I’m not much of a shopper.

I don’t enjoy going to the mall and buying things. Personally, as far as material objects are concerned, I just really don’t spend much money on that stuff. Stocks, on the other hand, drive me wild.

High-quality dividend growth stocks are my favorite merchandise in the world. And so the stock market is my favorite store in the world. Why wouldn’t I be happy when the store is running a sale?

Price and yield are inversely correlated. All else equal, lower prices result in higher yields.

If you want to one day live off of the safe, growing dividend income that’s produced by your portfolio, lower prices and higher yields can make that happen even faster.

Today, I want to tell you about 5 dividend growth stocks that are down 20% or more from their recent highs.

Ready? Let’s dig in.

The first dividend growth stock we have to talk about is Ally Financial (ALLY).

Ally Financial is a bank holding company with a market cap of $8 billion. With a “banking crisis” upon us – which I happen to think is totally overblown – you already know that I have to feature at least one bank today. However, Ally Financial is a bit of a unique bank. Ally Financial can trace its roots back to GMAC, which was the financing arm of General Motors. GMAC became Ally Financial in 2009.

Ally Financial now operates as a quasi-bank, but it is still heavily focused on auto loans. That makes it somewhat insulated from the current issues plaguing certain banks, but it also exposes it to what could be an upcoming spate of underwater auto loans. That said, Ally Financial has been putting up impressive numbers, especially when it comes to dividend growth.

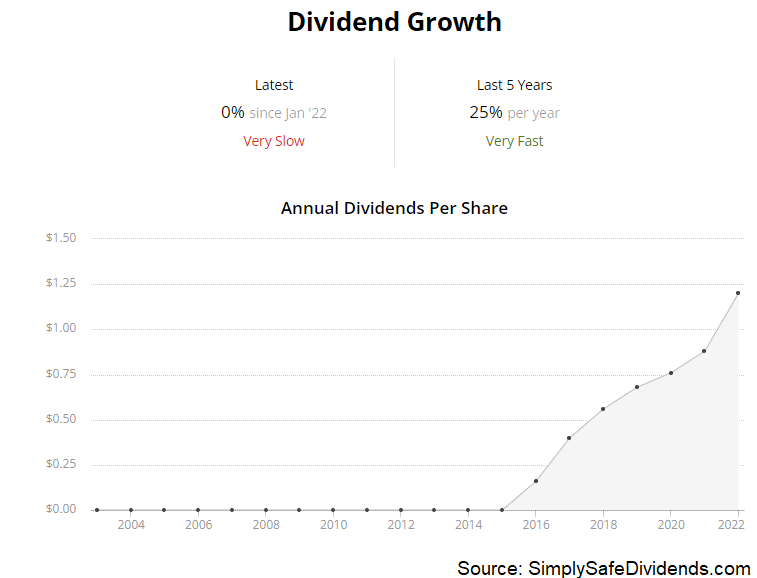

The bank holding company has increased its dividend for seven consecutive years.

That short track record is mostly a symptom of the fact that Ally Financial, as it exists now, is a fairly new entity. But it’s been doing good things for its short history. The five-year DGR is 24.6%. Even the most recent dividend raise came in at 20%. And the stock yields 4.7%. How often do you see a near-5% yield with a 20%+ dividend growth rate? Not often. And the payout ratio is only 29.1%. So even if there are some auto loan woes coming up, there’s a nice cushion in place there.

That short track record is mostly a symptom of the fact that Ally Financial, as it exists now, is a fairly new entity. But it’s been doing good things for its short history. The five-year DGR is 24.6%. Even the most recent dividend raise came in at 20%. And the stock yields 4.7%. How often do you see a near-5% yield with a 20%+ dividend growth rate? Not often. And the payout ratio is only 29.1%. So even if there are some auto loan woes coming up, there’s a nice cushion in place there.

This stock is down a jaw-dropping 43% from its 52-week high. What’s strange about this one, though, is that it doesn’t necessarily track the rest of the banks. Most bank stocks are down heavily YTD. But this stock is actually up on the year. It’s just that its 52-week high of $44.33 came about almost a year ago, and it’s been mostly down since then, now sitting at about $25.

But this stock has held up remarkably well in the face of industry-wide turmoil. Meantime, the slide, which started way before this spring, has created a very low valuation. Most banks command P/B ratios of between 1 and 2, depending on quality, during normal times. This bank’s P/B ratio is only 0.7. The P/E ratio is 6.2. These are incredible numbers. If you’re looking for a cheap, and somewhat unique idea in banking, and you want a high yield, Ally Financial is worth a look.

The second dividend growth stock I want to highlight is CDW Corporation (CDW).

CDW is an information technology company with a market cap of $22 billion.

CDW provides a range of IT solutions across areas such as analytics, cyber security, cloud, etc. Essentially, companies across the board have to manage their digital transformation and then their digital footprint. Companies like CDW help on both ends of the spectrum. They’ve been making a lot of money by doing so. And I don’t see that slowing down anytime soon, which obviously bodes well for the dividend and the growth of it.

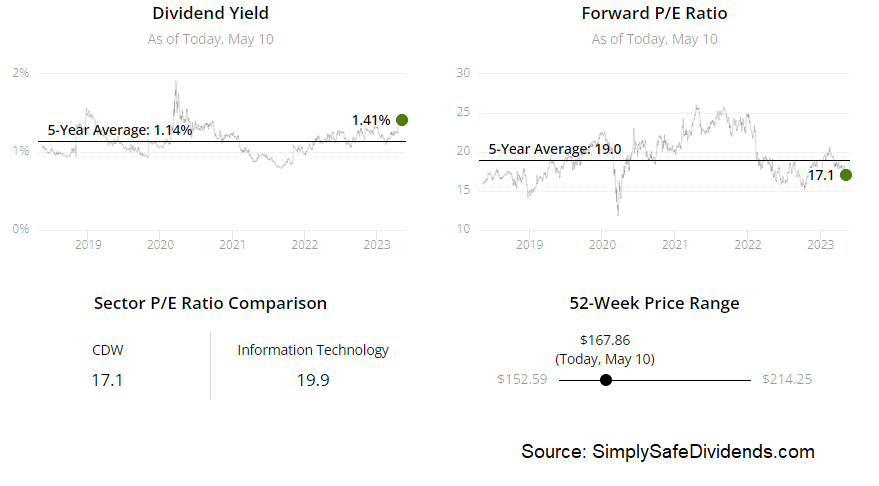

The IT company has increased its dividend for 10 consecutive years. The stock’s 1.4% yield isn’t the highlight. That’s not what sells CDW. It’s instead the growth of the dividend. The five-year DGR is 24.8%. The most recent increase to the dividend came in at 18%. Huge, double-digit growth here. And it looks very sustainable to me, as partially evidenced by the payout ratio of only 30%.

This stock’s 23% drop from its 52-week high may have created a rare opportunity.

This was a $215 stock at the 52-week high. It’s now a $166 stock. And that gap matters, as CDW is one of those high-quality dividend growth stocks that almost always looks a bit expensive. But not now. Every multiple I look at is sitting below its respective recent historical average.

This was a $215 stock at the 52-week high. It’s now a $166 stock. And that gap matters, as CDW is one of those high-quality dividend growth stocks that almost always looks a bit expensive. But not now. Every multiple I look at is sitting below its respective recent historical average.

The earnings multiple of 20.8 is a great example. Its five-year average P/E ratio is 24.7. So that’s a pretty big disconnect. If your portfolio could use a major IT player with fairly high returns on capital, and you’re looking for a rare bargain, this could be the time to jump on CDW.

The third dividend growth stock I want to bring to your attention is Domino’s Pizza (DPZ).

