WeWork (WE) has finally put shareholders out of their misery.

The company filed for bankruptcy last week.

Just four years ago, it was valued at $47 billion. Now it’s worth zero.

And several months ago, I warned readers to stay far away from this sinking ship. Even the turnaround expert hired to get the company back on track abandoned it as a lost cause.

If you managed to avoid this dumpster fire, give yourself a pat on the back.

But don’t relax just yet.

WeWork’s downfall will send a shock through our financial system that could trigger the collapse of more banks.

Today I’ll explain why and share a special briefing to walk you through how to protect your wealth.

The Consequences of WeWork’s Downfall

Do you remember the banking crisis earlier this year?

Three banks – Silvergate, Silicon Valley, and Signature – all collapsed in a matter of just five days. First Republic fell apart as well just a month later.

The rapid rise in interest rates over the past year reduced the value of the bonds they held. And when skittish depositors tried to pull their money out, there wasn’t enough money to pay them all back.

After the Federal Deposit Insurance Corporation (FDIC) stepped in to guarantee deposits, customers calmed down.

The media attention faded away.

But the banking crisis is still unfolding to this day.

In July, Heartland Tri-State Bank was shut down to protect depositors.

And last week, the FDIC took over Citizens Bank due to financial instability.

The collapse of WeWork is going to put even more stress on the small and mid-sized banks that are on the brink of going under.

Here’s why…

WeWork was a major tenant leasing commercial office space, including nearly 4.2 million square feet in Manhattan. It also had large amounts of office space in San Francisco and Los Angeles.

But now that it declared bankruptcy, WeWork will be able to cancel or renegotiate leases. The company has already filed to cancel nearly 70 leases.

That puts pressure on the owners of those office buildings. If they are forced to accept lower rents or can’t find tenants to replace WeWork, then they may start to fall behind on mortgage payments.

More than $2.4 billion in commercial mortgage loans are backed by properties where WeWork is one of the top five tenants.

And if building owners can’t pay the mortgage, they’ll default on the loan and hand the keys to their lenders – the banks.

Impact on Banks

Now banks are in the business of lending money, not running office buildings. So after they foreclose on those properties, they’ll do whatever it takes to get rid of them – likely selling them off for cheap.

That creates more problems. Other banks that still have office loans will have to mark down the value of the properties backing their loans.

That makes the “loan-to-value” go up, which means that the loans are riskier.

And since there are strict rules about how much risk banks can take, they’ll have to increase their reserves. Those that can’t stay in compliance are at risk of being shut down.

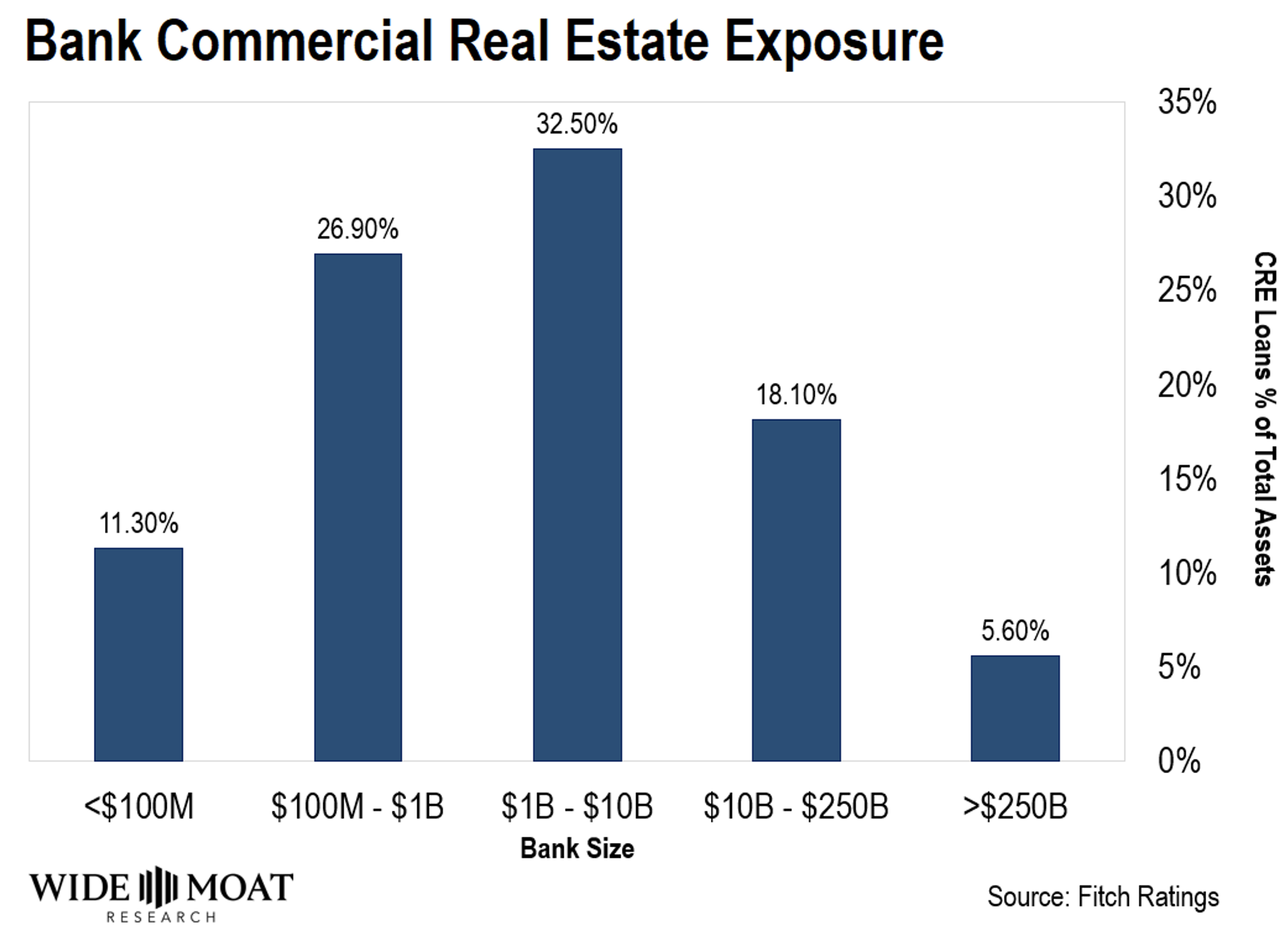

It’s a particularly big problem for small and mid-sized banks. Analysts at Citibank say that smaller banks hold 70% of all commercial real estate (CRE) loans.

Data from Fitch Ratings show that these loans make up nearly a third of assets for some banks. That’s nearly 6x more exposure compared to the big banks.

That’s why WeWork’s bankruptcy could be the trigger that sets off a chain reaction that blows up more banks.

That’s why WeWork’s bankruptcy could be the trigger that sets off a chain reaction that blows up more banks.

There is no need for you to pay the consequences of WeWork’s mismanagement and these banks’ risky investment deals.

Happy SWAN (sleep well at night) investing,

Brad Thomas

Editor, Intelligent Income Daily

Source: Wide Moat Research