After blasting first-quarter expectations earlier in the month, M.D.C. Holdings (MDC) stock looks attractive sporting a Zacks Rank #1 (Strong Buy) and an overall “A” VGM Style Scores grade for the combination of Value, Growth, and Momentum.

MDC’s Building Products-Home Builders Industry is also in the top 3% of over 250 Zacks industries. Pent-up demand from the pandemic and a hefty backlog led to MDC having expansive growth over the last few years and the company remains intriguing as mortgage rates show signs of stabilization.

Homebuyers may be more inclined to shop again and MDC should continue benefiting as the company’s primary homebuilding operations include land acquisition and development, home construction, sales and marketing along with customer service.

Style Scores

After recently hitting 52-week highs on strong first-quarter results, higher highs could be around the corner for MDC stock. To that point, MDC checks all the boxes as it relates to the Zacks Style Scores which serve as a complementary set of indicators to use alongside the Zacks Rank.

“A” Momentum Grade

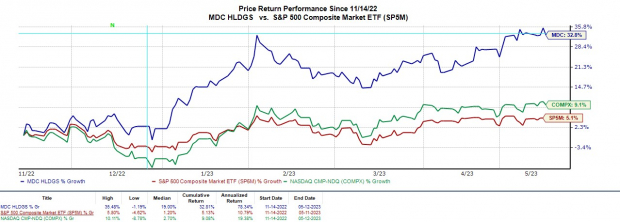

MDC stock continued to soar this year after its first-quarter report on May 2. MDC very impressively surpassed Q1 bottom-line expectations by an astonishing 145% on EPS of $1.08 compared to estimates of $0.44 per share.

On the top line, MDC topped estimates by 18% with Q1 sales at $1.04 billion compared to estimates of $888.80 million. First quarter results confirmed MDC is benefiting from its strong business industry and provided a further catalyst to the stocks impressive rally over the last six months.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Trading at $41 a share, MDC stock is up +10% over the last month to roughly match the Building Products-Home Builders Markets +11% and top the S&P 500’s virtually flat performance. Even better, MDC stock is now up +31% year to date to also match its Zacks Subindustry and outperform the broader indexes.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

“A” Growth Grade

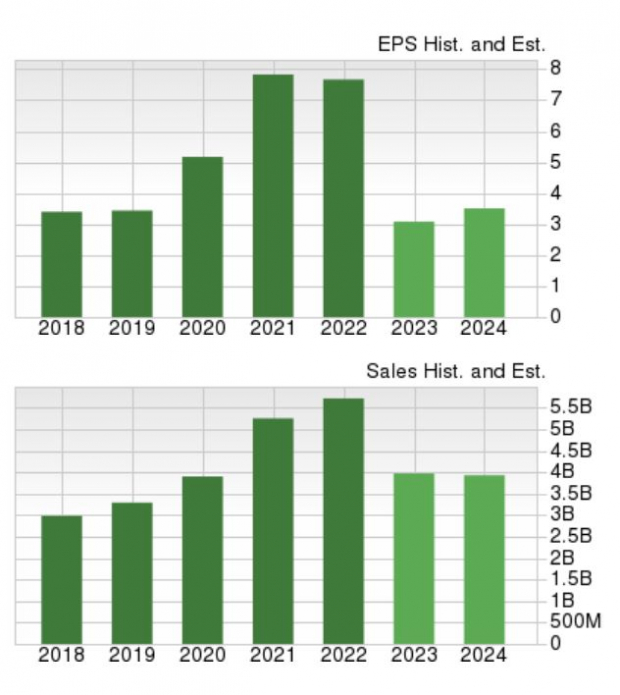

Despite mortgage rates rising to over 6%, MDC had a couple of monster years in terms of growth in 2021 and 2022 with the company’s top and bottom lines expected to come back to reality this year. With that being said, earnings estimate revisions have soared over the last month which correlates to MDC’s strong stock performance.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Fiscal 2023 earnings estimates have jumped 27% over the last 30 days with FY24 EPS estimates climbing 30%. Earnings are now expected to drop -58% this year at $3.23 per share after an extremely tough-to-compete-against year that saw EPS at $7.67 in 2022. Still, fiscal 2024 earnings are forecasted to rebound and jump 21% at $3.90 per share.

Fiscal 2024 EPS would still be 13% above pre-pandemic levels with 2019 earnings at $3.44 per share. Plus, fiscal 2024 sales estimates of $4.19 billion would remain 27% higher than pre-pandemic sales of $3.29 billion in 2019.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

“A” Value Grade

In regards to valuation fundamentals, MDC trades at 14.5X forward earnings which is nicely beneath the S&P 500’s 19.1X but slightly above the industry average of 10.2X. Still, MDC’s growth in recent years has made the stock worthy of a slight premium with the rising earnings estimates offering further support.

Furthermore, when considering enterprise value, MDC’s EV/EBITDA of 3.9X is on par with the industry and attractively below the benchmark’s 19.7X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Stellar Dividend

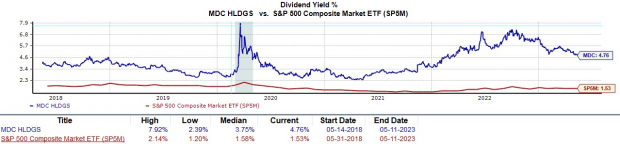

Piggybacking off of MDC’s valuation, the company’s strong balance sheet and liquidity allow for an industry-leading dividend. To that point, MDC’s total cash and equivalents have skyrocketed 176% over the last year at $1.61 billion compared to $581.9 million in Q1 2022.

Regardful to investors, MDC appears to be in great financial health and its 4.76% dividend yield is much higher than the industry average of 0.43% and the S&P 500’s 1.53% average.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Takeaway

Now may be a good time to buy MDC shares and the company also looks like a sound investment for 2023 and beyond with management effectively taking advantage of immense profits in recent years. It looks quite possible that MDC’s impressive YTD performance could continue, especially after easily topping first-quarter expectations.

— Shaun Pruitt

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks