Every single listed company out there has to update the market on its earnings every quarter. That’s earnings season to you and me, and I think it’s the most wonderful time of the year. Good thing it happens four times a year.

Millions of investors – and, more importantly, tens of thousands of analysts – go over these releases with a fine-toothed comb, and the teensiest over- or under-performance can spark big gaps up or down in the stock’s price.

We’ve all seen stock charts before. When the market’s humming along as usual, there’s a fairly smooth price pattern that goes up and down, up and down; it can take days or weeks of trading for a trend to appear and play itself out.

But a gap is a spot on a stock price chart where the price moves sharply up or down in one session with little or no trading in between. The chart will then show a “gap” in the usual price pattern.

Stocks gap at earnings all the time, but what you might not know is regular traders can use these gaps to take down big profits – big, reliable profits – virtually like clockwork.

There are two earnings reports coming up on stocks that have a long history of making these profitable gaps. I’ve done the legwork here, so I’ll run you through what’s happening and list the trades to make…

Some Stocks Have a History of Earnings Gaps – That’s Key

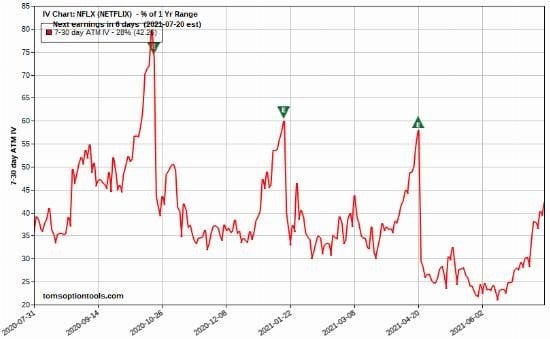

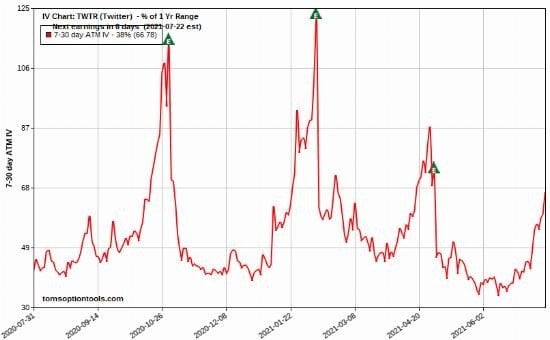

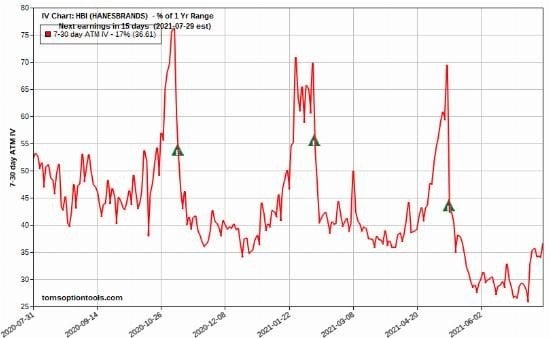

Take a look at these three charts of famous stocks that consistently gap at earnings – the green “E” triangles are earnings events.

History tends to repeat, so with a historical earnings gap record, it’s likely that these stocks will gap at their next earnings announcement.

The icing on the cake is that these consistent gaps create an even more reliable pattern. One component of an option’s value is implied volatility (IV). IV is the expense of options and as earnings approaches, the option IV of gapping stocks surges, sometimes in a big way. This means that options bought prior to earnings will be more expensive – sometimes way more expensive – at earnings. That’s money you can pocket.

Check out the IV charts for the gapping stocks above:

As you can see, the IV “surges,” rising into earnings each time. Just as importantly, IV tanks immediately after earnings. The pros call this “IV crush.”

Now, I can’t overstate this or say it enough: IV crush is critically important because if you hold options over the earnings announcement, you’ll get hammered when the options get suddenly waaaaay cheaper.

So, with these two consistent patterns, we can come up with option trades that are profitable based on stock movement AND IV rush. It’s like a one-two profit punch!

Here’s the Safest Way to Make the Trade

There are various ways to do this, but over the decades I’ve spent trading, I’ve developed a “favorite” way that generates the biggest profits:

- Find stocks that move consistently up or down into earnings;

- Buy a call or put to match the direction;

- Ride the surge;

- Get out before the earnings announcement to avoid IV crush.

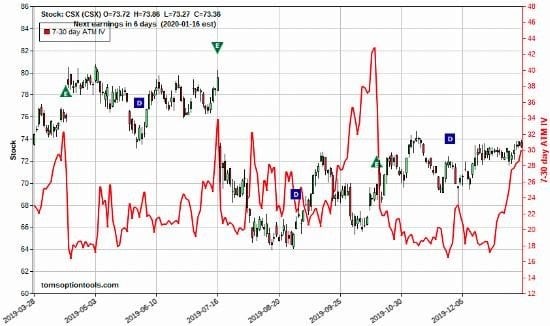

Here’s an example of a trade on CSX Corp. (NYSE: CSX), an American railroad company.

This is the stock and options IV chart as it appeared six days before earnings, on Jan. 10, 2020:

Notice two things:

- CSX gaps at earnings (green “E” triangles).

- The IV surges higher into earnings (and tanks in an IV crush right after).

We bought a CSX Jan. 17, 2020 $74 call option for $1.30.

Six days later, just before the earnings announcement, here’s what the chart looked like:

As you can see, both the stock and the IV went up. That’s a perfect cue to exit, so on the exit date, the CSX Jan. 17, 2020 $74 call option we bought for $1.30 was worth a whopping $3.45, a 165% profit in six days.

Two IV “Surge Strike” Earnings Plays for This July

Finding these kinds of setups is like shooting fish in a barrel when you have scanners and – whaddya know – I have them. My scanner finds these patterns and determines the optimal day to enter to maximize profits.

Two popped up on my screen that I’ll share right now. Remember, at-the-money (ATM) means the strike price closest to the current stock price.

Zoetis Inc. (NYSE: ZTS) is an American pet and livestock drug company reporting earnings on Aug. 5, 2021, before market open (BMO). Zoetis sports a 221.62% average return on investment (ROI) over the past four earnings periods.

ZTS stock is currently trading at $199. Buy an at-the-money (ATM) ZTS call on July 22, 2021. Select an ATM call with an Aug. 20, 2021 expiration. Exit the trade no matter what on Aug. 4, 2021, the day before Zoetis reports.

Calix Inc. (NASDAQ: CALX) is a Cloud computing firm out of Petaluma, Calif., reporting earnings on July 26, 2021, after market close (AMC). Calix boasts a 60.31% return on investment over the past four earnings periods.

CALX shares are currently trading at $43.73. Buy an at-the-money CALX call on July 21, 2021. Select an ATM call with an Aug. 20, 2021 expiration. Exit the trade come what may before the market closes on July 26, 2021.

— Tom Gentile

Source: Money Morning