The Kraft Heinz Company (KHC) is one of North America’s largest consumer packaged food and beverage companies. A few of its products include condiments and sauces, cheese, dairy, meals, meats, refreshment beverages, coffee, and other grocery products.

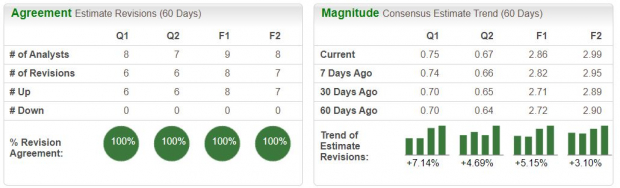

Currently, the stock boasts the highly-coveted Zacks Rank #1 (Strong Buy), indicating that analysts have become bullish on its near-term outlook.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In addition, the stock resides in the Zacks Consumer Staples sector, which is currently ranked in the top 25% (4 out of 16) of all Zacks Sectors. With a favorable earnings outlook, let’s take a look at a few other attractive aspects that KHC shares are displaying.

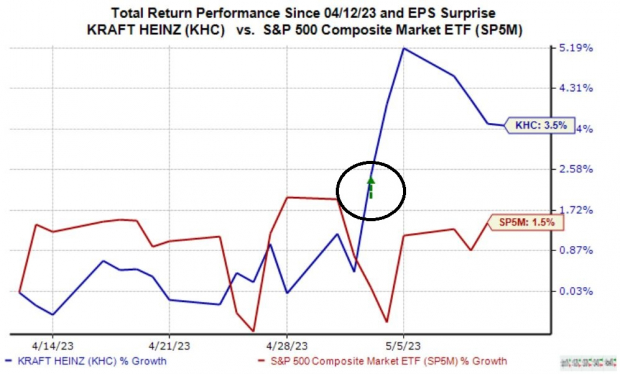

Share Performance & Quarterly Results

KHC shares have found buyers over the last month, climbing 3.5% in value and outperforming the S&P 500 modestly. As we can see in the chart below, the market reacted positively to the company’s latest release, with shares getting a nice boost post-earnings.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

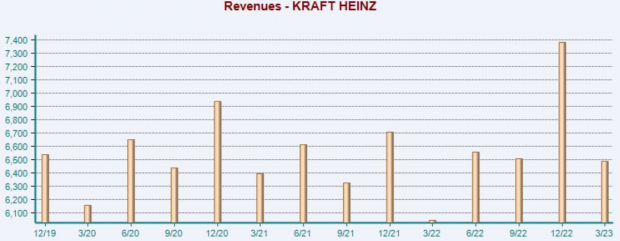

Regarding the latest release, the results were solid. Kraft Heinz posted earnings of $0.68 per share, 13% above the Zacks Consensus EPS Estimate. Quarterly revenue totaled $6.5 billion, modestly above expectations and improving 7.3% from the year-ago period.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Pricing power helped drive the strong results, with the print reflecting the 13th consecutive quarter of Kraft Heinz exceeding the Zacks Consensus EPS Estimate.

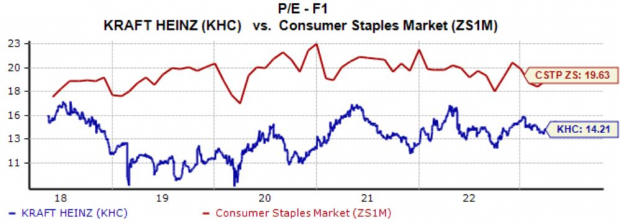

Valuation

The company’s shares aren’t stretched regarding valuation, with the current 14.2X forward earnings multiple sitting just above the five-year median and well below the Zacks Consumer Staples sector average.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

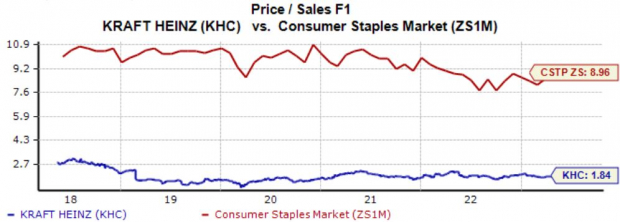

In addition, KHC shares trade at a 1.8X forward price-to-sales ratio, nearly in line with the five-year median and again well below the Zacks sector average.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

KHC carries a Style Score of “C” for Value.

Dividends

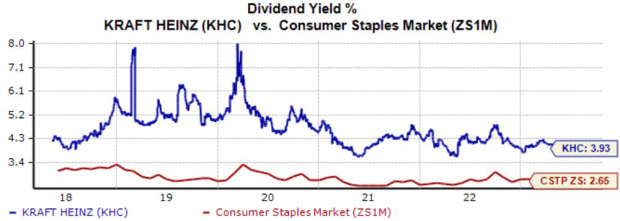

For those seeking income, KHC shares provide precisely what you’re looking for. The company’s annual dividend currently yields 3.9%, well above the Zacks sector average of 2.7%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Still, it’s worth noting that the company hasn’t increased its payout in some time, perhaps steering away those who seek consistent dividend growth.

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

The Kraft Heinz Company would be an excellent stock for investors to keep on their watchlists, as displayed by its Zack Rank #1 (Strong Buy).

— Derek Lewis

Want the latest recommendations from Zacks Investment Research? [sponsor]Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks