The coronavirus pandemic isn’t finished with us just yet, but hopefully it’s nearing its end.

On Monday, the U.S. reported 1.08 million new cases of COVID-19, according to the Johns Hopkins University of Medicine’s Coronavirus Research Center. “The new daily tally brings the total number of cases confirmed in the U.S. since the start of the pandemic to 56,189,547. In total, the virus has caused at least 827,748 deaths across the country,” added CNBC, reporting on the JHU data.

While that’s terrible news for millions of us, it’s a solid catalyst for companies with vaccines, as well as those, such as Rite Aid (RAD), that offer testing.

In fact, Barron’s reports that as Rite Aid nears its February fiscal year close, the company now expects to lose less money than anticipated, thanks to higher demand for COVID vaccines and testing. Rite Aid now expects to lose about $0.49 per share, which is far less than the $0.90 loss it previously forecast. The company also expects to see adjusted EBITDA of between $500 million and $520 million for the full year, as compared with previous estimates for between $460 million and $500 million.

“As a result of… momentum in the third quarter, and an anticipated increase in demand for COVID-19 vaccines and testing vs. prior expectations, Rite Aid Corporation is raising its fiscal 2022 adjusted EBITDA guidance,” the company said in a recent report to investors.

“As a result of… momentum in the third quarter, and an anticipated increase in demand for COVID-19 vaccines and testing vs. prior expectations, Rite Aid Corporation is raising its fiscal 2022 adjusted EBITDA guidance,” the company said in a recent report to investors.

Fueling upside, Rite Aid President and CEO Heyward Donigan bought 14,350 shares for $200,000 the day after the company posted stronger than expected earnings.

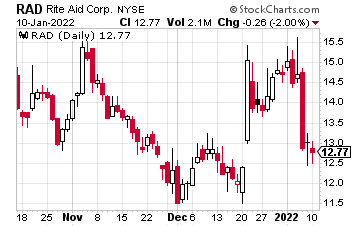

Technically, after falling from about $32 to $12, RAD is starting to show signs of strength. From a current price of $15, we’d like to see the stock challenge $18 in the near-term. In short, weakness in Rite Aid stock could be a solid long-term opportunity.

— Ian Cooper

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley