There’s a grinding pandemic and stocks are still up 15%! It’s tough to believe, given the year we’ve all lived through, but here we are.

So what the heck do we do now? Is there more upside ahead or is another big plunge around the corner?

You’re not the only one asking this question—everyone is. And the media and Wall Street, as always, feel they have the answer. A quick glance at the CNN Fear and Greed Index shows that we’re at the top end of “greed”—not exactly in “extreme greed” territory but getting there.

Source: CNN Business

Source: CNN Business

Usually, when the market has gotten too greedy, it’s time to get fearful. And when the market is too fearful, it’s time to get greedy. This Warren Buffett quote is what moved me to go bullish on stocks—or more specifically stock-focused closed-end funds (CEFs)—in my CEF Insider service during the pandemic selloff. It’s also why I want to introduce you to a 7.3%-yielding fund that’s perfect for the greedy market we’re seeing today.

The Greed Case

Before we go into the details of this fund and why it’s perfect for this period, let’s take a look at just how greedy the market is.

Beyond soaring prices, analysts are pointing to a lot of reasons to keep buying stocks.

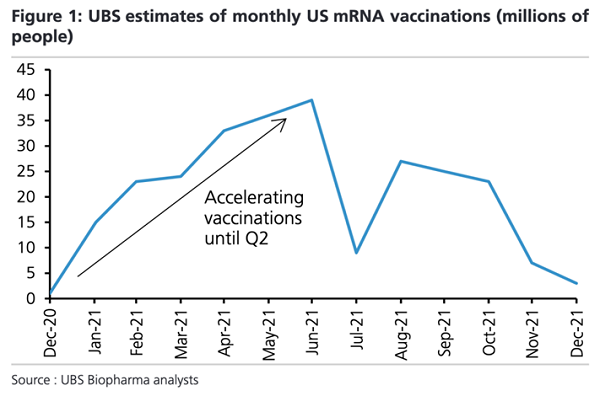

A report from UBS, for example, says investors are likely not being bullish enough, putting a 4,100 price target on the S&P 500, or a 12.4% gain from here.

But UBS itself says this could be too low, adding that it sees an “upside case on even higher valuations as more likely.” And with that, it says a 20% gain could be on the horizon.

The vaccine is just the tip of the iceberg in this report.

With about 80% of the population receiving the vaccine by the end of 2021, the report suggests herd immunity could be reached this summer. That, says UBS, will cause a shift in spending from e-commerce to travel, transportation and entertainment. This would be a boon to companies from American Airlines (AAL) to AMC Theaters (AMC).

That, in turn, will drive more jobs and more spending in other sectors and a rising tide to lift all boats. Or so the theory goes.

UBS is far from alone in their optimism. Canadian investment bank CIBC released its Economics Insights report in early December stating that 2021 is the beginning of a long period of economic prosperity. “There are reasons to believe that growth in subsequent years could surprise consensus expectations to the upside,” the report says, adding that GDP growth in 2021 will be over 4%, over 3% in 2022 and possibly higher in the years to come.

Those growth rates, by the way, are better than anything we’ve seen for over a decade.

CIBC’s reports are usually cautious, contemplative and comprehensive—they encompass the kind of restraint one would expect from a Canadian bank. Yet this report speaks of a coming boom.

The Cautious Response

Could these analysts be right? Of course they could, and I can’t say I’m much more pessimistic than them. But in the immediate few months, dissemination of the vaccine, acceptance of the vaccine and consumers’ confidence of the vaccine’s efficacy are crucial to getting the economy back on track. And while the UK, Canada and USA have approved the vaccine, there are still many countries where the vaccine is out of reach, which means it could take a lot longer for COVID-19 to end.

The longer it takes, the less patient the market will be, and the likelier it is that we’ll have a short-term dip in stocks before a longer-term rise kicks in.

