Investing gives one fascinating insight into the human psychology.

In theory, investing is surprisingly simple.

You spend less than you make and intelligently invest the difference for the long run.

In reality, day-to-day investing can be like walking through a crowded flea shop where everyone is screaming tickers and prices at each other.

This is why it’s so important to ignore the noise and focus on what matters.

What matters?

Living below your means and putting your capital to work with great businesses.

That latter part is why I’m such a huge advocate of dividend growth investing.

This is a strategy whereby one buys and holds shares in world-class enterprises that pay safe, growing dividends to their shareholders.

After all, what does a great business look like?

After all, what does a great business look like?

Well, regularly growing revenue and profit would be a pretty good start.

And the only way a business can afford to return a steadily growing dividend back to shareholders is by generating the steadily rising profit necessary for that.

You can find many examples of these businesses by perusing the Dividend Champions, Contenders, and Challengers list.

This list contains invaluable information on hundreds of US-listed stocks that have raised dividends each year for at least the last five consecutive years.

I’ve been personally using this strategy for more than a decade now, and it’s guided me as I’ve gone about building the FIRE Fund.

That’s my real-life, real-money portfolio.

It produces enough five-figure passive dividend income for me to live off of.

In fact, I’ve been able to live off of dividends for years now.

In fact, I’ve been able to live off of dividends for years now.

I was even able to retire in my early 30s.

And my Early Retirement Blueprint explains how I was able to do that.

Of course, much of my success circles back around to focusing on the fundamentals and investing in the right businesses.

But it’s not just that.

Investing when valuations are right has also been key to my success.

Whereas price tells you what you pay, it’s value that tells you what you get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Keeping things simple is a great way to stay on the right track with investing, and it doesn’t get much more simple than buying high-quality dividend growth stocks when they’re undervalued.

Of course, as simple as it may sound, that does require some kind of familiarity with the concept of valuation.

Good news.

Fellow contributor Dave Van Knapp put together Lesson 11: Valuation in order to help familiarize all kinds of investors with valuation.

Part of a comprehensive series of “lessons” on dividend growth investing, it lays out a valuation template that can be used to estimate the fair value of just about any dividend growth stock you’ll run across.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Philip Morris International Inc. (PM)

Philip Morris International Inc. (PM)

Philip Morris International Inc. (PM) is the world’s largest publicly traded tobacco company, engaged in the manufacture and marketing of tobacco and related products.

Originally founded in 1847, Philip Morris International is now a $145 billion (by market cap) global tobacco monster that employs nearly 80,000 people.

FY 2022 revenue can be broken down geographically as follows: European Union, 38%; East Asia & Australia, 16%; South & Southeast Asia, 14%; Eastern Europe, 12%; Middle East & Africa, 12%; the Americas, 6%; and Other, 2%.

Philip Morris sold approximately 622 billion cigarettes in 2022, down slightly from approximately 625 billion in 2021.

The company’s global market share of cigarettes is an estimated 28%, excluding China and the US.

This incredible market share is due largely to the strength and ubiquity of Philip Morris’s Marlboro brand, the #1 cigarette brand in the world.

This one brand alone comprised more than 39% of the company’s total cigarette sales volume for last year.

It is one of the most dominant consumer brands in the world.

And dominant brands tend to stay dominant, as long as the brand is taken care of.

That puts companies with dominant brands in a powerful spot.

What makes Philip Morris especially powerful in this respect is the fact that the company combines a dominant brand with the addictive nature of the product.

A company can go far with brand loyalty alone.

But Philip Morris takes that idea to the next level by adding addictive properties to the equation.

That equation spits out an end product that is highly price inelastic – i.e., an increase in price doesn’t significantly reduce demand.

This kind of pricing power is very uncommon, and it’s a potent antidote to counteract the unfavorable industry dynamics (decreasing volumes).

But wait.

There’s more.

Management figured out a while ago that the traditional cigarette industry is a “melting ice cube”.

In response, Philip Morris started a number of years ago to transform the entire business model by investing in cigarette alternatives, most notably its IQOS HTUs (heated tobacco units).

IQOS uses heat-not-burn technology that is designed to produce a similar but less harmful experience for its traditional cigarette customers.

