Today’s episode of Full Court Finance at Zacks dives into where the stock market stands as we start September. The bullish backdrop seems to remain in place at the moment as Wall Street bets on a soft landing and a huge return to earnings growth next year. Therefore, some investors might want to consider looking for proven large-cap stocks that haven’t bounced back yet.

Despite a bit of a cooldown on the last day of the month, Wall Street could have hardly imagined a better end to what was shaping up to be a rough stretch for the market following the great start to 2023. The downturn was certainly healthy and needed.

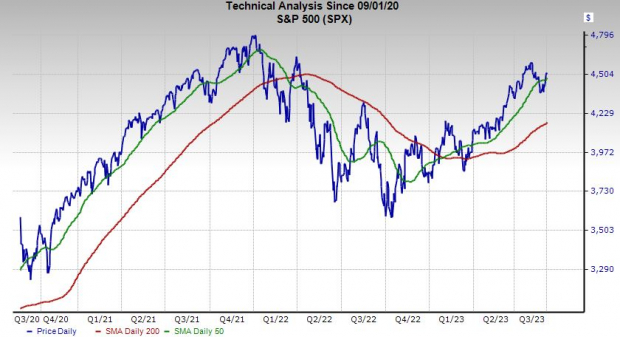

Investors weathered that storm and the bulls have seemingly retaken control of the market, with the S&P 500 and the Nasdaq back above their 50-day moving averages.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The wave of economic data this week highlighted why many are leaning toward a soft landing as the economy continues to slowly cool while remaining stable. The impressive outlook for earnings growth in 2024 and 2025, 11.8% and 11%, respectively, further bolsters the bullish case.

Of course, there could always be more selling in the coming weeks. But long-term investors shouldn’t try too hard to time the market, with the last three and a half years serving as a useful illustration.

The two stocks we explore today—Nike (NKE) and NextEra Energy (NEE) —are trading at least 30% below their records even though they remain titans of their respective industries.

Nike, Inc. (NKE) stock has tumbled as the sportswear powerhouse deals with rapidly changing consumer shopping patterns over the last several years, as well as higher costs and some increased competition in the running shoe market.

Yet, Nike remains one of the biggest apparel and shoe companies in the world and one of the most valuable and recognizable brands on the planet. Nike has gone all-in on its own e-commerce and direct-to-consumer offerings to boost margins and adapt to the new retail era.

Nike fell just short of our Q4 EPS estimate in late June. But its overall FY23 revenue still climbed 10%, and 16% on a currency neutral basis. Zacks estimates call for Nike’s revenue to jump 5% in FY24 and another 9% in FY25 to help boost its adjusted earnings by 15% and 18.5%, respectively. NKE lands a Zacks Rank #3 (Hold) at the moment, but its most accurate/most recent EPS estimates came in solidly above consensus for this year and next.

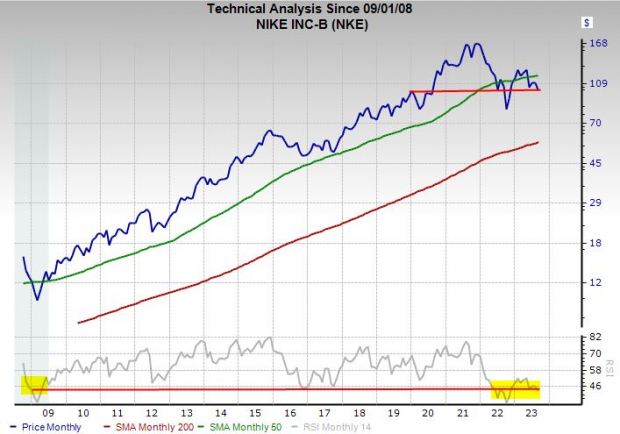

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Nike shares are down around 40% from their highs and 30% below their average Zacks price target. NKE recently bounced out of oversold RSI territory, but it is still trading under some key short-term and long-term moving averages that might make some investors nervous to buy right now.

But those who can handle more near-term downside risk might want to consider Nike as it trades around where it was before the initial Covid selloff in early 2020.

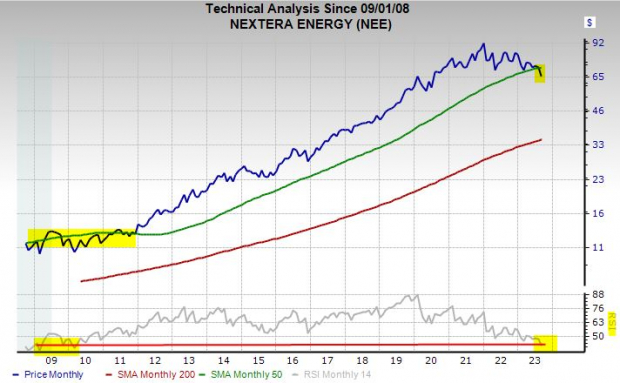

NextEra Energy (NEE) stock has fallen 20% in 2023 as part of a roughly 30% drop from its peaks. Similar to Nike, NEE is trading solidly beneath a handful of key moving averages and around where it was prior to the initial Covid market crash.

The downturn also has NEE sitting at long-term RSI levels that it last hit back in 2009 and 2010. And NextEra trades at a 40% discount to own its 10-year highs at 20.4X forward 12-month earnings and not too far above its median.

Even with the drop, NEE stock has climbed by 750% in the last 20 years vs. the S&P 500’s 355%. Plus, NextEra is one of roughly 65 S&P 500 Dividend Aristocrats, which are firms that have both paid and raised dividends for at least 25 straight years. And 10 of the 13 brokerage recommendations Zacks has for NEE are “Strong Buys.”

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

On the business side, NextEra runs one of the largest electric utilities in the U.S., Florida Power & Light Company, and it is one of the biggest producers of wind and solar energy on the planet. NextEra is a battery storage leader as well, and it is exposed to resurgent nuclear power.

Overall, the $135 billion market cap firm provides a potent combination of stability via its utility segment and the long-term growth potential of renewable energy.

— Benjamin Rains

Want the latest recommendations from Zacks Investment Research? [sponsor]Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks