Surging interest rates sent shockwaves through the stock and bond markets in September, dragging the S&P 500 down 9.2%. The benchmark index has now lost about 24% year-to-date.

The yield on the 10-year Treasury note, the global benchmark for borrowing, soared from 3.1% at the start of the month to a hair above 4% – its highest level since 2010 – before settling closer to 3.8%.

Investors began taking the Federal Reserve’s pledge to tame inflation more seriously as policy makers in mid-September hiked short-term interest rates by another 0.75% to cool the economy.

The Fed also reiterated expectations for “a meaningfully restrictive stance of policy” until inflation comes down, even as “the chances of a soft landing” diminish, according to Fed Chair Jay Powell.

The spike in yields weighed heavily on bond-like dividend stocks such as utilities, telecoms, and real estate investment trusts, which lost between 11% and 13% in September.

With the 10-year Treasury yield sitting near 4% compared to 1.5% at the start of the year, investors now have a more attractive risk-free investment option to consider, putting upward pressure on dividend yields to keep them competitive in this new environment.

No one knows how far or for how long rates will rise.

But based on management comments made at investor events over the last three weeks, the economy remains resilient outside of rate-sensitive purchases like houses and cars and discretionary goods like apparel and certain electronics that boomed during the pandemic.

Demand from lower-income consumers has also slowed as they feel a bigger pinch from high food and fuel costs.

Here are some lightly edited excerpts:

- Costco: Many of you have asked about private label with the recent inflationary environment and what’s happening, are people trading down. And our first response is they’re not trading down. They’re trading up or certainly trading the same.

- Nike: We see strong consumer demand in North America currently. There’s no signs of any softness. It was relatively promotional in August but strong, strong into the first couple of weeks of this quarter.

- Carmax: This quarter reflects widespread pressure the used car industry is facing. Macro factors, including vehicle affordability that stem from persistent and broad inflation, climbing interest rates and low consumer confidence, all led to a market-wide decline in used auto sales.

- Lennar: The interest rate movements were very sudden and adjusted very quickly, and that suddenness has always led to a pullback in housing demand. Part of the pullback is driven by simple affordability, and part of the pullback is driven by the psychology of the sudden and aggressive interest rate hike causing either monthly payments figure shock or a sense of having missed the boat.

- FedEx: We saw a decline in our volumes during the first quarter, which accelerated in the final weeks. Our softening volumes in Asia and the U.S. were predominantly due to the economy while the shortfall in Europe was both economic- and service-related.

- Disney: The situation that we have right now is strong, strong demand for our parks. We have more demand than we have supply. And all the lead indicators indicate that, that’s the case for the future.

- Darden: Inflation remains a headwind for consumers as well, particularly those in households making less than $50,000 a year. Olive Garden and Cheddar’s have more direct exposure to these guests. Looking at guest behavior across our entire portfolio, we are seeing softness with these consumers, while conversely, we are seeing strength with guests in higher-income households.

- General Mills: Significant inflation and reduced consumer spending power has led to an increase in at-home eating and other value-seeking behaviors. We think elevated demand for food at home was one reason we saw lower-than-expected volume elasticities in Q1, particularly in North America Retail.

- MGM Resorts: In the Las Vegas strip, business has really never been stronger than it is right now. In the second quarter, we set all-time records in our Las Vegas properties.

- Mastercard: The consumer remains strong. We’re encouraged by what we see there.

These anecdotal data points on the economy would normally be encouraging, but the market would prefer to see more cracks forming. Softening trends could encourage the Fed to pivot from its aggressive rate-hiking campaign sooner than later, reducing the potential for a deep downturn.

This thinking jolted a two-day rally earlier this week when job openings fell sharply, suggesting the labor market is loosening and inflation-inducing wage pressures could ease. But one data point does not make a trend, and conditions can change quickly.

With many investors hanging on every economic news release and geopolitical tensions persisting with the war in Ukraine and strained U.S.-China relations, elevated volatility in financial markets will likely persist until inflation (and monetary tightening) is on a clear downtrend.

The Fed expects this to play out next year as it continues raising its key interest rate from around 3% to a projected level of 4.6% in 2023. Rates are expected to retreat to 2.5% in the longer run.

Policy makers believe this will reduce the rate of their preferred measure of inflation from 4.5% in 2022 to 3.1% next year, with price increases further slowing to their 2% target by 2025.

That said, the Fed is notorious for making poor predictions. And high inflation, supply-chain snarls, pandemic-driven shifts in consumer spending, labor shortages, and war in Europe are variables that make the current environment unique and hard to navigate.

In the middle of unprecedented events, there is a lot we are going to learn. With a dose of humility, we have been busy combing through the stocks and closed-end funds in our Dividend Safety Score coverage universe to keep tabs on how businesses are positioned for various economic scenarios.

Year-to-date, we have changed the scores of less than 1% of the companies we cover. This overall stability in ratings reflects the long-term perspective we take when assessing dividend risk over a full cycle, which anticipates a moderate recession occurring at some point.

The dual threat posed by high inflation and rising interest rates is the most challenging to handicap.

Most leveraged, capital-intensive businesses that are more vulnerable to these factors took advantage of ultra-low interest rates and booming demand in 2020-21 to refinance debt on attractive terms, stagger their debt maturities, and bolster their liquidity.

Across the dozens of public companies we have scrutinized recently, I estimate that on average at least 75% of their debt carries fixed interest rates, providing some near-term cash flow insulation from higher borrowing costs.