IQOS uses heat-not-burn technology that is designed to produce a similar but less harmful experience for its traditional cigarette customers.

In addition, Philip Morris recently (in late 2022) acquired Swedish Match, the Stockholm-based maker of ZYN nicotine pouches, boosting Philip Morris’s exposure to non-cigarette products.

The strategy appears to be working.

Whereas cigarette volume is down 1.3% YOY for the first nine months of 2023, HTU volume is up 18.3% YOY and oral nicotine volume is up 14.4% YOY.

Moreover, smoke-free products are now comprising 35.4% of the company’s total net revenues (as of the first nine months of 2023).

That number was less than 1% as recently as 2015, and Philip Morris is aiming to get more than two-thirds of its total revenue from smoke-free products by 2030.

Put simply, Philip Morris is positioned extremely well for continued revenue, profit, and dividend growth for years to come, despite industry dynamics and a changing environment for nicotine products.

Dividend Growth, Growth Rate, Payout Ratio and Yield

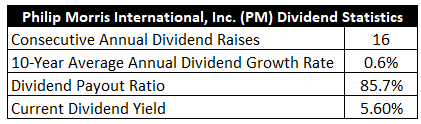

To date, the company has increased its dividend for 16 consecutive years.

That track record is as long as it could possibly be, dating back to the company’s initial spin-off from former parent company Altria Group Inc. (MO) in 2008.

By the way, Altria Group retained exclusive ownership of the Marlboro brand for the US market.

The 10-year dividend growth rate for Philip Morris is 4.7%, although more recent dividend raises have been closer to the 3% area.

Far from amazing growth, no doubt about it.

Far from amazing growth, no doubt about it.

Two things to keep in mind, though.

First, that lack of growth is somewhat offset by the stock’s market-smashing 5.6% yield – a yield that is 10 basis points higher than its own five-year average.

When you’re starting off with a near-6% yield, you don’t need a whole lot of growth in order to make sense of an investment, especially from an income-oriented perspective.

Indeed, many investors right now are chasing fixed-income instruments that yield less than 6% and don’t offer any income growth at all.

The second thing is, Philip Morris is priming itself for an acceleration in growth over the coming years, thanks to its investments in smoke-free products.

Whereas pretty much every other traditional cigarette company is slowly diminishing, Philip Morris’s relatively modest annual volume declines in its core product is allowing time for the smoke-free products to grow and start to take over.

It’s the only setup like it in tobacco.

I don’t know of any other large company in this space that has so clearly articulated a realistic plan and then executed on it.

The large dividend is protected by a payout ratio of 85.7%, based on midpoint guidance for this year’s adjusted EPS.

Elevated, yes, but the company has been working with an elevated payout ratio for years.

However, seeing as how it is so high, growth of the dividend will be limited to growth of the business – the payout ratio cannot be expanded.

For income-oriented dividend growth investors, there’s a lot to like here.

Revenue and Earnings Growth

As likable as these dividend metrics may be, though, many of them are looking into the past.

However, investors must always look into the future, as today’s capital is being risked for tomorrow’s rewards.

That’s why I’ll now build out a forward-looking growth trajectory for the business, which will be of aid when the time comes later to estimate intrinsic value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

I’ll then reveal a professional prognostication for near-term profit growth.

Blending the proven past with a future forecast like this should give us enough information to roughly gauge where the business might be going from here.

