Interest rates have gone up sharply over the past year, and stocks are down. As a result, more people are interested in buying bonds. After all, you can now earn 6% or higher on safe investment-grade bonds. And if you’re willing to take on a little more risk, 8% to 10% is easily within reach in high-yield bonds.

I’m talking about individual bonds, not bond funds. In fact, I strongly recommend you stay away from bond funds. If interest rates continue to climb, you will lose money in a bond fund, whereas with individual bonds, you will make money. I explain why here.

As long as rates are rising, stick with individual bonds.

Here’s exactly how to do that.

Buying individual bonds is similar to buying stocks, but it’s not exactly the same.

You can buy any stock you want that is listed on a U.S. exchange with any domestic broker. The price will be the same no matter where you look. But not every broker has every bond available to its customers.

Some brokers have bonds in their inventory that they can sell you. Other times they will have to go out into the open market to get the bonds for you. There are occasions when they will not be able to obtain the desired bonds for customers if there are no sellers.

If you don’t see the bond you want on your broker’s website, call its fixed income desk and ask it to get it for you. Don’t just speak to a representative. Call the fixed income desk so that you’re speaking with someone who specializes in bonds.

To buy a bond online, you go to the fixed income (sometimes shown as “Bonds/CDs”) section of your broker’s website. You can do a search for bonds based on certain criteria, such as maturity date, S&P or Moody’s ratings (they rate how safe or risky the bonds are), and yield to maturity (YTM) – which is essentially the annual return you will earn on the bond.

Or if you know the bond you want to buy, you can enter the CUSIP, which is similar to a stock ticker. The CUSIP is a combination of nine numbers and letters. While a stock ticker will be in the format of “ABC,” a CUSIP may look like “12345abc6.”

You enter the CUSIP, and your broker’s site will bring up all of the relevant information, including the price, the YTM and the minimum number of bonds you must buy to place an order, which is another difference between stocks and bonds. Some bonds may have no minimums, but others may have large ones – it all depends on the seller.

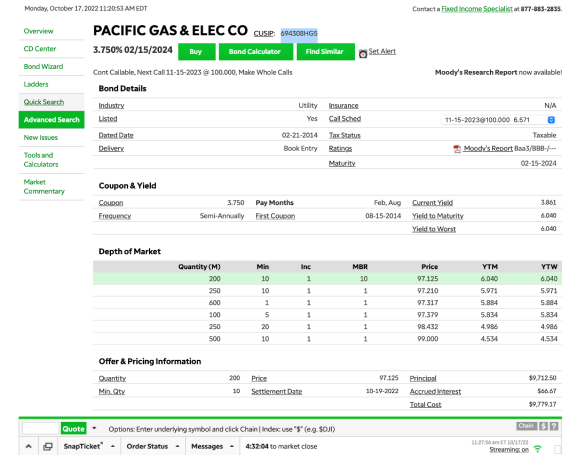

Here is what it looks like on TD Ameritrade if you pull up an individual bond. This is a bond for the Pacific Gas & Electric (CUSIP 694308hg5) 3.75% coupon bond maturing on February 15, 2024.

The bond was issued by utility Pacific Gas & Electric. It pays a 3.75% coupon, which means it pays $37.50 per year in interest because the coupon is always based on the $1,000 price at which nearly all bonds are issued. It matures on February 15, 2024. You can see the CUSIP next to the name of the bond.

The bond was issued by utility Pacific Gas & Electric. It pays a 3.75% coupon, which means it pays $37.50 per year in interest because the coupon is always based on the $1,000 price at which nearly all bonds are issued. It matures on February 15, 2024. You can see the CUSIP next to the name of the bond.

Below that are more details, including the bond’s rating – Baa3 by Moody’s and BBB- by S&P.

While the bond pays a 3.75% interest rate, the YTM is around 6% because the price is around $97, which actually means around $970 per bond. You multiply the bond price by 10 to get how much the bond actually costs. So the interest rate is a little higher than 3.75% because the principal is lower than $1,000.

The first line shows a price of $97.125, which means $971.25 per bond (remember, multiply the bond price by 10 for the actual cost). . The bondholder will also make $28.75 in profit at maturity because they paid $971.25 for the bond but it will be redeemed for $1,000. So the profit plus the interest is included in the YTM calculation.

You’ll also see that there are different sellers out there. The first one requires a 10-bond minimum at a price of $97.125. The second, also with a 10-bond minimum, is asking $97.210. If you want to buy just one bond, you’ll pay $97.317.

If you want to buy the bond, you’d click the “Buy” button under the company name and on the next screen you’d enter how many bonds you want to buy and at what price if it’s different from what’s shown on the page.

If you didn’t buy the bond and wanted to check on it the next day, you’d just go to the fixed income page and enter the CUSIP to see if anything changed, such as the price, minimums, etc.

Like anything you do for the first time, buying a bond can seem intimidating. But most of us felt the same way when buying a stock online the first few times. Once you play around on your broker’s bond page, you’ll get more comfortable and you’ll start earning safe 6% or higher yields in no time.

Good investing,

Marc

Should You Invest in This Dividend Stock Right Now? [sponsor]

There’s not a single dividend stock I like more than the one I’m giving away for free today.

It owns the bestselling drug in the world… and it has a pipeline of other blockbuster drugs that are expected to generate $35 billion in sales.

Last year, this company’s stellar drug sales allowed it to pay shareholders $8.8 billion in dividends. The best part? That dividend is increasing by 20% per year!

Click here to get my No. 1 dividend stock as part of my FREE Ultimate Dividend Package.

Source: Wealthy Retirement