Domino’s is a multinational pizza restaurant chain with a market cap of $11 billion.

You know what’s so interesting about Domino’s? Its simultaneously big and small. This is the largest pizza restaurant chain in the world. Yet its market cap is only $11 billion, which is actually quite small by restaurant standards.

So it has scale, but it also has growth potential – at the same time. That’s really kind of a unique situation. What’s also interesting about Domino’s is that it franchises almost everything out, so it’s just a recurring revenue machine. That’s why it continues to rack up higher revenue and profit, which has been fueling tons of dividend growth.

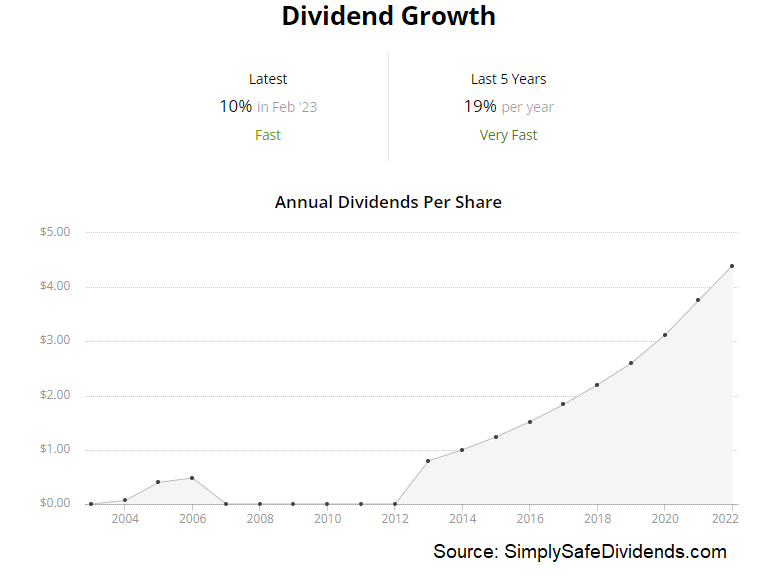

The pizza chain has increased its dividend for 11 consecutive years.

The stock’s 1.6% yield won’t knock you dead. But the five-year DGR of 19% oughta catch your attention. A dividend that can compound at a high rate like that can turn into a very significant income source after a number of years.

The stock’s 1.6% yield won’t knock you dead. But the five-year DGR of 19% oughta catch your attention. A dividend that can compound at a high rate like that can turn into a very significant income source after a number of years.

Using the Rule of 72, a 19% growth rate doubles the dividend in less than four years. Just think about that. That’s huge. And with the payout ratio sitting at 37.3%, we can be decently confident in the ability for this dividend to continue compounding.