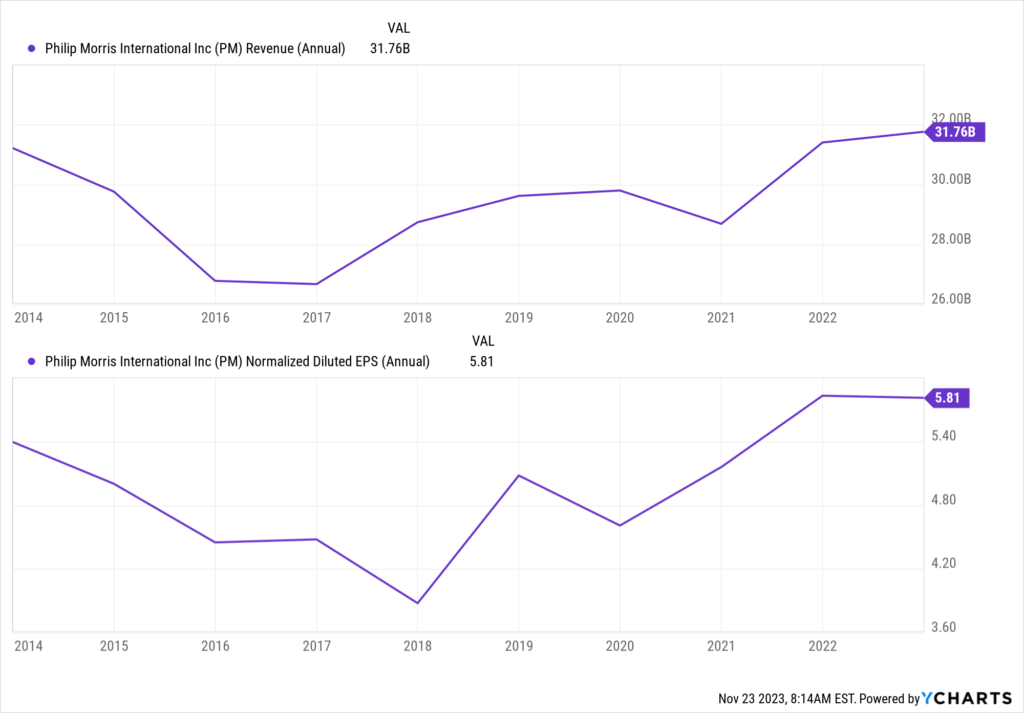

Philip Morris increased its revenue from $31.2 billion in FY 2013 to $31.8 billion in FY 2022.

That’s a compound annual growth rate of 0.2%.

Mixed picture here.

Flat revenue over a decade?

Not impressive.

On the other hand, the fact that Philip Morris was able to keep the revenue base intact in the face of its core product experiencing secular decline says a lot about the firm’s pricing power.

Meanwhile, earnings per share grew from $5.26 to $5.81 over this period, which is a CAGR of 1.1%.

Meanwhile, earnings per share grew from $5.26 to $5.81 over this period, which is a CAGR of 1.1%.

Bottom-line growth is nearly as uninspiring as top-line growth.

If this were all that’s in store for shareholders over the next decade, there’d be little to be excited about here.

However, again, anyone investing in Philip Morris today must have some enthusiasm and belief when it comes to the future viability of the smoke-free products.

Otherwise, Philip Morris is just another melting ice cube.

In the end, we invest in where a business is going, not where it’s been.

Looking forward, CFRA is forecasting that Philip Morris will compound its EPS at an annual rate of 7% over the next three years.

That’s more like it, right?

Clearly, CFRA is seeing the promise of the new products and how those volumes should lift the fortunes of the business.

The $16 billion acquisition of Swedish Match, combined with years of IQOS development, uniquely catalyzes a new growth process that is unique in the industry.

I think this quote from Philip Morris’s Q3 earnings release says a lot: “ZYN nicotine pouch shipment volume in the U.S. of 89.9 million cans, representing growth of 53.1% versus second-quarter 2022 Swedish Match shipments of 58.7 million cans.”

That is the kind of volume growth that can make a staid tobacco company exciting once again.

It’s estimated that ZYN’s share of the US nicotine pouch market is somewhere around 60%, so it is actually an even more dominant brand than Marlboro is.

Quite incredible.

Philip Morris’s own guidance for FY 2023 is calling for 10% to 10.5% YOY adjusted EPS growth, so CFRA’s 7% call doesn’t sound unreasonable at all.

Now, I wouldn’t pull out the champagne bottles.

Dividend growth will likely remain somewhat modest in the near term, as the payout ratio is elevated and Philip Morris’s debt load is high (that Swedish Match growth was purchased with debt).

Still, the pickup in growth does at least alleviate fears over what kind of long-term future the business may have.

Furthermore, additional cash flow can be used to reduce the debt load while also steadily compressing the payout ratio in order to set shareholders up for larger dividend raises when looking out past the next couple of years.

Patience is needed, but something better than a mid-single-digit dividend growth rate could be in the cards here.

When starting off with the high yield, it’s tough to complain about that.

