If we spend all of our money, we won’t be able to build wealth.

That’s why living below our means and saving money is so important.

However, saving is just the first step.

Just putting money in the bank and letting it collect dust is not a very good long-term strategy.

One also needs to consistently invest those savings in order to take advantage of the power of compounding and build serious wealth over time.

How serious could this wealth get?

Well, compounding $500 per month in savings at a 10% annual rate of return over 30 years turns into just over $1 million.

So, yeah, it can really add up over time.

Now, there are many different approaches to investing.

But I’d argue that dividend growth investing is the best way to approach it.

This is a long-term investment strategy whereby one buys and holds shares in world-class businesses that pay safe, growing dividends to shareholders.

You can find many examples of such businesses by perusing the Dividend Champions, Contenders, and Challengers list.

That list has compiled cherished data on hundreds of US-listed stocks that have raised dividends each year for at least the last five consecutive years.

You’ll notice dozens upon dozens of really special businesses on this list.

You’ll notice dozens upon dozens of really special businesses on this list.

Shouldn’t be a surprise.

It takes a special kind of business in order to produce the reliable, rising profit necessary to afford reliable, rising dividend payments.

And when a strategy is almost automatically funnels you right into special businesses, you’ve got a special strategy on your hands.

I’ve been personally using this strategy for more than a decade, letting it guide me as I’ve gone about building my FIRE Fund.

That’s my real-life, real-money portfolio, and it generates enough five-figure passive dividend income for me to live off of.

Indeed, I’ve been in the very fortunate position of being able to live off of dividends for years now, even being able to retire in my early 30s.

My Early Retirement Blueprint explains exactly how I was able to achieve such a feat.

Suffice it to say, living below my means, saving money, and intelligently investing my capital into high-quality dividend growth stocks has served me well.

However, that’s not quite the whole story.

However, that’s not quite the whole story.

It’s not just investing in the right businesses but also investing at the right valuations.

See, price is only what you pay, but it’s value that you get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Putting hard-earned savings to work with undervalued high-quality dividend growth stocks can allow you to take advantage of the incredible power of compounding over the long run in one of the best ways possible.

Of course, recognizing undervaluation requires one to first have some kind of basic understanding of valuation.

Not a problem.

My colleague Dave Van Knapp penned Lesson 11: Valuation in order to help newer investors build that understanding.

One of his “lessons” designed to teach the dividend growth investing strategy from the ground up, it provides an easy-to-understand valuation template that can be applied toward just about any dividend growth stock you’ll run across.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Lithia & Driveway (LAD)

Lithia & Driveway (LAD)

Lithia & Driveway (LAD) is an American automotive dealership group.

Founded in 1946, Lithia & Driveway is now an $8 billion (by market cap) car dealership monster that employs more than 20,000 people.

Lithia & Driveway operates approximately 300 dealerships across 25 US states representing 40 different OEM car brands (such as Stellantis and Toyota).

The company also started international expansion recently by entering Canada and the UK, but the vast bulk of operations are in the US.

The company reports results across five categories: New Vehicle Sales, 46% of FY 2022 revenue;, Used Vehicle Sales, 38%; Service, Body & Parts, 10%; Finance & Insurance, 5%; and Fleet & Other, 1%.

Because of the higher margins in servicing and providing parts for vehicles, the company’s Service, Body & Parts category accounted for an outsized portion of FY 2022 gross profit (nearly 1/3).

By vehicle type, its sales mix for FY 2022 was: Import, 43%; Domestic, 29%; and Luxury, 28%.

Lithia & Driveway has used the serial acquirer method to build up an empire of automotive dealerships.

This is a terrific business model on which to apply such a method, as automotive dealerships have an economic flywheel built right in.

Once someone buys a new (or even gently used) vehicle from a dealership, they’re “locked” into an ecosystem.

Only dealerships with direct OEM relationships are authorized to carry out warranty repairs on vehicles.

