent Seven” stock that has significantly boosted the market’s returns in recent years and is one the most appealing technology-driven companies to invest in at the moment.

— Shaun Pruitt

Want the latest recommendations from Zacks Investment Research? [sponsor]Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks