Is there any game in the world more fascinating than investing?

It will constantly challenge you, humble you, push you, surprise you, and reward you.

Those rewards come partially in the form of money, of course.

But the money isn’t just about financial gain.

But the money isn’t just about financial gain.

No, the money you can make through investing is largely about freedom.

Financial freedom, that is.

I’ve been investing for more than a decade now.

It’s been a wild, wonderful journey, and it’s rewarded me with financial freedom.

Indeed, I was even able to retire in my early 30s.

How?

My Early Retirement Blueprint digs into the details.

Suffice it to say, a lot of it came down to living below my means and intelligently investing my savings.

My form of intelligent investing can be summed up the strategy I’ve employed, which is dividend growth investing.

This strategy involves buying and holding world-class businesses that pay reliable, rising cash dividends to their shareholders.

Those reliable, rising dividends are funded by reliable, rising profits.

And reliable, rising profits are produced when a business does the right things.

You can find hundreds of examples of these businesses by perusing the Dividend Champions, Contenders, and Challengers list.

This list contains invaluable information on US-listed stocks that have raised dividends each year for at least the last five consecutive years.

Following the dividend growth investing strategy led me to build the FIRE Fund.

Following the dividend growth investing strategy led me to build the FIRE Fund.

This in my real-money portfolio, and it generates enough five-figure passive dividend income for me to live off of.

Now, the dividend growth investing strategy is more than just which stocks to buy.

It’s also about the valuation of stocks at the time of investment.

After all, price is only what you pay, but it’s value that you ultimately get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

The best way to play and get rewarded from the long-term game of investing might be to simply buy high-quality dividend growth stocks when they’re undervalued.

Of course, this would require one to first understand the ins and outs of valuation.

Fear not.

My colleague Dave Van Knapp has got you covered with Lesson 11: Valuation.

Part and parcel of an overarching series of “lessons” on dividend growth investing, it provides a simple-to-follow valuation template that can be applied toward just about any dividend growth stock out there.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

NXP Semiconductors NV (NXPI)

NXP Semiconductors NV (NXPI)

NXP Semiconductors NV (NXPI) is a Dutch semiconductor company that supplies high-performance mixed-signal chips.

Founded in 2006 as an independent company, but with roots dating back to the late 1800s, NXP is now a $52 billion (by market cap) technology giant that employs more than 34,000 people.

The company operates under four end markets: Automotive, 52% of FY 2022 revenue; Industrial & IOT, 21%; Communication Infrastructure & Other, 15%; and Mobile, 12%.

NXP has positioned itself well in all of the most exciting and fastest-growing areas of technology.

Morningstar has this to say about NXP’s main business line: “The merger of Freescale and the former NXP in 2015 led to a powerhouse in automotive semiconductors, which makes up about 55% of the company’s total revenue. Like many of its chipmaking peers, NXP is well positioned to benefit from safer, greener, smarter cars in the years ahead. It is among the market leaders in automotive semis, especially in microcontroller units, or MCUs, which serve as the brains of a variety of electronic functions in a car.”

It’s important to point out that NXP’s Automotive business line is not only its largest but also its fastest-growing.

That’s because vehicles are quickly becoming electric and “smart”.

It’s an exponential curve in technology.

In addition, NXP’s strengths in MCUs carries over into IoT, which is allowing the business to generate strong growth there.

And NXP remains a key supplier of components, such as power amplifiers, for wireless infrastructure equipment.

What we have here is a diversified semiconductor company that’s exposed to some of the most durable sources of demand in all of tech.

And that’s what should make its revenue, profit, and dividend growth durable over the long run.

Dividend Growth, Growth Rate, Payout Ratio and Yield

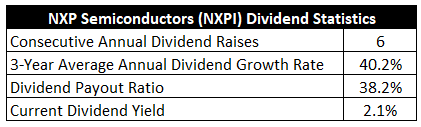

Already, the company has increased its dividend for six consecutive years.

The three-year dividend growth rate of 40.2% shows what a strong start NXP is off to, although much of that growth was fueled by an expansion of the payout ratio off of a low base.

That said, the most recent dividend raise was 20%, so the dividend growth remains brisk.

You get to pair that double-digit dividend growth with a market-beating yield of 2.1%.

This yield, by the way, is 90 basis points higher than its own five-year average.

That’s an incredible spread, but the speed of the dividend’s rise makes it hard to create an accurate comparison here.

Still, the payout ratio is only 38.2%.

Still, the payout ratio is only 38.2%.

So I’d expect NXP to continue increasing its dividend at an aggressive pace.

NXP has the makings of a high-quality compounder.

For long-term dividend growth investors who have time to let those big dividend raises add up and compound, NXP offers some fascinating dividend metrics.

Revenue and Earnings Growth

As fascinating as these metrics may be, we’re mostly looking in the rearview mirror.

But investors must constantly look through the windshield, as today’s capital is being risked for tomorrow’s rewards.

Thus, I’ll now build out a forward-looking growth trajectory for the business, which will be highly useful when the time comes later to estimate intrinsic value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

And I’ll then reveal a professional prognostication for near-term profit growth.

Lining up the proven past with a future forecast in this way should allow us to roughly gauge where the business could be going from here.

NXP increased its revenue from $4.8 billion in FY 2013 to $13.2 billion in FY 2022.

That’s a compound annual growth rate of 11.9%.

Great top-line growth here.

I usually look for a mid-single-digit top-line growth rate from a mature business.

NXP might not necessarily be mature, but this is still excellent growth for a large business.

Meanwhile, earnings per share grew from $1.36 to $10.55 over this period, which is a CAGR of 25.6%.

Remarkable bottom-line growth; however, I’d be careful with drawing too many conclusions here.

