In the world of investing, there’s one indicator that really stands out: Free Cash Flow (FCF) yield. Think of it as a sign that a company is good at making money and using it wisely. When this number is high, it often means the company is in a strong position.

In this article, we’ll introduce you to three standout stocks with impressive FCF yields, remarkable historical returns, and top Zacks Ranks. Additionally, I will lay out the reasons why focusing on Free Cash Flow is one of the best ways to analyze a stock.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Why Free Cash Flow Yield?

Companies with high Free Cash Flow (FCF) yield can often be considered superior investments for several reasons:

- Indication of Financial Health: Free Cash Flow is the cash generated by a company that is available to be distributed to investors (shareholders and debt holders) after all planned capital expenditures have been made. A high FCF yield indicates that the company is generating more cash than the market values it for, suggesting that the company is undervalued.

- Flexibility and Growth Potential: Companies with a strong FCF have the flexibility to invest in growth opportunities without depending on external financing. This can include expanding operations, entering new markets, investing in research and development, or launching new product lines.

- Enhanced Shareholder Returns: High FCF yield can lead to enhanced returns for shareholders. Companies might use their FCF for share buybacks, which can drive up the share price, or for dividend payments, providing a direct return to shareholders.

- Debt Repayment: A high FCF allows companies to pay down debt faster, reducing interest costs and further strengthening the company’s financial position.

- Acquisition and Strategic Moves: With ample free cash flow, companies can make strategic acquisitions to expand their market presence, diversify their portfolio, or eliminate competition.

- Buffer Against Economic Downturns: Companies with a high FCF yield are better positioned to weather economic downturns. They can continue to operate without needing to access external financing, which might be expensive or unavailable during tough economic times.

- Attractiveness to Investors: From an investment perspective, high FCF yield can be an indicator of undervaluation, suggesting that the stock price might rise as the market corrects this undervaluation. This can make these companies attractive targets for both individual and institutional investors.

- Reduced Manipulation: While earnings can sometimes be manipulated by changing accounting practices, FCF is a more concrete measure of a company’s profitability, making it a more reliable metric for investors.

Applied Industrial Technologies

Applied Industrial Technologies (AIT) is a leading industrial distributor that provides critical components, equipment, and value-added services to a wide range of industries, from manufacturing to utilities. With a vast network of suppliers and locations, AIT offers its customers access to a broad product portfolio, including bearings, power transmission components, fluid power components, and industrial supplies.

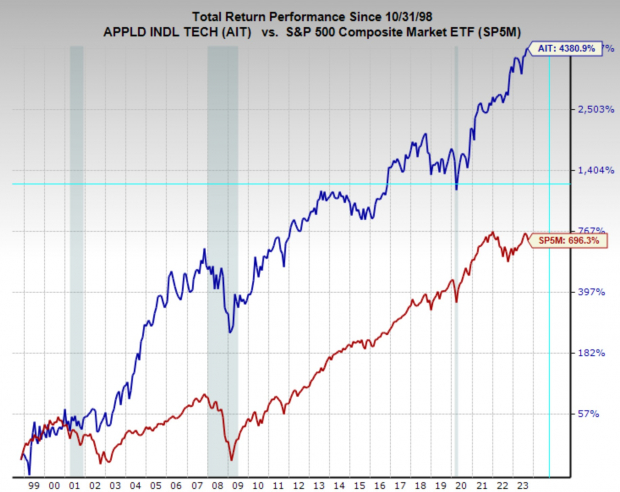

Applied Industrial Technology currently enjoys a Zacks Rank #1 (Strong Buy) rating, indicating upward trending earnings revisions and improving the near-term odds of a move higher in the stock. However, AIT stock has put up incredible returns over the long-term as well.

Over the last 25 years Applied Industrial Technology stock has compounded at an annual rate of 16.2%, double the average annual return on the S&P 500.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

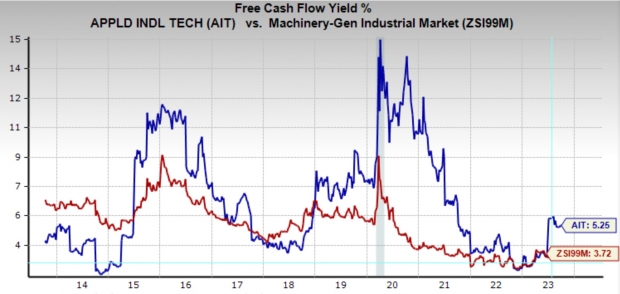

In the chart below we can see that AIT has an FCF yield of 5.25%, which is above the industry average of 3.5% and a relatively high percentage in general. Furthermore, AIT has shown that it has maintained a history of positive free cash flow indicating financial discipline. The company has grown its annual FCF by a CAGR of 12.5% annually.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

