When it comes to investing in stocks, I believe that intelligent investing implies investing for specific objectives or needs. Every investor is unique, and therefore, possess unique goals, objectives, and risk tolerances. Therefore, each investor’s portfolio should reflect those attributes to empower them to stay the course.

Certain investors may be most concerned with growth. Others with safety. And of course, many retired investors – since they no longer work – are looking for income that can keep up with and preferably exceed inflation. In recent times, fighting inflation has become paramount just to survive.

Certain investors may be most concerned with growth. Others with safety. And of course, many retired investors – since they no longer work – are looking for income that can keep up with and preferably exceed inflation. In recent times, fighting inflation has become paramount just to survive.

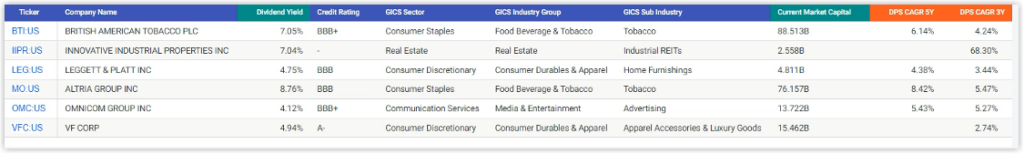

As a result, it all boils down to designing a portfolio with objectives that make sense for each unique investor. In this video I provide a condensed demonstration of how to blend dividend growth stocks together in such a way as to accomplish a specific income need.

Additionally, I discuss how to deal with evaluating performance, and risk.

— Chuck Carnevale

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: FAST Graphs