Financial Position

Moving over to the balance sheet, Philip Morris has a good financial position.

Because of negative shareholders’ equity, there’s no debt/equity ratio.

We can see that the balance sheet carries nearly $35 billion in long-term debt.

Is this egregious for a company with a market cap of $145 billion?

I don’t think so.

The interest coverage ratio is over 10, which indicates no issues with servicing the debt load.

Prior to the Swedish Match acquisition last year, Philip Morris had been making good progress with paying down debt and deleveraging the balance sheet.

Between FY 2017 and FY 2021, long-term debt had been reduced by 20%.

The new growth and cash flow should help the company to get back on track with this debt reduction process.

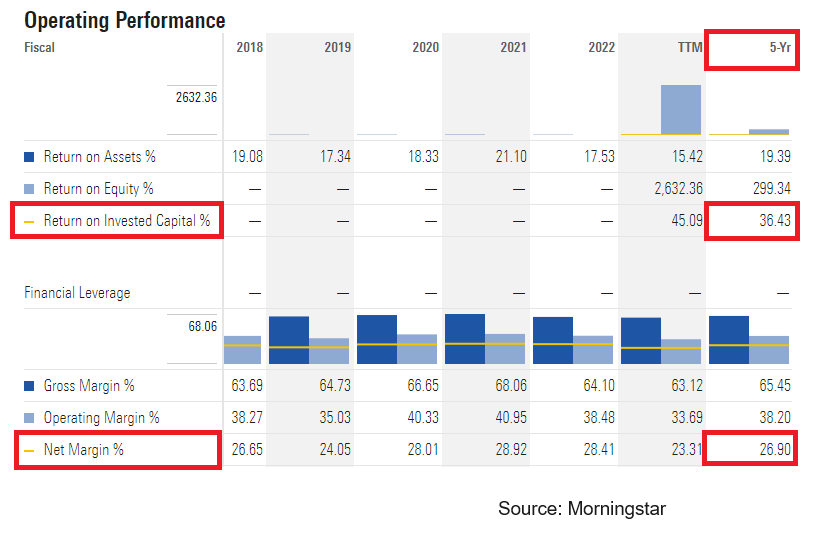

Profitability is outstanding.

Net margin has averaged 26.9% over the last five years.

ROE isn’t applicable because of negative equity; however, return on invested capital has averaged 36.4% over the last five years.

Philip Morris is adapting to changing industry dynamics, which is exactly what you want any business to do.

Philip Morris is adapting to changing industry dynamics, which is exactly what you want any business to do.

It’s transforming from a slow-growth cash cow focused on a product in secular decline to a fast-growth play on safer nicotine delivery.

And with pricing power, brand loyalty, global economies of scale, and high barriers to entry, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Litigation, regulation, and competition are omnipresent risks in every industry.

The very business model introduces above-average regulation and litigation risks.

Smoking bans, prohibitions on flavored tobacco products, and crackdowns on e-cigarettes are all examples of rising regulatory pressure on the business model.

On the other hand, competition is somewhat limited, as the entrenched players, while competitive with one another, are unlikely to see any major new competition ever because of how impossibly difficult it would be to start to a new tobacco company from scratch today.

Being headquartered in the US and reporting results in USD but deriving most of its sales from outside of the US exposes the company to currency exchange rates more than the average US-based business.

Any slowing of the worldwide adoption of cigarette alternatives (primarily via ZYN and IQOS) would harm the company’s ability to offset traditional cigarette volume declines with growth elsewhere.

Lastly, any speedup in the annual contraction of cigarette volumes would harm the company’s ability to transform itself.

While these risks are formidable, the business model is also formidable.

