I just love investing.

It’s incredibly fascinating, challenging, exciting, frustrating, and rewarding.

Owning shares in a business means that you’re actively participating in and benefiting from capitalism.

Those benefits, by the way, can be tremendous.

Those benefits, by the way, can be tremendous.

One of the best benefits?

Passive dividend income!

Yes, collecting dividends that roll in without any effort on your part is magical.

This is just one of the reasons why I’m a diehard fan of dividend growth investing, which is a strategy that prescribes buying and holding shares in high-quality businesses that pay safe, growing dividends to shareholders.

You can find hundreds of examples of these businesses by perusing the Dividend Champions, Contenders, and Challengers list.

This list has prized statistics on US-listed stocks that have raised dividends each year for at least the last five consecutive years.

I’m such a diehard fan of this strategy that I’ve personally applied it with my own money for more than a decade now.

I’m such a diehard fan of this strategy that I’ve personally applied it with my own money for more than a decade now.

This application has helped me to build the FIRE Fund.

That’s my real-life, real-money portfolio, and it generates enough five-figure passive dividend income for me to live off of.

Indeed, I’ve been in the fortunate position of being able to live off of dividends for many years now.

I was even able to quit my job and retire in my early 30s.

My Early Retirement Blueprint explains how I was able to accomplish this.

Now, the dividend growth investing strategy is more than just investing in great businesses that compound while paying safe, growing dividends.

Valuation at the time of investment is also very important.

See, price is only what you pay, but it’s value that you ultimately get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

If one routinely buys undervalued high-quality dividend growth stocks, they can receive, perhaps, the most tremendous investing benefit of all: financial independence.

The valuation aspect of this equation can seem daunting.

Fear not.

Lesson 11: Valuation, penned by fellow contributor Dave Van Knapp, demystifies valuation by providing an easy-to-follow valuation template.

This template can be used to estimate the fair value of almost any dividend growth stock out there.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Lockheed Martin Corp. (LMT)

Lockheed Martin Corp. (LMT)

Lockheed Martin Corp. (LMT) is the world’s largest defense contractor.

Founded in 1912, Lockheed Martin is now a $105 billion (by market cap) global defense juggernaut that employs more than 120,000 people.

The company reports results across four segments: Aeronautics, 41% of FY 2023 revenue; Rotary and Mission Systems, 24%; Space, 19%; and Missiles & Fire Control, 17%.

Lockheed Martin sources nearly 75% of its revenue from the US government (including approximately 64% from the US Department of Defense).

Locked Martin manufactures a range of major military aircraft platforms, including the F-35 Lightning II, the F-22 Raptor, the F-16 Fighting Falcon, and the SH-60 Seahawk.

The F-35, a fifth-generation combat aircraft, is the largest and most expensive military weapons system in the world.

In addition, the company’s various missile programs are critical for both offensive and defensive capabilities.

There’s a sad truth to our reality, which explains why the likes of Lockheed Martin will always exist and prosper.

That sad truth is this: conflict is part of the human condition.

I wish it weren’t so, but it is.

And it’s incumbent upon us investors to invest in the reality we have, not the one we wish we had.

As we can all deduce right away, Lockheed Martin is the type of business that is obviously going to benefit from this reality.

The company provides the advanced machinery and weaponry necessary for sovereign nations to protect themselves against possible outside threats.

Since conflict induces ceaseless demand for these defense products, defense contractors are practically guaranteed ongoing sales for a time period that stretches well beyond my lifetime.

Furthermore, because defense products continue to become more complex and more expensive, sales from Lockheed Martin to its customers become incrementally larger in absolute dollar amounts.

Nations used to fight with swords and shields, but we now fight with multimillion-dollar jets.

This is inherent progression layered onto built-in demand.

But wait.

There’s more.

What makes Lockheed Martin especially formidable is that it is the world’s largest defense contractor, headquartered in the world’s largest spender on defense products and services.

It’s a symbiotic relationship between the biggest supplier and the biggest customer.

Simply put, Lockheed Martin has an unparalleled combination of scale and positioning within an industry that, unfortunately, is necessitated by the existence of human beings.

And that should translate into much more growth ahead for the firm and its revenue, profit, and dividend.

Dividend Growth, Growth Rate, Payout Ratio and Yield

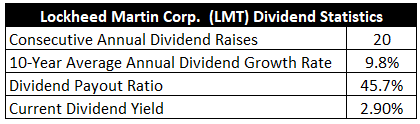

To date, the company has increased its dividend for 20 consecutive years.

A two-decade stretch of ever-larger dividends has obviously been very nice for long-term shareholders, and this just goes to show how committed to the dividend (and the growth of it) Lockheed Martin is.