But should interest rates continue rising for more than a couple of years, debt costs will increase as more bonds mature and are refinanced at higher rates.

Coupled with higher prices for materials, labor, and other inputs needed to run a business, the outlook begins to dim for leveraged companies unable to pass through higher costs if the Fed’s tightening campaign fails to make much progress restoring price stability.

Your guess is as good as ours. For now, when evaluating a company’s dividend safety, we assume that inflation will moderate over the next year to avoid a prolonged environment of stagflation.

These looming risks are uncomfortable though, and the relatively long grind down in this bear market compared to 2020 feels psychologically more difficult.

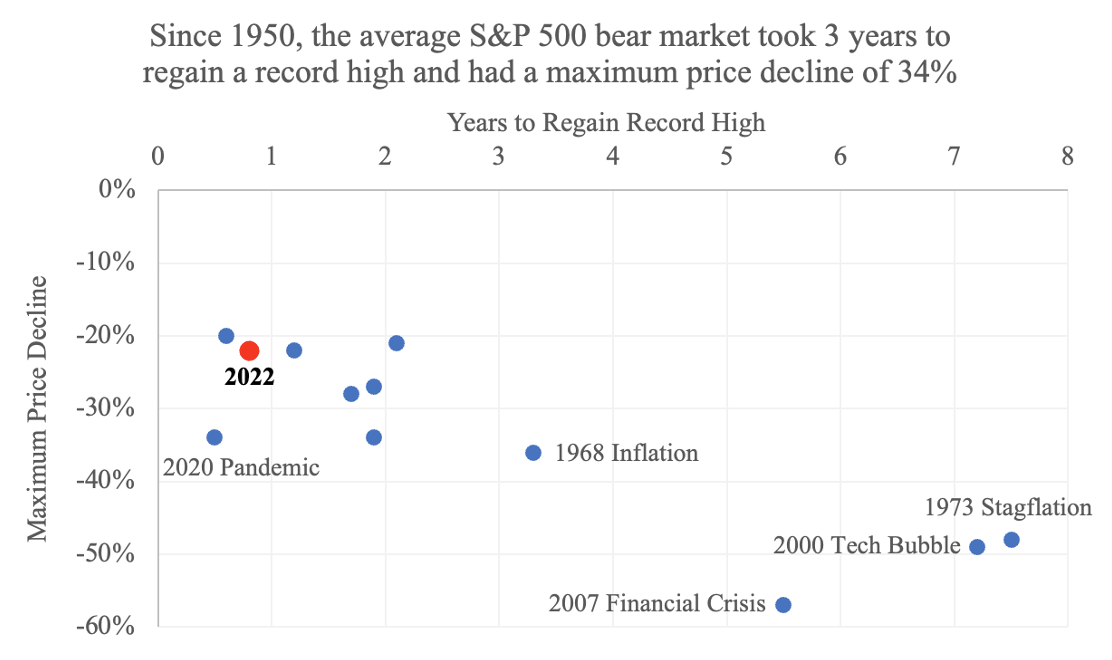

Since 1950, the S&P 500 has now experienced 12 bear markets (see below). On average, they have taken three years to reclaim a new high, with an average drawdown of 34% at the bottom.

The 2022 bear market (red dot below) is not quite one year old, and the S&P 500 sits 22% below its record high.

If the market followed a 1973-style stagflation scenario, the S&P 500 would have another 33% to fall and require nearly seven more years before topping its January 2022 high.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

The data above is not meant to scare you. If anything, the resilience of American business inspires some confidence.

Since 1950, the S&P 500 always reached a new record high within three years except for four bear markets, none of which took longer than eight years to fully recover regardless of how tough the economic environment became or how overvalued the market was at the top.

Your mettle will be tested if the 2022 bear market dot above continues drifting down and to the right. But do not allow anxiety of the moment to derail your retirement plans by panicking and doing something that affects your portfolio’s long-term sustainability.

Always maintain an asset allocation you are comfortable with and will stick to no matter what.

Dividend stocks can play a role and have performed relatively well this year, providing some comfort for investors depending on this income strategy in retirement.

We believe this reflects dividend stocks’ generally durable cash flow streams and more defensive financial profiles, which hold greater appeal when appetite for risk fades.

For investors who remain anxious about the path of inflation, the most resilient companies have essential products and services, low debt loads, pricing power, and capital-light operations.

If you own a diversified portfolio of quality dividend stocks with an emphasis on companies that earn Safe or Very Safe Dividend Safety Scores, chances are you have stakes in numerous businesses that possess at least some of these qualities.

Looking ahead, try not to lose perspective. Companies have weathered many storms, and most of them will emerge stronger on the other side of whatever weather pattern comes next.

Whether you need to calm your nerves or not, I recommend reading our 10 favorite pieces of timeless investment advice from Warren Buffett here to help stay the course.

As always, we will continue doing our best to provide the portfolio tools, data, and research our members need to tune out the noise and stay informed in this dynamic environment, especially with what could be an exciting third-quarter earnings season kicking off later this month.

— Simply Safe Dividends

He issued warnings for RNG before it crashed 89%, BYND before it crashed 90%, TDOC before it crashed 84%, and FVRR before it crashed 86%. Now, he's stepping forward to name the popular stock that could go down as one of the worst-performing tickers of the year. It could be the most dangerous stock of 2026. Click here for its name and ticker, 100% free.

Source: SimplySafeDividends.com