We’ve all got bills. No matter what’s going on in the world, those bills reliably keep on coming.

Wouldn’t it be nice if you could find a totally passive income source that’s just as reliable? Well, that’s what dividend growth investing is all about.

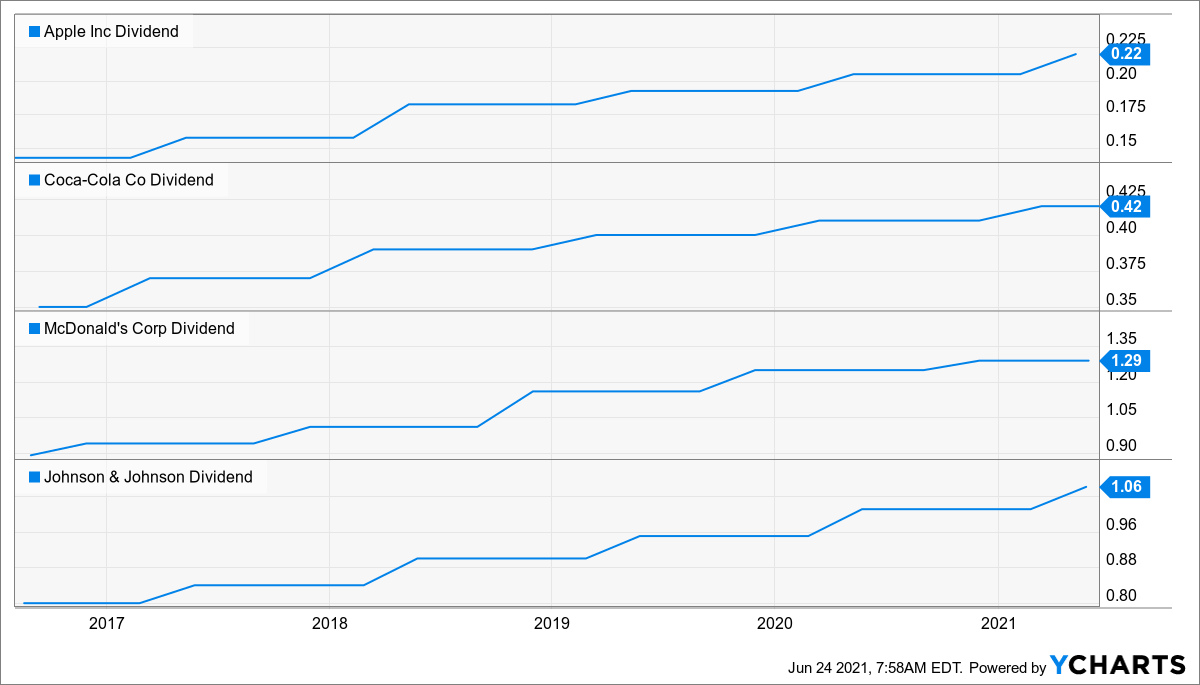

High-quality dividend growth stocks represent equity in world-class enterprises producing reliable, rising profits. And those reliable, rising profits fund reliable, rising dividends.

One cool thing about this strategy is, you can totally offset your bills with matching dividends. Those bills you’re paying on are part of the reliable, rising profits these companies produce.

It’s an ecosystem. An ecosystem that you can benefit from. Why not invest in the very companies sending you those bills?

Then you can collect safe, growing dividends from these same companies, and use those dividends to offset the bills.

Today, I want to tell you how to pay your bills with matching dividends from dividend growth stocks. Ready? Let’s dig in.

Peter Lynch, a legendary investor who returned nearly 30% per year during his time with Fidelity, has said many times to invest in what you know. Look around you. There are companies everywhere you look providing the world with the products and/or services it wants, needs, and demands.

These are the companies you’re interacting with almost every day. These are the bills you’re paying.

I’ll give you a great example. How about your monthly utility bill? Can’t live without electricity, right? Well, neither can anybody else. Modern-day society can’t function with power. That’s a great business model with inherent demand. And your utility company is likely pretty easy to invest in.

Let’s say you’ve got an average power bill of $100/month.

Well, you could buy shares in your local provider and totally offset that bill. If financial freedom is the name of the game, and it is for most investors, then you need to have your bills taken care of without needing to work.

Having your power bill paid for in perpetuity would be an awfully nice start toward financial freedom.

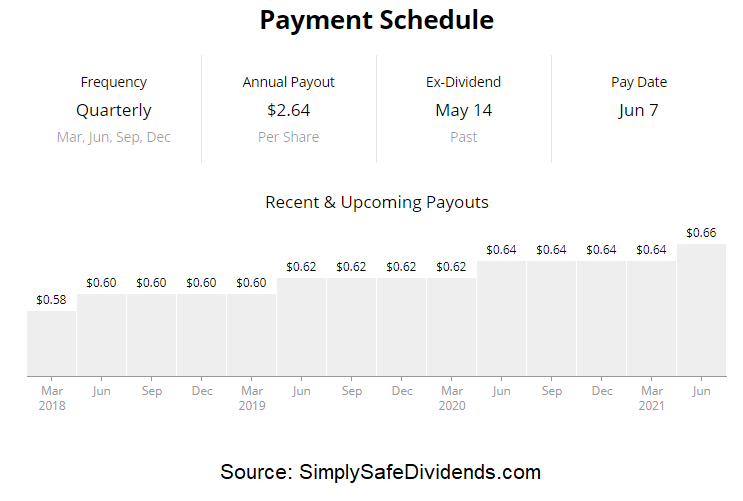

If you can offset one bill at a time, pretty soon you’ll find yourself without any bills left to pay. Because your dividend income from these companies will be recycled back into the bills they’re sending you. Let’s say your power company is Southern Co. (SO), for example. Owning 450 shares of Southern would spit out just under $1,200 in annual dividend income, or almost $100/month.