Very encouraging.

The 10-year dividend growth rate is 9.8%, which is very good and easily outpaces inflation, although more recent dividend raises (such as the last one) have been in a mid-single-digit range.

Along with that consistent and solid dividend growth, the stock yields a market-beating 2.9%.

Not a bad combination of yield and dividend growth here.

Not a bad combination of yield and dividend growth here.

This yield, by the way, is 30 basis points higher than its own five-year average.

That spread gives some early indication of possible undervaluation.

And with a healthy payout ratio of just 45.7%, Lockheed Martin’s dividend is almost a lock for more growth over the coming years.

Just solid metrics right across the board.

No individual number stands out and “wows” me, but it’s such a balanced package.

You get a good-sized dividend consistently growing at a nice clip.

Tough to dislike that.

Revenue and Earnings Growth

As likable as the dividend metrics may be, though, many of the numbers are looking into the past.

However, investors must always be thinking about the future, as the capital of today is being risked for the rewards of tomorrow.

As such, I’ll now build out a forward-looking growth trajectory for the business, which will be of great aid when the time comes later to estimate fair value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

And I’ll then reveal a professional prognostication for near-term profit growth.

Amalgamating the proven past with a future forecast in this way should give us what we need to roughly judge where the business could be going from here.

Lockheed Martin advanced its revenue from $39.9 billion in FY 2014 to $67.6 billion in FY 2023.

That’s a compound annual growth rate of 6%.

I usually like to see at least a mid-single-digit top-line growth rate from a mature business like this, and Lockheed Martin really came through.

Meantime, earnings per share grew from $11.21 to $27.55 over this 10-year period, which is a CAGR of 10.5%.

Even better.

We can now see how that near-10% dividend growth over the last decade has been afforded by very similar bottom-line growth.

Those two growth rates lining up so well shows deft control by management.

Excess bottom-line growth was driven by share buybacks and margin expansion.

For perspective on the former, the outstanding share count has been reduced by 22% over the last decade.

Looking forward, CFRA believes that Lockheed Martin will compound its EPS at an annual rate of 6% over the next three years.

This would represent a pretty sizable step down from what Lockheed Martin has done over the last 10 years, although more recent earnings results line up decently well with where CFRA is at here.

CFRA highlights a few nagging issues for Lockheed Martin.

One is the defense contractor’s exposure to manned military aircraft in an environment in which spending has been shifting toward unmanned alternatives.

Another problem revolves around contracts, as CFRA opines: “Fixed-price contracts comprise 62% of [Lockheed Martin’s] sales, many of which are long-term and lack the ability to adjust pricing for higher-than-expected inflation. This puts margins at risk if cost inflation accelerates.”

These are fair points.

Another fair point, which CFRA delves into, is simply the nature of the business model: “[Lockheed Martin] is effectively a mature firm with relatively low organic growth prospects but with a decent dividend (2.9%) and a track record of share count reductions from buybacks.”

I think that pretty much sums it up.

This isn’t some high-growth business that offers sky-high compounding potential at the risk of going to zero.

This is the world’s largest defense contractor, and it’s steadily moving forward through incremental progress across organic growth opportunities, bolt-on acquisitions, and buybacks – all while paying shareholders a generous dividend.

I mean, you could do a lot worse than that.

If an investor goes into the investment with that fully understood, I think one can do fairly well over the long run – say, a 10% or so annualized total return.

All that said, I would say that CFRA’s forecast could be a smidge conservative.

After all, geopolitics are running hot right now, and we currently have a kinetic war in Europe.

Lockheed Martin may not shoot the lights out with growth, but the geopolitical tailwinds put a floor under the business, in my view.

If we take CFRA’s number as the near-term base case, that still sets up the dividend for like-or-better growth over the next few years.

With the payout ratio where it’s at, I don’t see why Lockheed Martin can’t make good on high-single-digit dividend growth over the coming years.

And you’re starting off with a near-3% yield.

Like I said, you could do a lot worse than that.

Financial Position

Moving over to the balance sheet, Lockheed Martin has a rock-solid financial position.

The long-term debt/equity ratio is 2.5, while the interest coverage ratio is slightly under 10.

That former number is optically high, but that’s only because of low common equity.

A long-term debt load of $17.3 billion is not at all concerning or cumbersome for a company of this size.

I’d certainly prefer an even better balance sheet, but Lockheed Martin has no major issues here.

Profitability is robust.

Return on equity has averaged 86% over the last five years, while net margin has averaged 10.2%.

ROE is juiced by the balance sheet, but even ROIC is routinely over 30%.

Lockheed Martin is undoubtedly generating high returns on capital, which is great.

And circling back around to the margin expansion story I touched on earlier, net margin was below 8% at the beginning of the last decade.