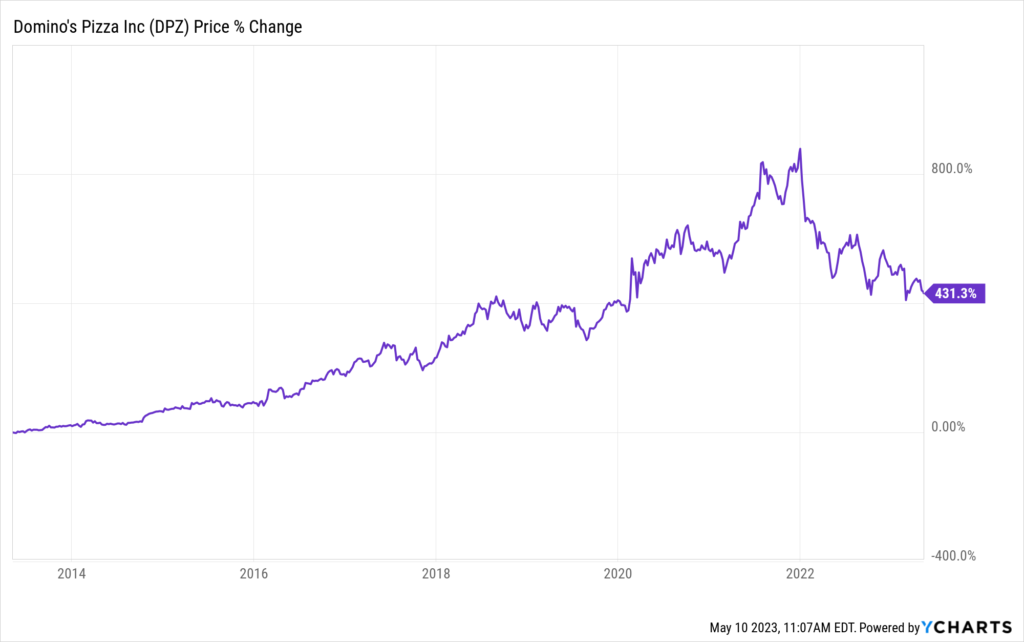

This long-term winner is suffering through a rare bout of underperformance, and it’s down 27% from its recent high.

Keep in mind, this stock is up more than 400% over the last decade. That’s right. What a winner. What a compounder. But it’s been wobbling over the last year or so, as the pandemic caused a huge runup that has since deflated. The 52-week high of $426.44 is long gone. And maybe it was never deserved in the first place.

Keep in mind, this stock is up more than 400% over the last decade. That’s right. What a winner. What a compounder. But it’s been wobbling over the last year or so, as the pandemic caused a huge runup that has since deflated. The 52-week high of $426.44 is long gone. And maybe it was never deserved in the first place.

Nonetheless, the current pricing of about $311 strikes me as favorable when looking at the long-term risk/reward setup. This stock’s five-year average P/E ratio is 33.1. Now? It’s 23.9. Still a bit elevated. But pizza never dies. And I don’t see this business, its stock, or its dividend dying. That level of relative certainty is worth a lot. If you haven’t yet considered Domino’s, now might be a good time to do just that.

The fourth dividend growth stock we have to go over is Tyson Foods (TSN).

Tyson Foods is one of the world’s largest processors of various food proteins with a market cap of $18 billion.

We have a very simple investment thesis here. People have to eat. If you don’t eat, you don’t survive. Going beyond the basic necessity of it, most people usually want to eat the best food they can get their hands on. That often leads to proteins like beef, chicken, and pork. Well, Tyson Foods is a massive processor of these proteins.

Now, the company is facing some near-term margin challenges. The most recent quarter was, in a word, awful. But it’s hard to imagine a world 10 or 20 years from now that isn’t demanding what Tyson provides. And so that does augur well for the business and its dividend.

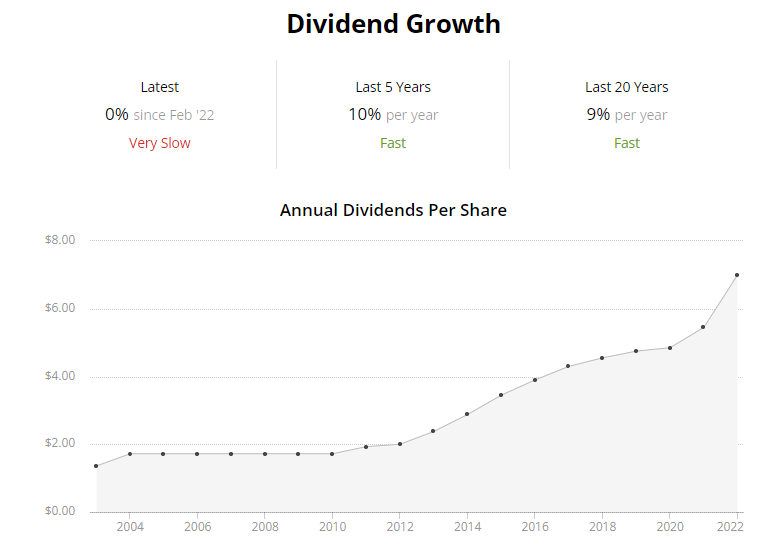

The food company has increased its dividend for 11 consecutive years.

The 10-year DGR is 27%, but it’s super misleading. More recent dividend raises have been in the mid-single-digit range, and that’s really where Tyson is at in terms of its dividend growth potential. In fact, with the business currently struggling in a very real way, near-term dividend growth could be quite muted.

On the other hand, the stock’s 3.8% yield is 150 basis points higher than its own five-year average. That’s pretty incredible. The 43.8% payout ratio, based on TTM adjusted EPS, looks okay, but profit is definitely moving in the wrong direction. So I’d say this dividend is shakier than it looks at first glance.

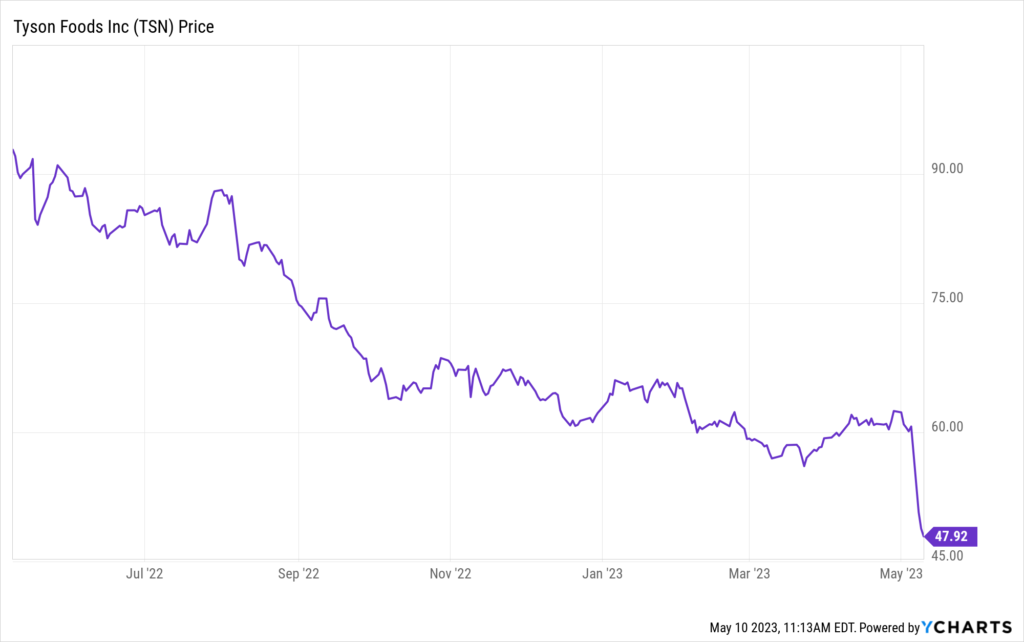

Is this stock’s stunning 46% fall from its 52-week high a chance to be greedy while others are fearful?

Is this stock’s stunning 46% fall from its 52-week high a chance to be greedy while others are fearful?

I’m mixed on this one. If you bought this stock at, or near, its 52-week high of $94.77, you have my sympathies. But for those looking to get in now, the stock’s current pricing of about $50 sure looks a lot more appetizing. Look, price is what you pay, and value is what you get. In this case, the price has fallen significantly in a pretty short period of time. But the value of the business also looks to have fallen.

We last analyzed and valued Tyson Foods late last year, with the fair value estimate coming out to $81.83/share. Now, I came out a lot more cautious than Morningstar or CFRA. My DDM analysis came up with a $68.48/share fair value. I’d probably bring that down after reworking the assumptions. But for contrarian investors who like to charge in, Tyson Foods is interesting here.

The fifth dividend growth stock I should bring up today is Whirlpool Corporation (WHR).