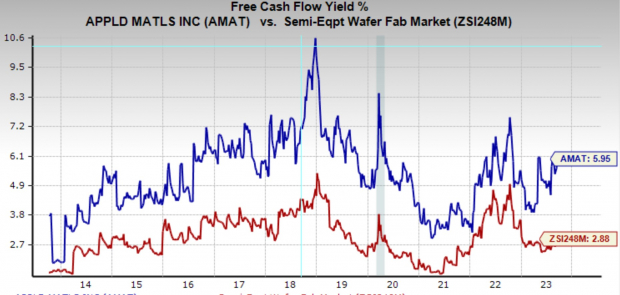

Applied Materials

Applied Materials (AMAT) is a global leader in materials engineering solutions used to produce virtually every new chip and advanced display in the world. Their expertise lies in modifying materials at atomic levels and on an industrial scale. Through their innovations, AMAT plays a crucial role in the semiconductor and display industries, helping to make smartphones, flat-screen TVs, and solar panels more affordable and accessible.

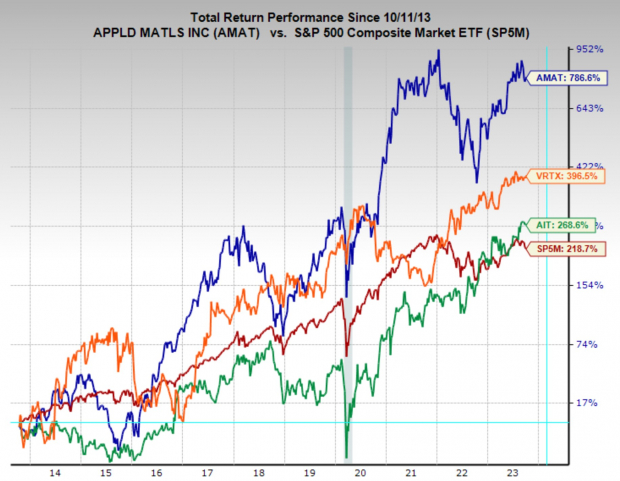

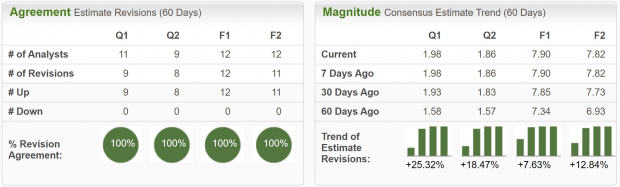

Applied Materials boasts a Zacks Rank #1 (Strong Buy) rating, reflected by its strongly upward trending earnings revisions. Current quarter earnings estimates have increased 25% over the last two months, while FY23 have been revised higher by 7.5% and FY24 by 12.8%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

AMAT has an FCF yield of nearly 6%, which is well above the industry average of 2.9%. The company also shows a history of high free cash flows, growing the number by CAGR of 16.2%, and extremely impressive growth rate.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

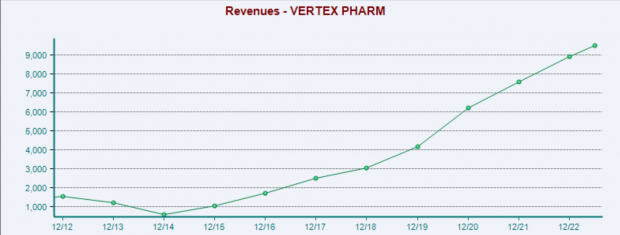

Vertex Pharmaceutical

Vertex Pharmaceuticals (VRTX) is a global biotechnology company that focuses on the discovery, development, and commercialization of innovative medicines for people with life-threatening diseases. Best known for its treatments for cystic fibrosis, Vertex has a robust pipeline of investigational drugs aimed at other serious and genetic diseases.

Sales growth at Vertex Pharmaceuticals has exploded over the last decade, propelling the company to positive Free Cash Flow. Sales over the last ten years have grown at an incredible CAGR of 32%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

VRTX has an FCF yield of 4.2%, which is above the broad market average of 4.1%. Additionally, we can see that free cash flow has become a priority for the company as it was not net profitable until 2016, however since then annual FCF has grown from just $180 million to $3.9 billion in the trailing twelve months.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Free cash flow is an honest and straightforward way for investors to analyze a stock and is worth utilizing whenever looking for robust and steady investments.

— Ethan Feller

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks