I’ll never forget walking into my friend’s office – who happened to be a homebuilder – around Thanksgiving back in 2007… That’s when I knew something was wrong.

The early 2000s were a golden age for real estate developers, and I was right in the middle of the action.

The banks were handing out cheap credit to anyone who wanted it and house prices were only going one direction: up.

Two of my friends had built up an extremely successful homebuilding business specializing in large-scale tract home communities in South Carolina. They got a huge payoff when they sold their company to Pulte Homes in 2004.

But rather than retiring on their millions, they doubled down and plowed it all back into a new homebuilding company.

I watched them take it from nothing to a full-fledged operation with 500 houses under construction and an inventory of over 2,000 lots by the time the housing market hit its peak in 2007.

It was like a manufacturing business – and they had put together an almost bulletproof blueprint with dominating market share. My mom even worked as a real estate agent selling their townhouses in what came to be successful, thriving communities.

But, it couldn’t last forever.

In fact, it all fell apart in a matter of months.

When I visited my friend in his office in November 2007, he teared up as he told me that his two primary lenders – Wells Fargo and Bank of America – were freezing his credit lines.

Over the next few weeks, he scrambled to liquidate anything and everything he could in a last-ditch attempt to avoid bankruptcy.

All around the country, other developers were doing the exact same thing, trying to unload inventory they had built on speculation for pennies on the dollar.

I wish I could have scooped up tons of valuable real estate in the biggest sale I’ll probably ever see in my lifetime. But I was just as strapped for cash as everyone else.

Unlike my developer friends and former young-self who gambled everything and lost, here at the Intelligent Income Daily we focus on safe, dependable investments. And while we can’t control the market price of our shares, we know that we own durable companies that will eventually rebound and will continue paying us handsomely while we wait.

Today, as we face a “garden-style” mild recession, I’ll explain why the real estate market is unlikely to melt down as it did during the Financial Crisis… and why real estate investment trusts (REITs) are poised to outperform the market.

We Are Not in the Financial Crisis

Many factors contributed to the housing bubble and its collapse. In my opinion, three of the most important ones were:

- Poor lending standards and bank regulation

- Homeowners with adjustable rate mortgages and too much debt

- Speculative overbuilding of houses

Today, these factors are not an issue.

In the aftermath of the Financial Crisis, regulators cracked down on banks, forcing them to increase their reserves and capital ratios, improve lending standards, and regularly go through stress tests. Banks today are much more prepared to handle a recession.

Consumers today have mostly locked in fixed-rate mortgages with low interest rates. Plus, many people have built up savings over the past few years. Bank of America recently noted that one of its groups of customers had an average of $12,800 in their accounts compared to just $3,400 pre-pandemic, giving them a large cushion of savings to draw on.

Over the past decade, home construction activity has been at historic lows and homebuilders focused on custom homes with buyers lined up rather than speculative units. This long period of underbuilding has led to a shortage of housing.

In 2022, the real estate sector sold off due to fears of rising rates causing another recession. But, for the reasons I pointed out above, this recession should not be anywhere close to another 2008. That means real estate companies are trading at attractive prices.

In 2022, the real estate sector sold off due to fears of rising rates causing another recession. But, for the reasons I pointed out above, this recession should not be anywhere close to another 2008. That means real estate companies are trading at attractive prices.

Though I have been talking a lot about homebuilders today, those are still risky bets as they depend on people buying properties. The better opportunity is in REITs, which own real estate for the long term and collect steady rent checks.

Poised to Outperform the Market

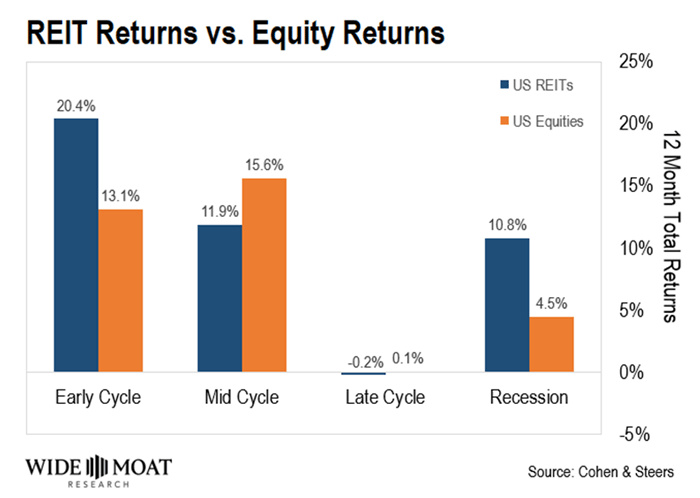

A study from Cohen & Steers shows that REITs tend to outperform the stock market by an average of over 6% during recessions and by more than 7% during the early cycle.

We are currently in the late cycle and will most likely enter a recession later this year. So now’s the time to start building positions in the most attractive REITs.

We are currently in the late cycle and will most likely enter a recession later this year. So now’s the time to start building positions in the most attractive REITs.

My team and I are in the midst of a REIT-buying frenzy as all my favorite REITs are trading at a discount.

If you’re not sure where to start, the Vanguard Real Estate ETF (VNQ) is a good way to get exposure to REITs. This ETF invests in REITs across all sectors and many of its top holdings are the strongest REITs on the market, which are most likely to perform well in a recession.

Happy SWAN (sleep well at night) investing,

Brad Thomas

Editor, Intelligent Income Daily

Source: Wide Moat Research