Whirlpool is a multinational manufacturer and marketer of home appliances with a market cap of $7 billion.

Appliances. Not exactly the sexiest products out there. But guess what? Hard to live life in our modern-day society without, say, a refrigerator. And when it comes to appliances, Whirlpool is known as one of the best out there in terms of brand names. It’s synonymous with quality and durability, which keeps the customers coming back time and time again. And that should keep the dividend growing time and time again.

The appliance maker has increased its dividend for 12 consecutive years.

A 10-year DGR of 13.3% looks great, right? Well, get this: The most recent dividend raise, which was announced last February, was a whopping 25%! However, the dividend has gone six quarters in a row at that rate, so that’s mildly concerning.

Then again, this stock yields a monstrous 5.1%. With that kind of yield, can one forgive a delayed dividend raise? Perhaps. With the payout ratio sitting at 50%, based on midpoint guidance for this fiscal year’s EPS, there is room for a higher dividend. But the economy is quite uncertain right now.

Then again, this stock yields a monstrous 5.1%. With that kind of yield, can one forgive a delayed dividend raise? Perhaps. With the payout ratio sitting at 50%, based on midpoint guidance for this fiscal year’s EPS, there is room for a higher dividend. But the economy is quite uncertain right now.

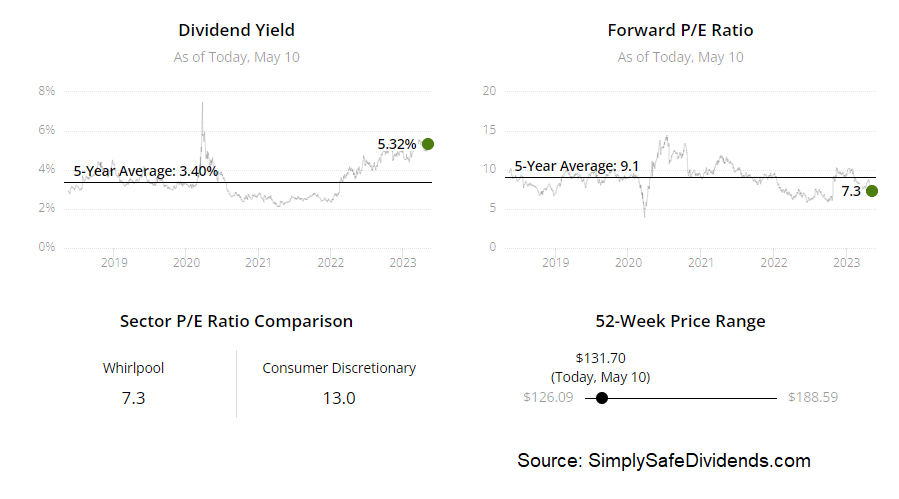

This stock’s 30% retreat from its recent high has made the shares look much more appealing.

I’ve never really been a huge fan of appliance companies. The returns on capital are low. The margins are thin. And when this stock was priced at $196.30, back at its 52-week high, it also suffered from a challenging valuation. But it’s now sitting at about $137. And the valuation has become undemanding.

For example, based on that aforementioned guidance, the forward P/E ratio is 9.8. The stock’s own five-year average P/E ratio is 13.6. If you have room in your portfolio for an appliance company, and if you’re looking to jump on a 5%+-yielder while it’s way down, Whirlpool should definitely be on your radar.

For example, based on that aforementioned guidance, the forward P/E ratio is 9.8. The stock’s own five-year average P/E ratio is 13.6. If you have room in your portfolio for an appliance company, and if you’re looking to jump on a 5%+-yielder while it’s way down, Whirlpool should definitely be on your radar.

— Jason Fieber

P.S. Would you like to see my entire stock portfolio — the portfolio that’s generating enough safe and growing passive dividend income to fund my financial freedom? Want to get an alert every time I make a new stock purchase or sale? Get EXCLUSIVE access here.

Source: Dividends & Income