What’s really great about this kind of investing mentality is that it creates a healthy feedback loop.

What’s really great about this kind of investing mentality is that it creates a healthy feedback loop.

You’re thinking like an owner. If you were to own an entire company, why would you ever want to use a competitor? You wouldn’t. Well, the same is true if you own only part of a company. You want that company to thrive so that your passive dividend income keeps going up. There’s a reason why you never see Warren Buffett drinking Pepsi, right? So if you own shares in the very companies providing you with the products and/or services you use, you’re paying into that ecosystem, then simultaneously benefiting from it via the growing dividends that are coming back your way. It’s this healthy feedback loop where capital is being recycled and compounded.

This is a win-win across the board.

This is a win-win across the board.

The company wins. That’s because they’re thriving. They’re generating reliable, rising profits, investing back into the company to ensure its future prosperity, and sending out those reliable, rising dividends the shareholders expect. And you win. You’re getting the products and/or services you want. And you’re collecting safe, growing dividends to boot, which allow you to offset the very costs of said products and/or services, essentially making them, in a way, totally free for you.

That’s right. If you’re able to offset your bills with matching dividends, what you use is basically free.

Imagine that. Imagine having your power no longer really costing you $100/month because it’s totally paid for you by the very company providing you the power. That’s an awesome life hack, right? Have the bill sender pay your bill. I mean, that’s fantastic. And the $100/month you no longer need to save up from your day job in order to cover that bill can then be diverted into other areas of life, such as investing in other companies to offset other bills in your life.

Now, it would take an investment worth over $25,000 in Southern to make this particular example work.

That seems daunting. But large investments aren’t built overnight.

That seems daunting. But large investments aren’t built overnight.

I now have a dividend growth stock portfolio that’s valued at well into the six figures.

However, I built this portfolio by investing my savings month in and month out over the course of years.

I was only making about $30,000 per year when I first started investing in 2010, and all I could muster up with my savings was a bit over $1,000 per month. Look where I am now – financially free in my 30s. You climb a mountain one step at a time. You eat an elephant one bite at a time. A six-figure or seven-figure portfolio gets built one share at a time. Trust me. Consistent saving and investing does add up over time.

And it adds up even faster when bills are slowly being offset by dividend income, which frees more of your savings up to be invested.

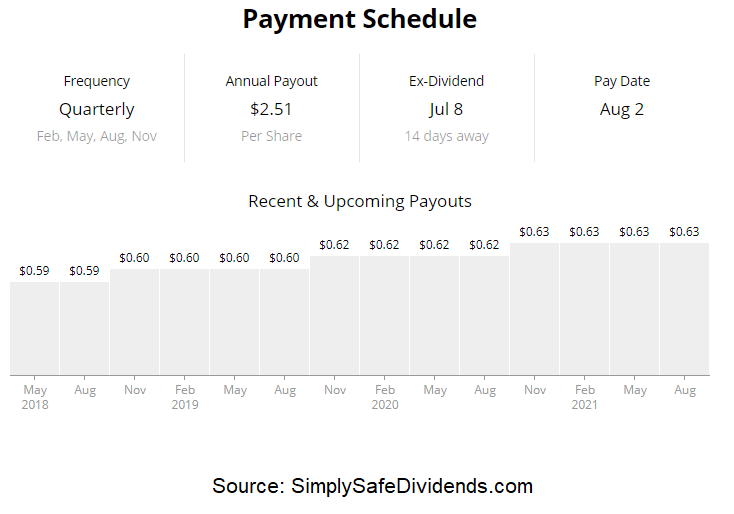

The power bill was just one example. But there are many, many examples of this. Let’s say you’ve got a $50/month bill from Verizon Communications (VZ) for your mobile connectivity. Well, you could own 240 shares of Verizon to totally offset this bill in perpetuity – 240 shares of Verizon would produce slightly over $600/year, or $50/month, in dividend income. 240 shares of Verizon would have a market value of less than $14,000 at today’s price, which makes it even easier to attain than the utility example.

What about these bills going up year after year? Well, dividend growth investing has you covered.

What about these bills going up year after year? Well, dividend growth investing has you covered.

That’s right. It’s dividend growth investing. I’m not talking about just dividends here. I’m talking about growing dividends. Because these companies are routinely increasing their prices, you also benefit from this again. When your power or mobile phone bill goes up, guess what? The company’s revenue and profit goes up.

And guess what else goes up?

Yep. You guessed it. Their dividends. How do you think these companies can increase their dividends for decades on end? They can do that because they’re regularly earning more and more profits after selling more products and/or services, to more people, at higher prices.

I’ve given you two examples of how to do this. But there are many, many examples.

Think about the fuel you put into your car. The health insurance you might have. The property management company billing your rent. Think about the grocery store you buy your food from or the companies behind the credit cards your in wallet. On and on it goes. These bills can often be offset with reliable, rising dividends. Offset enough of them and you end up financially free. The mountaintop might look too high from the ground. But it gets closer and closer the higher you climb. So get busy climbing. Invest your savings into the very companies you use and pay, then directly benefit from that very ecosystem.

— Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Source: DividendsAndIncome.com

The goal? To build a reliable, growing income stream by making regular investments in high-quality dividend-paying companies. Click here to access our Income Builder Portfolio and see what we’re buying this month.