We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: MMTec, Inc. (NASDAQ: MTC)

Today’s penny stock pick is the Chinese internet-based technology services and solutions company, MMTec, Inc. (NASDAQ: MTC).

MMTec, Inc. develops and deploys platforms that enable financial institutions to engage in securities market transactions and settlements worldwide. The company operates in two segments, Gujia, MM Future, MMBD Advisory and HC Securities; and MM Global.

It offers Internet-based securities solutions comprising Securities Dealers Trading System, which supports securities registration and clearing, account management, risk management, trading and execution, and third party access middleware; Private Fund Investment Management System that supports multi-account management, fund valuation, risk management, quantitative trading access, liquidation, and requisition management; and Mobile Transaction Individual Client System and PC Client System for Apple IOS, Android, PC, and Web applications.

The company enables its customers to white label its trading interface, as well as select modular functionalities. It serves hedge funds, mutual funds, registered investment advisors, proprietary trading groups, and brokerage firms.

Website: https://www.haisc.com

Latest 10-k report: https://www.sec.gov/ix?doc=/Archives/edgar/data/0001742518/000121390022021197/f20f2021_mmtecinc.htm

Analyst Consensus: Not covered by Wall Street analysts.

Potential Catalysts / Reasons for the Hype:

- The company recently announced a securities purchase agreement update. MTC entered into a securities purchase agreement pursuant to which the Company issued an unsecured senior convertible promissory note in the principal amount of $40,000,000 to a non-U.S. investor for a purchase price of $32,000,000. The transaction contemplated under the Agreement was closed on February 22, 2023.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern Breakout: The daily chart shows that the stock has been forming a falling wedge pattern for the past several months. These are marked as purple color lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock has currently broken out from the falling wedge pattern. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MA: The stock is currently above its 50-day SMA, indicating that the bulls have currently gained control.

#4 Bullish Stoch: The %K line of the stochastic is above the %D line, and has also moved higher from oversold levels, indicating possible bullishness.

#5 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#6 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#7 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for MTC is above the price of $1.75.

Target Prices: Our first target is $2.60. If it closes above that level, the second target price is $3.30.

Stop Loss: To limit risk, place a stop loss at $1.20. Note that the stop loss is on a closing basis.

Our target potential upside is 49% to 89%.

For a risk of $0.55, our first target reward is $0.85, and the second target reward is $1.55. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

