You’ve probably already heard of the household dividend growth stock names many times. These are the blue chips we all know and love. I’m talking about the likes of Apple (AAPL), Johnson & Johnson (JNJ), and Pepsi (PEP).

Why are these stocks talked about so much? Simple.

They’ve been excellent long-term investments. And they’ll almost certainly continue to be excellent long-term investments.

However, today, I want to switch it up and tell you about two under-the-radar dividend growth stocks that you might not have ever heard of.

Neither is a household name. And I don’t really see very much coverage out there on them, either. But I think they both merit attention. So much attention, in fact, that I’ve been buying both stocks.

Now, Patrons have had advance notice of these buys. I alerted everyone over at Patreon about both investments as soon as they happened.

My positions in these businesses were actually initiated at much lower prices than where the stocks are at today. So if you you want those timely stock buy alerts, please consider becoming a Patron.

With all that said, even though I first bought these two stocks when they were much cheaper, I think both are still very appealing for long-term investment right now.

Ready to learn about these two under-the-radar gems that I’ve been buying? Let’s dig in.

Under the Radar Dividend Growth Stock #1: American Tower (AMT)

The first under-the-radar dividend growth stock I want to put on your radar is American Tower (AMT).

American Tower is a real estate investment trust that owns and operates cell towers. This is a unique business that’s compelling from three different angles.

You get real estate. You get infrastructure. And you get tech.

This company supercharges the idea of real estate by building valuable technology on that real estate. The massive 5G buildout you’ve been hearing all about? Well, that doesn’t happen without this company’s extremely valuable and necessary cell towers.

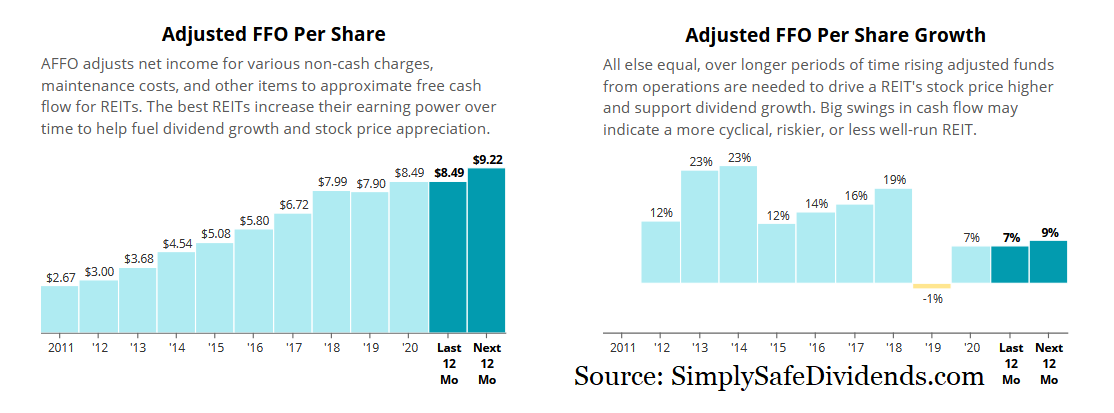

This isn’t your typical slower-growing REIT. American Tower is growing at an impressive rate.

Revenue has almost quadrupled over the last decade. Their most recent quarter showed AFFO growth of almost 9% YOY. They’re guiding for similar AFFO growth for this coming fiscal year. And the dividend, which has been increased for 11 consecutive years, has a five-year dividend growth rate of 19.1%, which is astounding.

That higher growth rate does come at the expense of yield, though.

That higher growth rate does come at the expense of yield, though.

The stock only yields about 2% here. But this isn’t an income play. It’s a long-term compounder. This stock has compounded at an annual rate of almost 20% over the last decade, turning a $1,000 investment into almost $6,000.

I alerted everyone at Patreon about this stock when I initiated my position at around $200/share back in early March.

It’s now over $250/share, so it’s up more than 20% since I bought in. However, I have averaged up on this name and bought more since early March. And I still think it’s a compelling long-term investment that’ll do very well over the long run. It’s not cheap, with a P/AFFO ratio of almost 30. But long-term compounders like this shouldn’t be cheap. You get what you pay for.

Under the Radar Dividend Growth Stock #2: Fidelity National Financial (FNF)

Under the Radar Dividend Growth Stock #2: Fidelity National Financial (FNF)

The second under-the radar gem I want to tell you about is Fidelity National Financial (FNF). Fidelity National Financial is the largest title insurance company in America. Just think about it for a second. All of those houses selling like hotcakes? Guess what they all have?

You guessed it. Title insurance.

It’s something that every bank requires in order to protect both the lender and the buyer. And since claims are rare, the company is able to build up a float. It’s a free cash flow machine.

Fidelity National Financial is quietly growing and compounding for its shareholders.

