This video reviews 5 investment grade dividend paying growth stocks that appear attractively valued in the industrial sector. These are 5 research candidates that are offered for potential investment as total return opportunities. Although each pays a dividend, the primary potential for investing in these dividend paying stocks is total return.

This video reviews 5 investment grade dividend paying growth stocks that appear attractively valued in the industrial sector. These are 5 research candidates that are offered for potential investment as total return opportunities. Although each pays a dividend, the primary potential for investing in these dividend paying stocks is total return.

Furthermore, I believe these candidates offer insights into the essence of value investing. At its core, value investing is all about participating fully in the operating performance of the company under scrutiny. The central idea is that prudent investors are generally seeking to invest in companies that they admire and that they believe are going to be good opportunities for growth.

Therefore, prudent investors also realize that if you overpay to invest in these quality businesses, you ruined their ability to reward you adequately. Value investors do not chase price, intelligent value investors look for great companies that can perform to their benefit over the long run.

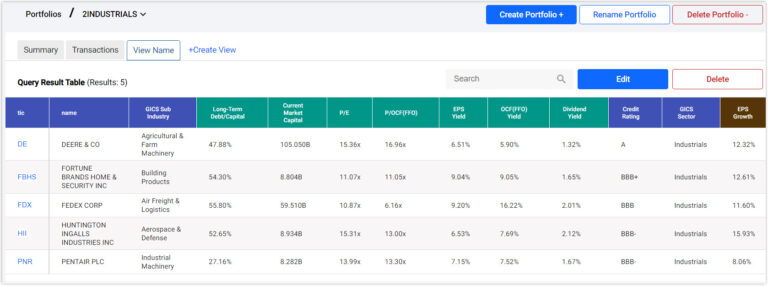

FAST Graphs Analyze Out Loud on Huntington Ingalls Industries (HII), Deere & Co (DE), Fortune Brands Home & Security (FBHS), FedEx Corp (FDX), Pentair Plc (PNR).

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: FAST Graphs