These repairs cannot be handled by “Bob’s Repair” down on the corner.

Moreover, because of how complex modern vehicles are, it’s difficult – sometimes even impossible – for independent repair shops to handle maintenance and repairs on these vehicles without access to certain machines, documents, and specialized technicians.

And that’s only one way in which this plays out.

There are also lease returns (leading to another lease), as well as customer loyalty to brands (leading back to the OEM dealership again).

Plus, dealerships run local monopolies, as OEMs tend to offer only so many franchise rights per geographic area.

America runs on the automobile and the independence an automobile confers.

With a dearth of public transportation in most areas of the US, the powerful dealership model is very sticky and likely to persist for many years to come.

This bodes well for the company’s ability to continue growing its revenue, profit, and dividend.

Dividend Growth, Growth Rate, Payout Ratio and Yield

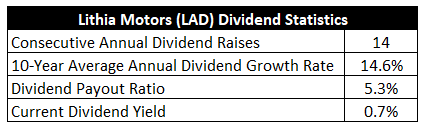

Already, Lithia & Driveway has increased its dividend for 14 consecutive years.

The 10-year dividend growth rate stands at 14.6%.

While that’s an incredible rate of dividend growth, what’s even more incredible is the fact that dividend growth has actually been accelerating.

Indeed, the last couple of dividend raises were approximately 20% each.

And since sustainable dividend growth must be powered by business growth over time, this kind of dividend growth has encouraging implications for what the business has been doing.

Now, the stock yields only 0.7%.

Now, the stock yields only 0.7%.

This is obviously not a yield play.

Instead, it’s a high-quality compounder.

One sacrifices yield in order to access the high rate of compounding here, and I think that’s a very acceptable trade-off (assuming one isn’t already in old age and in need of immediate income).

All that said, this yield is basically in line with its own five-year average, so market participants have historically been willing to accept this lowish yield in order to tap into the growth.

That’s been a smart move, as the business and stock have performed wonderfully well.

Notably, the payout ratio is only 5.3%, despite the huge dividend raises over the last decade.

This is one of the lowest payout ratios I know of, and it gives the company plenty of headroom to increase the dividend over the coming years – even if the business has some bumps along the way.

For dividend growth investors who lean more toward growth over yield and like to compound their money at high rates over time, this company’s dividend profile is highly alluring.

Revenue and Earnings Growth

As alluring is it may be, though, it’s mostly based on backward-looking numbers.

However, investors must look forward, as today’s capital is being risked for tomorrow’s rewards.

That’s why I’ll now build out a forward-looking growth trajectory for the business, which will be instrumental when the time comes to estimate intrinsic value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

I’ll then reveal a professional prognostication for near-term profit growth.

Amalgamating the proven past with a future forecast in this manner should give us what we need to make an informed call on what the business’s future growth path might look like.

Lithia & Driveway moved its revenue from $4 billion in FY 2013 to $28.2 billion in FY 2022.

That’s a compound annual growth rate of 24.2%.

Very, very impressive.

However, it should also be said that the company is a serial acquirer, consistently and methodically acquiring smaller dealerships in bolt-on deals in order to open up new markets and drive additional growth beyond what is organically possible.

I’m a big fan of the serial acquirer model and wholeheartedly approve of its usage in a highly fragmented market like this.

The company’s recent announcement to acquire Pendragon’s UK motor and fleet management divisions through a strategic partnership for a cash consideration of approximately $350 million, which further expands Lithia & Driveway’s geographic footprint, is a good example of this behavior.

All of these acquisitions have a way of driving absolute top-line growth, but what about relative bottom-line growth?

Well, the company increased its EPS from $4.05 to $44.17 over this 10-year period, which is a CAGR of 30.4%.

Truly outstanding.

There has clearly been value creation, not value destruction, here.

These acquisitions have been accretive to the parent organization, to the benefit of all shareholders.

This level of performance is really quite remarkable.

