When volatility is this high, green days are scarce. Finally investors had something to celebrate on Wednesday. The indices rose more than 1% across the board. This was despite some of the turbulence midday from releasing the Federal Reserve minutes. Lately, investors have been selling rallies at every turn. This has created problems for everyone because even the good stocks that are falling are unable to find support. The old adage says to not let a crisis go to waste. This is the concept of today’s thesis. I am presenting three value stocks to buy with at least 50% upside.

Claims this large usually sound fake, but not this time because of extreme corrections. The timeline on these could even be this year, but the typical target should be longer still. Currently investors are seeking more instant gratification trades. But I am certain that there are a silent majority that still prefer to buy and hold.

Normally, when I write about stocks to buy on dips, I insist on premier quality. In this case this wasn’t a necessary parameter because the goal is to have a large upside. Sometimes those come from the wildest tickers, which don’t normally have “sure thing” profiles. Meaning, they tend to be risky and carry a bit of speculation. I did my best to balance it out for a bit of both.

Zoom Video (ZM)

Source: Charts by TradingView

Source: Charts by TradingView

Zoom Video (NASDAQ:ZM) rallied 7% Wednesday, but it is still down 80% from its highs. Today, I am not arguing for the idea of resetting the all-time highs. Those came under false pretenses from a temporary situation. The pandemic caused the demand for Zoom’s product to explode exponentially. However, I’m willing to bet that it still has upside in the long run.

The lock down forced everyone to use online meeting and ZM platform was the default choice. Critics should respect the fact that management handled the volume burst well. They even managed to maintain the growth even now. That’s not easy to do, just ask other pandemic companies like Peloton (NASDAQ:PTON). They got a similar massive influx and failed at throttling the demand.

Now ZM stock is cheap even in absolute terms. It has a price-to-earnings of 22x and a price-to-sales ratio of 6x. Both are in line with many more mature mega-tech companies. There is no bloat in the current price level for Zoom stock. Technically, the weekly chart suggests that it could even exceed $200 per share. There will be tremendous resistance along the way, but the setup is there. All it needs is for markets in general to calm down.

Meta (FB)

Source: Charts by TradingView

Source: Charts by TradingView

Recently I wrote about seven safe stocks to buy and I narrowly passed on adding Meta Platforms (NASDAQ:FB). But it’s a promising stock to buy since FB stock actually became a value trade idea. For example, Meta’s price-to-earnings ratio is now 13x, which is lower than that of Exxon (NYSE:XOM).

FB dominates the hottest trend for the next decade. If we believe the global commitment to abolishing fossil fuels, XOM is in a dying business. I used this comparison because it is an extreme, but it does drive the point home. FB stock is cheaper than it should be, so it should support the thesis of a 50% rally from here. Temporarily, it still has to contend with the external hindrances like the correction for example.

On the bright side, the chart has a ray of hope from the April 27 candle. The $170 bounce marks a footing that the bulls can use this week. Beyond that, they could use it to start a recovery rally that could last through the summer. But for as long as the CBOE Volatility Index (INDEXCBOE:VIX) is near 30, I can’t fully commit. Taking partial positions makes a lot sense, but going all-in is too reckless.

Starbucks (SBUX)