FY 2013 was unusually weak, and FY 2022 was unusually strong.

Connecting these two points creates what is probably the most charitable view of NXP’s long-term growth profile.

Other, shorter periods over the last decade are not nearly as dazzling, indicating that NXP is likely growing at somewhere between a high-single-digit and low-double digit mark.

Looking forward, CFRA is forecasting an 8% CAGR for NXP’s EPS over the next three years.

I get it.

This is a long way off of what NXP put together over the last decade, and so it does look pessimistic against that backdrop.

However, again, the preceding 10-year period was special and unique in many ways.

I actually agree with where CFRA landed here, and I see it as a pretty realistic take on what NXP will likely put together over the next few years.

This passage from CFRA highlights the larger picture for NXP: “We are optimistic about content increases in the automotive space, with over one-third of NXPI’s exposure to that end market concentrated on high-growth areas for advanced driver assistance systems, EVs, infotainment, and secure in-vehicle networking. Despite recent softness across non-auto (e.g. mobile, industrial), as customers reduce inventories, revenue remains resilient. We note China concerns, but see NXPI as less exposed to potential U.S.-China political turmoil (Europe-based). We positively view greater cash to return to shareholders given NXPI’s improved free cash flow potential (we project about $3 billion annual run rate).”

I think that sums it up pretty well.

The major growth driver for NXP will be rising chip content per vehicle.

There are a number of trends that are causing vehicles to become more technologically advanced, including the expansion of infotainment systems, electrification, and self-driving capabilities.

All of that bodes well for the likes of NXP.

Some issues here and there, but NXP is running a great business that’s growing at a very good clip.

If we take CFRA’s projection as our near-term base case, that sets up the divided for like-or-better growth – the low payout ratio offers flexibility.

A dividend growing at 8%+ annually, building on top of a 2%+ starting yield, sets shareholders up for a 10%+ annualized total return, assuming a static valuation.

I see nothing wrong with that at all.

Financial Position

Moving over to the balance sheet, NXP has a good, but not excellent, financial position.

The long-term debt/equity ratio is 1.5, while the interest coverage ratio is nearly 9.

I’d like to see the leverage situation improve, but I don’t see anything immediately troublesome here.

Profitability is robust.

Net margin averaged 13.8% over the last five years, while return on equity averaged 18.2%.

Overall, NXP is running a great business.

Other than the balance sheet blemish, there’s almost nothing to dislike.

And the company does benefit from durable competitive advantages that include economies of scale, R&D, IP, technological expertise, switching costs, and barriers to entry.

Of course, there are risks to consider.

Litigation, regulation, and competition are omnipresent risks in every industry.

The very business model is a risk unto itself, as NXP must continuously innovate and stay ahead of the tech curve in order to remain competitive.

NXP is not very diversified by end market.

NXP is heavily reliant the auto industry, an industry which is vulnerable to cyclical downturns.

Any changes to chip content per vehicle, or the ways in which autos are manufactured, could have a major impact on the business.

Being a multinational business, NXP is exposed to currency exchange rates and geopolitical risks.

I see the balance sheet as a key risk, as NXP is more leveraged than a lot of other technology companies.

There are definitely some risks to keep in mind, but the quality and growth profile of the business should also be kept in mind.

In addition, after a recent 12% pullback in the stock’s price, we appear to have an attractive valuation present…

Stock Price Valuation

The stock is trading hands for a P/E ratio of 18.8.

That’s a below-market earnings multiple on a great business.

It’s impossible to compare this to NXP’s own recent historical average, as lumpy GAAP earnings have created nonsensical P/E ratios.

However, we can see a current sales multiple of 3.9 that compares nicely to its own five-year average of 4.2.

And the yield, as noted earlier, is significantly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 8%.

That dividend growth rate is as high as I’ll go, but I think NXP deserves the benefit of the doubt.

It’s well below the company’s demonstrated dividend growth to date.

And it’s right in line with the near-term forecast for EPS growth.

Plus, with the payout ratio being as low as it is, NXP could easily grow the dividend at a rate that slightly exceeds the rate of EPS growth, at least for a number of years.

If anything, NXP may well grow its dividend at a rate that is higher than what I’m anticipating, but it’s hard to imagine the business falling well short of this expectation.

That said, I’d rather err on the side of caution.

The DDM analysis gives me a fair value of $219.24.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

I see a stock that looks modestly undervalued.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates NXPI as a 4-star stock, with a fair value estimate of $240.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates NXPI as a 5-star “STRONG BUY”, with a 12-month target price of $250.00.

I came out a bit low here. Averaging the three numbers out gives us a final valuation of $236.41, which would indicate the stock is possibly 16% undervalued.

Bottom line: NXP Semiconductors NV (NXPI) is a great business that has hitched its wagon to some of the fastest-growing and most exciting end markets out there. With a market-beating yield, a double-digit dividend growth rate, a low payout ratio, more than five consecutive years of dividend increases, and the potential that shares are 16% undervalued, long-term dividend growth investors looking for a high-quality compounder at a reasonable valuation should have their eyes on this name.

Bottom line: NXP Semiconductors NV (NXPI) is a great business that has hitched its wagon to some of the fastest-growing and most exciting end markets out there. With a market-beating yield, a double-digit dividend growth rate, a low payout ratio, more than five consecutive years of dividend increases, and the potential that shares are 16% undervalued, long-term dividend growth investors looking for a high-quality compounder at a reasonable valuation should have their eyes on this name.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is NXPI’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 60. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, NXPI’s dividend appears Borderline Safe with a moderate risk of being cut. Learn more about Dividend Safety Scores here.  Source: Dividends & Income

Source: Dividends & Income