Looking forward, CFRA believes that Lithia & Driveway will compound its EPS at an annual rate of -1% over the next three years.

If CFRA’s projection comes to pass, it would represent a material deceleration in growth for the company.

Is this realistic?

It depends on which side of the fence you lean toward.

On one hand, CFRA states: “[Lithia & Driveway] will likely continue to grow through acquisition as it progresses toward its goal of $50B in revenue and $55-$60 in EPS by 2025. We believe [Lithia & Driveway] has one of the industry’s best management teams. The automotive retail industry is large and fragmented, which offers the potential for growth via acquisition. [Lithia & Driveway] has proven adept at growing EPS through accretive acquisitions and buybacks over time.”

Boy, $60 in EPS by 2025 does not sound like a material deceleration in growth at all.

On the other hand, CFRA has this to say about the near-term setup: “…We have concerns that near-term earnings have peaked and more difficult times are ahead for auto dealers as new vehicle sales slow and interest rates rise.”

In this kind of situation, I really must give the benefit of the doubt to the company.

Lithia & Driveway’s management team has a proven track record of excellence over a very long period of time.

Speaking of which, I’d like to call to attention to the fact that Lithia & Driveway is a family-led business.

The DeBoer family founded the company, own more than 1% of the company, and still control it through key management positions – Bryan DeBoer is CEO, and Sidney DeBoer (the son of the original founder) is the Chairman.

The DeBoer family undoubtedly has every incentive to continue with its excellent stewardship of the business.

While there could be some bumps in the road over the next year or so as high interest rates and falling car prices take their toll, Lithia & Driveway has built up a tremendous organization with scale and resilience.

I’d be inclined to split the difference here in terms of CFRA’s near-term EPS CAGR projection and Lithia & Driveway’s own demonstrated long-term EPS CAGR.

And that puts us well into double-digit territory.

With the payout ratio being so low, that clearly offers the company the ability to grow its dividend at a double-digit annualized rate for years to come, even in a suboptimal operating environment.

Seeing as how the yield is so low, one must bank on that kind of growth playing out, and I believe Lithia & Driveway will deliver over the longer term (while also acknowledging that the next 12-24 months could be dicey).

Again, for long-term dividend growth investors who don’t need immediate income, this a premier compounder poised to continue compounding at an elevated rate.

Financial Position

Moving over to the balance sheet, the so-so financial position is the one facet of this business that I don’t love.

The long-term debt/equity ratio is 1.1, while the interest coverage ratio is approximately 4.5.

Those metrics are not impressive.

Personally, I start to get uncomfortable when the interest coverage ratio is under 5.

Also, a long-term debt load of roughly $5.5 billion on this kind of market cap is slightly concerning.

I’m a huge fan of the serial acquirer method, and I own shares of many serial acquirers in my own portfolio, but most of these businesses are funding programmatic acquisitions with cash flow.

In this case, Lithia & Driveway is using quite a bit of debt for that activity.

The balance sheet is the one blemish for me.

Profitability, however, is fairly strong.

Return on equity has averaged 24.2% over the last five years, while net margin has averaged 3.5%.

The company’s returns on capital are decently high, and margins are supported by the servicing side of the business.

I’ll also note that margin has been steadily and slowly expanding over the last decade, indicating accretion from the acquisitions.

Overall, Lithia & Driveway has been a highly effective industry consolidator, building a dealership empire in the process of doing so.

And with scale in a fragmented industry, localized franchise monopolies, OEM-backed inventory, and OEM-authorized warranty servicing that protects the dealership flywheel, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Regulation, litigation, and competition are omnipresent risks in every industry.

While every industry has competition, each dealership is supported and protected by local franchise control.

Rising interest rates and falling used car prices are near-term headwinds for the business.

The company’s balance sheet is stretched, which may start to limit its consolidator abilities in the future.

Cars are high-ticket items, and any kind of recession would almost certainly reduce demand for autos, which would harm the company’s financial results.