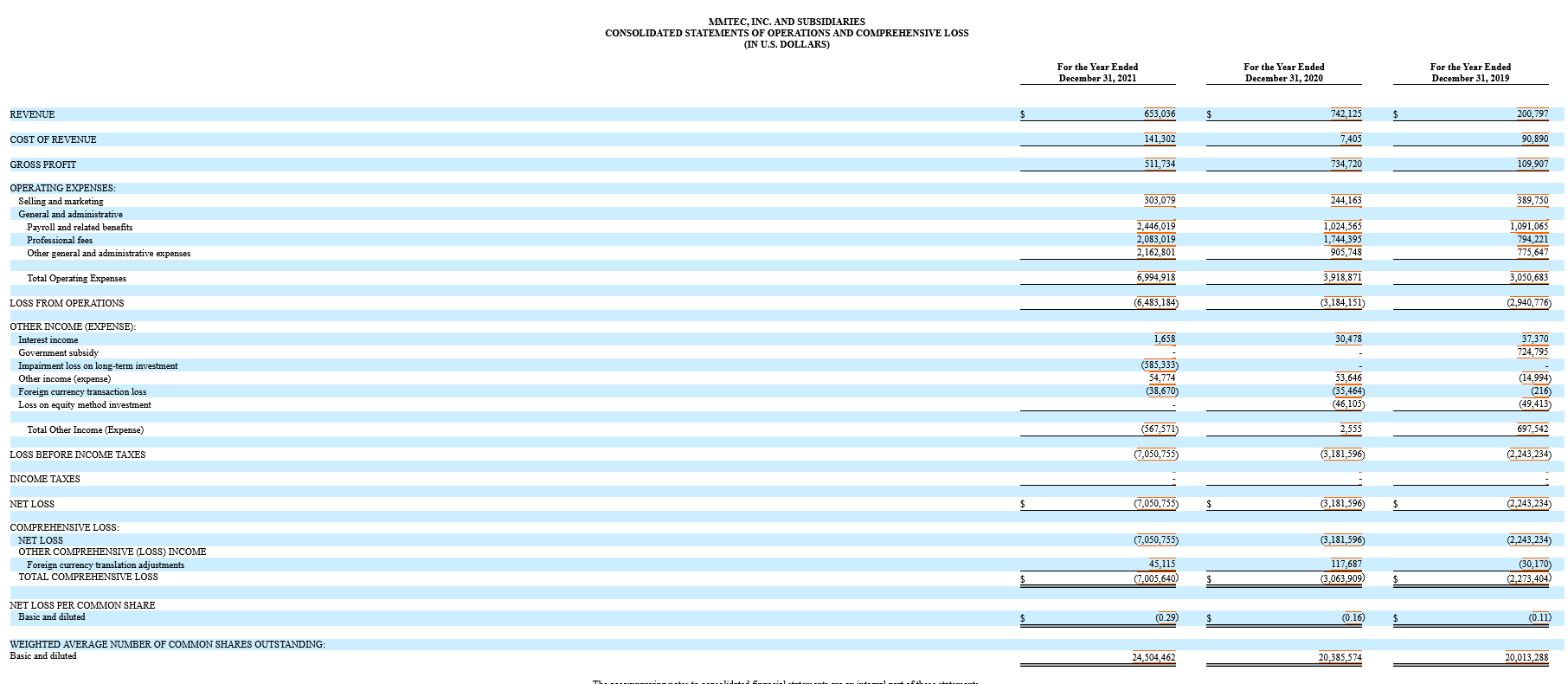

- The company has a history of net losses. MTC’s net loss was $7,050,755 for the year ended December 31, 2021, and $3,181,596 for the year ended December 31, 2020.

- The company’s operations depend on the performance of the Internet infrastructure and fixed telecommunications networks in China, which is under the administrative control and regulatory supervision of the Ministry of Industry and Information Technology.

- On January 26, 2022, the Nasdaq Listing Qualifications Department notified MTC that minimum closing bid price per share for its common stock was below $1.00 for a period of 30 consecutive business days and that the Company did not meet the minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2). If MTC is unable to cure the failure within the prescribed time period, its common stock will be subject to delisting. A delisting would materially reduce the liquidity of the stock and have an adverse effect on its market price.

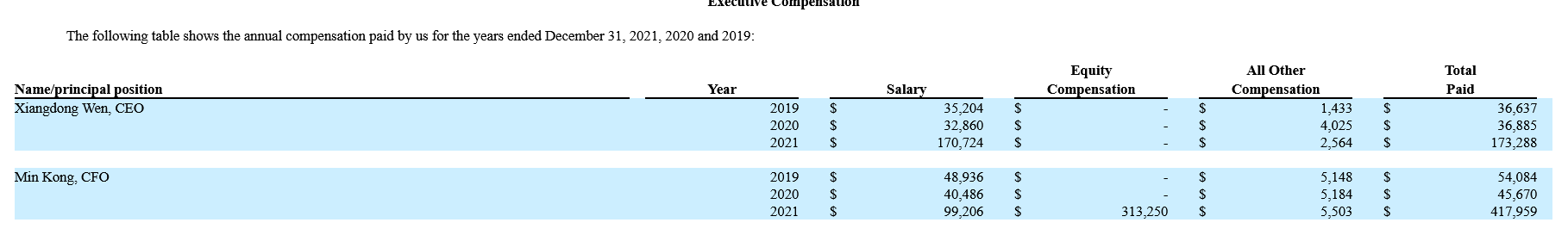

- Despite being a loss-making company, the executives are being paid significant compensation.

- The company’s segment, MM Global Securities, Inc. was subject to regulatory trading inquiries and investigations to determine whether any violations of federal securities or FINRA rules had occurred. MM Global was fined $450,000 as a part of a settlement with the Financial Industry Regulatory Authority (FINRA).

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: Trades of the Day