And with the stock’s price down 11% from its recent high, the valuation prices in a lot of issues…

Stock Price Valuation

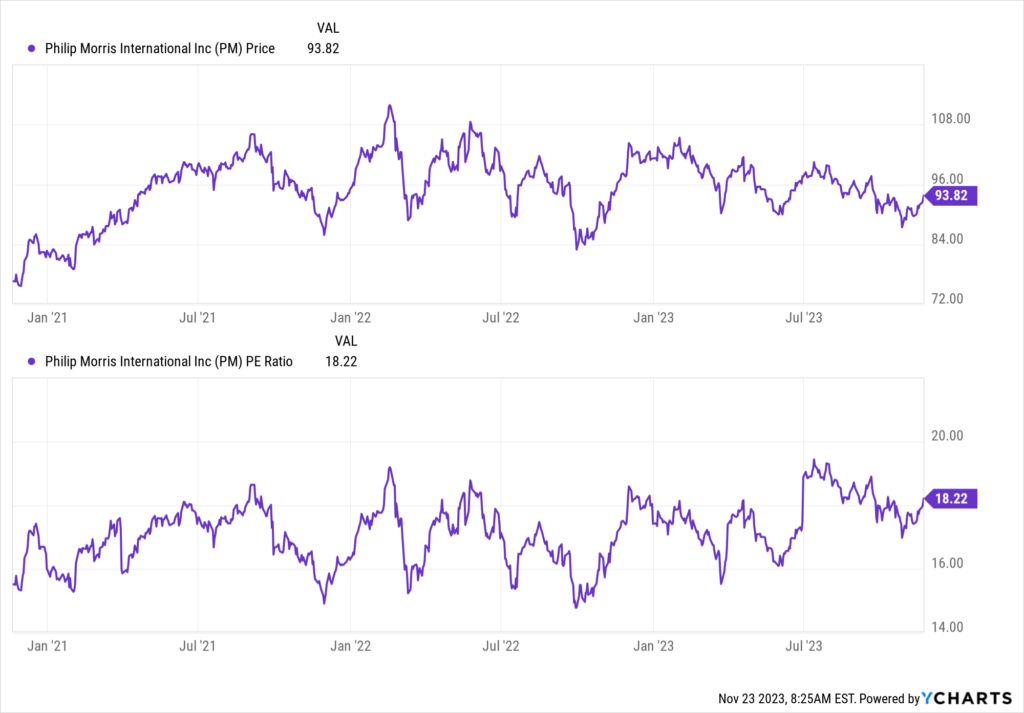

The P/E ratio is sitting at 18.2.

That’s using GAAP TTM EPS.

Using the company’s midpoint guidance for adjusted EPS for this year, the forward P/E ratio drops to 15.5.

Neither number is super demanding.

Neither number is super demanding.

The sales multiple of 4.3 is also not very high, and it’s lower than its own five-year average of 4.5.

And the yield, as noted earlier, is slightly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 4.5%.

The number I’m using is very close to the company’s own demonstrated dividend growth rate over the last decade, which is 4.7%.

Now, I am aware that recent dividend raises have been lower.

However, on the other hand, the near-term forecast for EPS growth is quite a bit higher than my number.

The payout ratio is elevated, and so management will have to be measured when it comes to the size of dividend raises.

That’s why I’m basically back to square one and believe that Philip Morris will right the ship and get back to its own long-term average on dividend growth.

The DDM analysis gives me a fair value of $98.80.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

Even after a thoughtful valuation, the stock comes out looking modestly undervalued.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates PM as a 4-star stock, with a fair value estimate of $103.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates PM as a 4-star “BUY”, with a 12-month target price of $110.00.

I came out on the low end, and perhaps I’m a tad bit too cautious. Averaging the three numbers out gives us a final valuation of $103.93, which would indicate the stock is possibly 10% undervalued.

Bottom line: Philip Morris International Inc. (PM) is executing a massive transformation and showing rare growth in a field where most other businesses are struggling with volumes. It’s a best-of-breed business positioned for better days ahead. With a market-smashing yield, a sound payout ratio, mid-single-digit dividend growth, more than 15 consecutive years of dividend raises, and the potential that shares are 10% undervalued, this cash cow with a unique growth catalyst could be perfect for income-oriented dividend growth investors.

Bottom line: Philip Morris International Inc. (PM) is executing a massive transformation and showing rare growth in a field where most other businesses are struggling with volumes. It’s a best-of-breed business positioned for better days ahead. With a market-smashing yield, a sound payout ratio, mid-single-digit dividend growth, more than 15 consecutive years of dividend raises, and the potential that shares are 10% undervalued, this cash cow with a unique growth catalyst could be perfect for income-oriented dividend growth investors.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is PM’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 64. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, PM’s dividend appears Safe with an unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income