The serial acquirer method requires consistently sound capital allocation, and so Lithia & Driveway’s management team must continue to be prudent and take on sensible acquisitions.

While these risks are worth taking seriously, I also think the quality of this business should be taken into account.

Also, the valuation appears to be very undemanding…

Stock Price Valuation

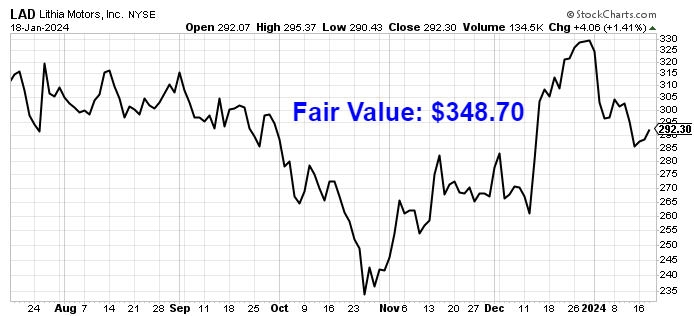

The stock’s P/E ratio is sitting at a lowly 7.7.

Now, this is a stock that never really commands a high earnings multiple.

Its own five-year average P/E ratio is 10.6.

Still, we are well below that already-low level.

I believe the market is trying to price in near-term softness.

But this may be overdoing it.

The P/S ratio of 0.3 is wildly pessimistic.

And the yield, as noted earlier, is basically in line with its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a two-stage dividend discount model analysis.

I factored in a 10% discount rate, a 10-year dividend growth rate of 20%, and a long-term dividend growth rate of 8%.

Admittedly, these are aggressive growth rates.

I rarely go this high in my model.

But if I’ve ever seen a business growth profile that deserves the expectations to be cranked up, it’s this one.

Lithia & Driveway has been growing its business at well over 20% for a decade straight, and the last two dividend raises were in the 20% area.

Despite the large dividend raises, the payout ratio is still only at a mid-single-digit level – one of the lowest payout ratios I know of.

As I noted earlier, if we split the difference between CFRA’s near-term EPS growth forecast and the company’s own 10-year EPS CAGR, we’re at a mid-teens growth rate over the next several years.

Thus, growing the dividend at 20% annually for 10 years, under those conditions, would only require a modest expansion in the payout ratio.

The only way Lithia & Driveway doesn’t deliver double-digit dividend growth over the next decade is if the business almost completely collapses.

I do not see that happening.

The DDM analysis gives me a fair value of $291.11.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

After a fairly aggressive model, the stock looks almost fairly valued to me.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates LAD as a 4-star stock, with a fair value estimate of $500.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates LAD as a 3-star “HOLD”, with a 12-month target price of $255.00.

A decently wide range here. Averaging the three numbers out gives us a final valuation of $348.70, which would indicate the stock is possibly 17% undervalued.

Bottom line: Lithia & Driveway (LAD) has built itself an automotive dealership empire after effectively consolidating its fragmented industry through sound acquisitions. The business model has powerful built-in competitive advantages that lock customers into its flywheel. With a reasonable yield, double-digit dividend growth, an extremely low payout ratio, nearly 15 consecutive years of dividend increases, and the potential that shares are 17% undervalued, long-term dividend growth investors ought to take a good look at this family-led serial acquirer.

Bottom line: Lithia & Driveway (LAD) has built itself an automotive dealership empire after effectively consolidating its fragmented industry through sound acquisitions. The business model has powerful built-in competitive advantages that lock customers into its flywheel. With a reasonable yield, double-digit dividend growth, an extremely low payout ratio, nearly 15 consecutive years of dividend increases, and the potential that shares are 17% undervalued, long-term dividend growth investors ought to take a good look at this family-led serial acquirer.

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is LAD’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 60. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, LAD’s dividend appears Borderline Safe with a moderate risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income

Disclosure: I have no position in LAD.