Overall, this is a business model that basically can’t lose over the long run.

And with global scale, high barriers to entry, long-term contracts, unique government relationships, R&D, IP, and technological know-how, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Regulation, litigation, and competition are omnipresent risks in every industry.

Because of the fact that only a few major defense contractors exist in the US, there’s an industry oligopoly present which reduces competition, but there are a number of promising private players in the industry that are coming up and becoming more formidable.

Direct government relationships can lead to more oversight and regulatory risk than the average business.

The very nature of the business model introduces geopolitical risk.

Execution risks have been visible, with cost overruns on the F-35 program being a prime example, and Lockheed Martin must execute properly in order to maintain leadership.

Any reduction in broader US government spending, which is a headline concern with the US deficit running so high, would likely lower the company’s growth trajectory, although defense spending has proven to be quite resilient through the cycles – especially for the likes of Lockheed Martin and its high-tech, long-duration, essential programs.

Being an international company, there’s exposure to currency exchange rates.

There are definitely risks to seriously consider, but the quality and standing of the business should also be considered.

Also, the valuation, which currently looks attractive, should be considered…

Valuation

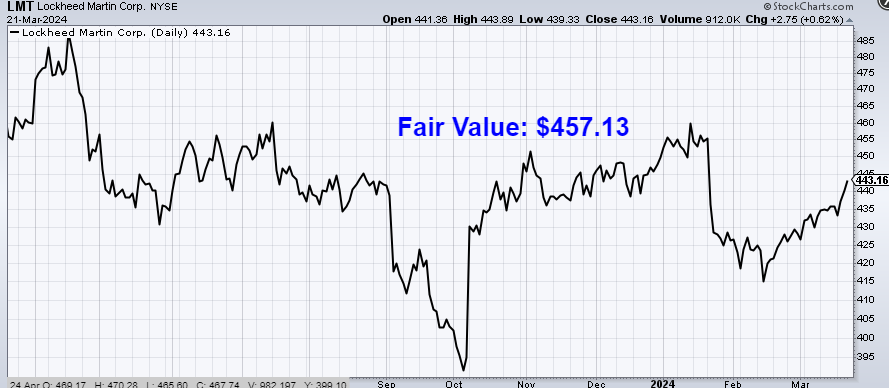

The stock is trading hands for a P/E ratio of 16.

That is a very undemanding earnings multiple that comes in well below where the broader market is at.

For context, this stock’s five-year average P/E ratio is 17.4.

We’re decently below that level now.

The stock’s P/S ratio of 1.6 is also below its own five-year average of 1.7.

And the yield, as noted earlier, is higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 7%.

This strikes me as a reasonable expectation for long-term dividend growth.

Lockheed Martin has done measurably better than this over the last decade in terms of both EPS and dividend growth.

However, the near-term forecast for EPS growth is slightly below this mark, and recent growth out of Lockheed Martin has been somewhat underwhelming.

I’m basically splitting the difference between the long-term results and more recent results, keeping that near-term EPS growth projection in center view.

I’d be surprised if Lockheed Martin grows its dividend materially slower than what I’m modeling in, but shooting the lights out with double-digit growth from here is probably not going to happen.

The DDM analysis gives me a fair value of $449.40.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

A balanced valuation model shows a stock that looks slightly undervalued.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates LMT as a 4-star stock, with a fair value estimate of $482.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates LMT as a 3-star “HOLD”, with a 12-month target price of $440.00.

Boy, we have a fairly strong consensus here. Averaging the three numbers out gives us a final valuation of $457.13, which would indicate the stock is possibly 4% undervalued.

Bottom line: Lockheed Martin Corp. (LMT) is in the business of catering to the necessity of sovereign defense – a necessity built upon the human condition, and one which only becomes more necessary and expensive over time. It basically can’t lose over the long run. With a market-beating yield, high-single-digit dividend growth, a moderate payout ratio, 20 consecutive years of dividend increases, and the potential that shares are 4% undervalued, long-term dividend growth investors who want to increase their industrial/defense exposure could have a great candidate on their hands.

Bottom line: Lockheed Martin Corp. (LMT) is in the business of catering to the necessity of sovereign defense – a necessity built upon the human condition, and one which only becomes more necessary and expensive over time. It basically can’t lose over the long run. With a market-beating yield, high-single-digit dividend growth, a moderate payout ratio, 20 consecutive years of dividend increases, and the potential that shares are 4% undervalued, long-term dividend growth investors who want to increase their industrial/defense exposure could have a great candidate on their hands.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is LMT’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 84. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, LMT’s dividend appears Very Safe with a very unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income

Disclosure: I’m long LMT.