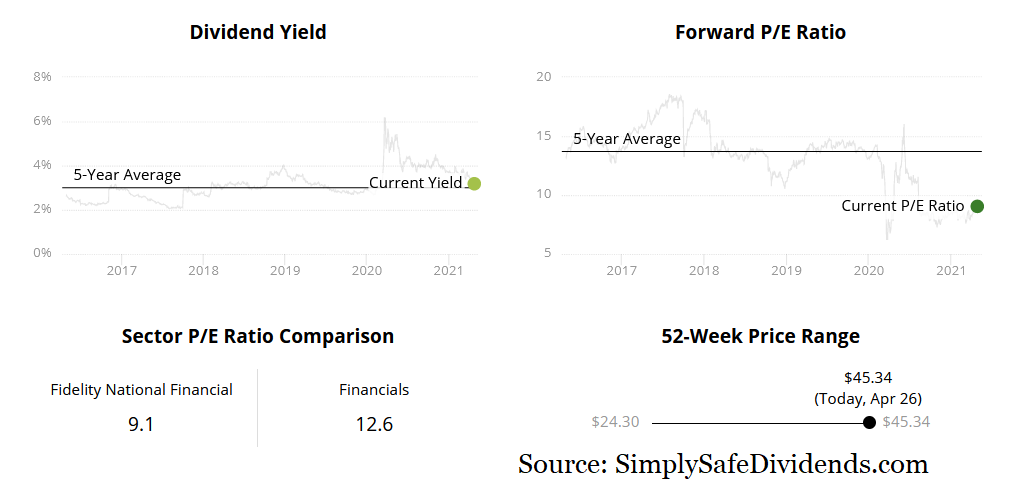

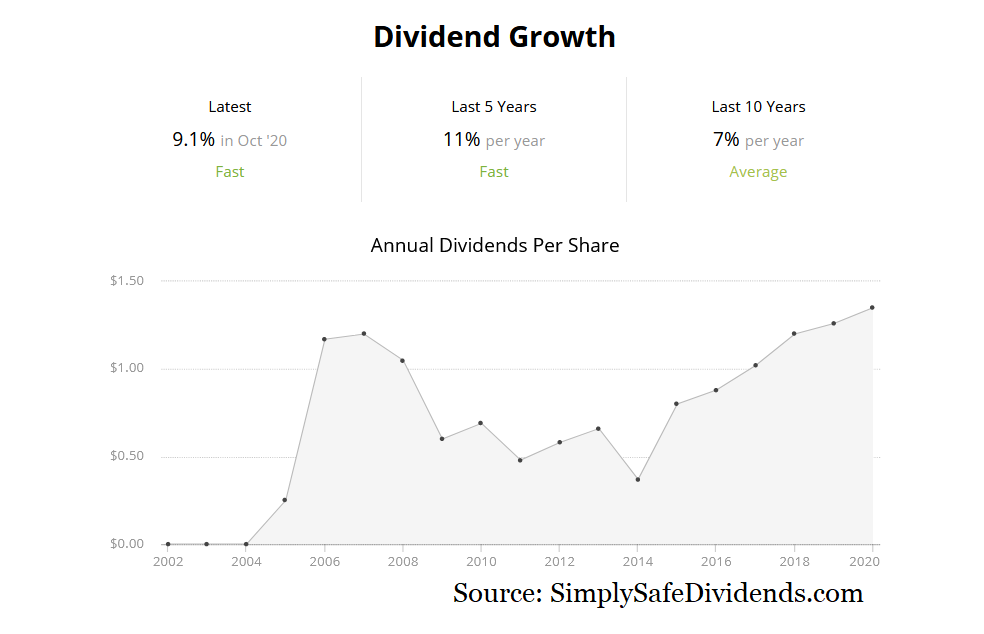

Revenue has more than doubled over the last decade. Earnings per share increased from $1.65 to $4.99 over that period, which is a CAGR of over 13%. The dividend has increased for nine consecutive years, with a five-year dividend growth rate of 16.5%. And the financial position is excellent. This stock has compounded at an annual rate of almost 22% over the last decade, turning a $1,000 investment into more than $7,000.

What’s not to like about this business? I don’t know. That’s why I initiated my position in late March at less than $41/share.

What’s not to like about this business? I don’t know. That’s why I initiated my position in late March at less than $41/share.

I alerted all of my Patrons about that trade when it occurred. However, I have averaged up on this stock multiple times since then. That’s because I think even after a 10% run since I bought in, it’s still attractively valued.

The stock trades hands for a P/E ratio below 10 and offers a yield of over 3%.

In a sea of expensive stocks, I see this as an underfollowed, underappreciated, and undervalued gem that I’ve already told Patrons about. And now I’m telling all of you about it. Take a look at this name if you haven’t already. These two stocks are only two of many stocks I’ve been buying and alerting Patrons about, but I thought these two names merited their own article due to the lack of attention they’re usually afforded.

In a sea of expensive stocks, I see this as an underfollowed, underappreciated, and undervalued gem that I’ve already told Patrons about. And now I’m telling all of you about it. Take a look at this name if you haven’t already. These two stocks are only two of many stocks I’ve been buying and alerting Patrons about, but I thought these two names merited their own article due to the lack of attention they’re usually afforded.

— Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

This article first appeared on Dividends & Income

The goal? To build a reliable, growing income stream by making regular investments in high-quality dividend-paying companies. Click here to access our Income Builder Portfolio and see what we’re buying this month.