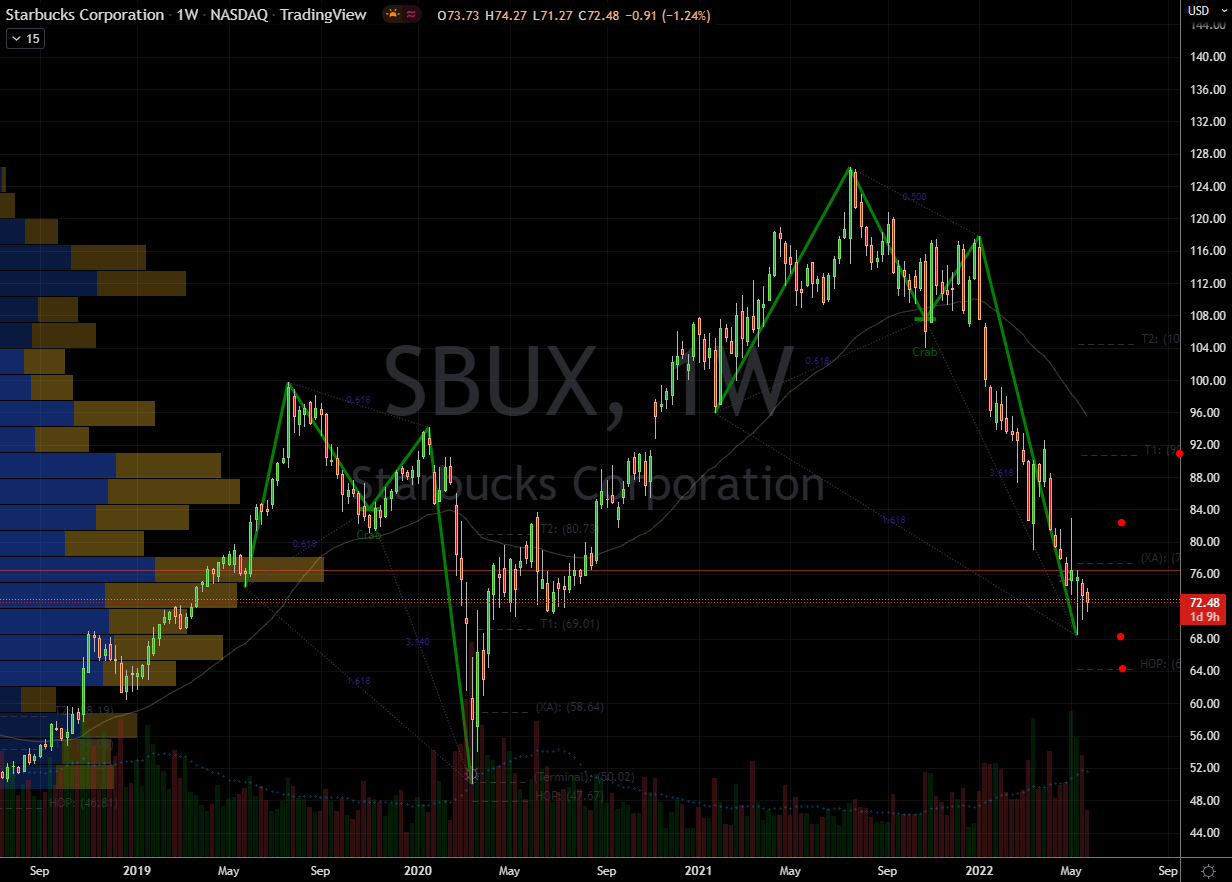

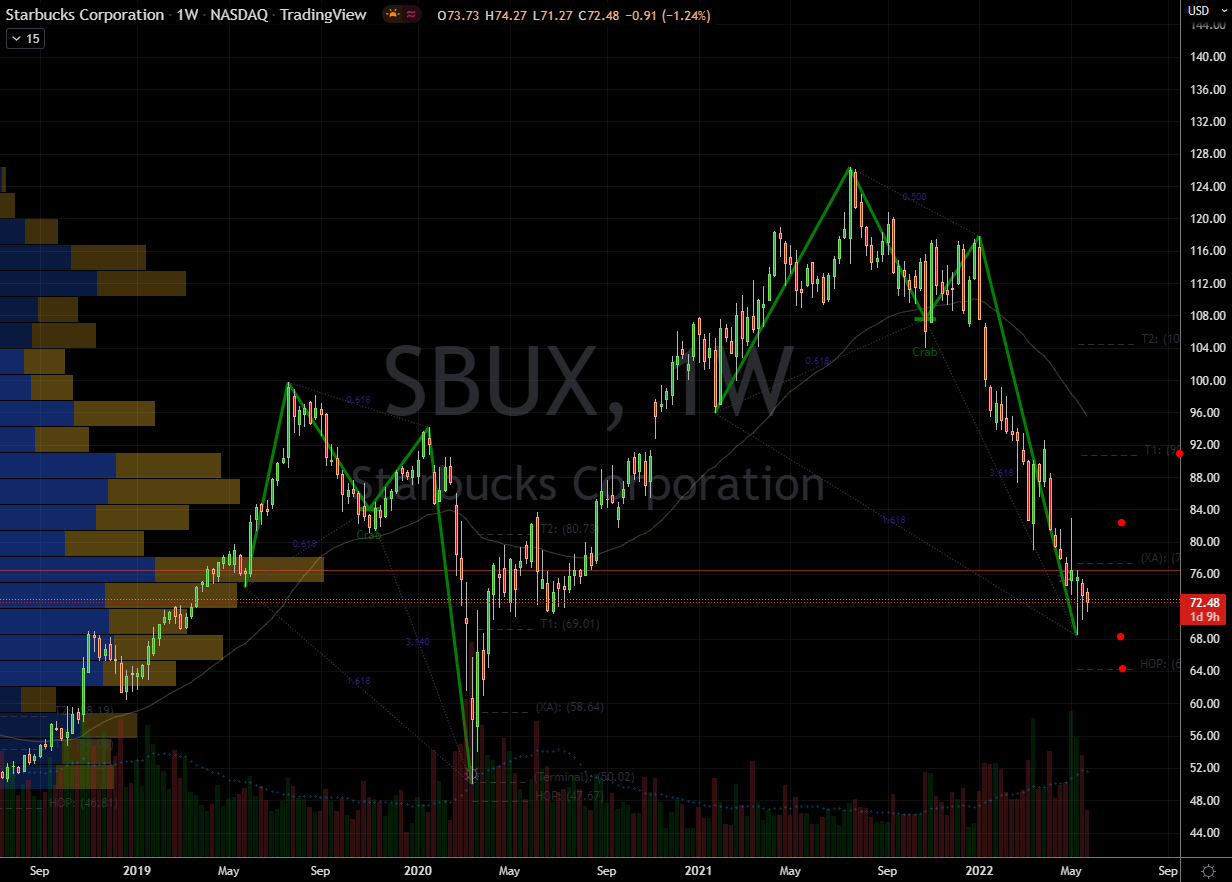

Source: Charts by TradingView

Source: Charts by TradingView

The pandemic seriously affected all company operations that depend on crowds for their business. Starbucks (NASDAQ:SBUX) was one and most definitely had to scramble to survive 2020. Management has already seen its fair share of tests, but this one was special. Starbucks emerged from it well enough to warrant being on this list of value stocks to buy, but the company still has issues in China from the recent lockdown situations.

The upside from here has the potential to be more than 50%. This will depend on the investor timeline of course. But technically SBUX stock has enough indicators that point to that happening sooner than later. It merely needs markets to stabilize, so it can live up to its expectations. Near term, if SBUX holds above $68, then it could target $80. There will be sellers lurking there, but the ascending trend would begin.

Fundamentally, there are no flagrant alarms from its financials. Its P/E is on the lower end of its range. Last year, the company generated $7.5 billion in cash from operations. This was higher than the prior two years, so it has worked out the lock down hiccup. It also appears that management is still able to pay down debt and reward its shareholders with dividends. This shows confidence, so I gain some of that too. If the stock markets rally in the future, then I bet SBUX stock will too.

— Nicolas Chahine

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place