Conditions like these make the Nuveen Dow 30SM Dynamic Overwrite Fund (DIAX) worth your consideration. This closed-end fund (CEF) has a 7.3% dividend yield and trades for 9.6% below the value of its portfolio (or the discount to NAV in CEF-speak). DIAX invests in the Dow Jones Industrial Average—the blue chip stocks that are among the least volatile on the market, while boasting the strongest cash flows. Top holdings include McDonald’s (MCD), Visa (V) and Home Depot (HD).

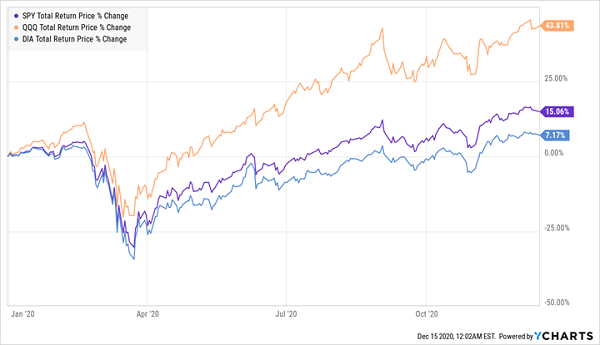

And looking at this year’s returns for the big indices, the Dow Jones looks the most compelling by far.

A Contrarian’s Time to Buy

As you can see, the Dow, shown above in blue through the performance of the SPDR Dow Jones Industrial Average ETF (DIA), is underperforming the benchmark ETFs for the S&P 500 and NASDAQ. Short-term underperformance like this often means the market is too heavily concentrated in one place, and it’s about time for investors to cycle elsewhere.

And if we do get a selloff, large cap stocks, with their historically lower volatility and household brand names, are where many investors are likeliest to go.

So why not buy DIA instead of DIAX? Because the CEF gives you an additional layer of protection by selling covered-call options on its portfolio. These are contracts that give buyers the right to buy DIAX’s holdings in the future at a fixed price, and DIAX sells these contracts in exchange for cash it passes to us as dividends.

That’s why DIAX’s 7.3% yield is nearly three times greater than DIA’s yield, even though both funds invest in the same companies.

Plus, since DIAX trades at a discount (unlike DIA) you get that portfolio for less than you’d pay if you bought the 30 Dow stocks on the open market or through an ETF. This makes DIAX all the more compelling for a future in which the market turns to large caps as a safe haven.

— Michael Foster

Urgent Note From the Publisher [sponsor]

Kevin Wallen here—I’m the publisher here at Contrarian Outlook.

I’m breaking in here to tell you that Michael has identified 5 other CEFs that are even better buys than DIAX for the year ahead.

Like DIAX, these 5 funds have been totally overlooked in the herd’s rush into stocks. But there’s a critical difference here—TWO differences, actually:

- These 5 urgent buys sport even bigger discounts than DIAX, and …

- They pay bigger dividends, too!

These 5 funds yield an outsized 8%, on average—and that’s just the average! One of these stout income plays sends out an incredible 9.1% dividend and pays you monthly, too. Drop, say, $100K into this fund and $9,100 in dividend cash comes back to you every year.

Imagine what a huge yield like that could do for your retirement plans.

Due to these 5 funds’ massive discounts, we’ve got them pegged for gains of at least 20% in 2021. And if we do see another crash, these big discounts will help cushion these funds’ prices.

Either way, we’ll still collect their massive 8% dividends!

Small Funds, Big Upside

These 5 funds are all current recommendations of Michael’s CEF Insider service, where he focuses on CEFs with market caps under $1 billion—the sweet spot where the biggest gains, and dividends, in CEFs live.

The best way for you to discover the profit-making power of smaller CEFs is to check them out for yourself. That’s why I’ve arranged a no-risk 60-day trial to CEF Insider for you. It comes your way along with the names and tickers of these 5 “win either way” CEFs.

I’m ready to share everything with you now. Go here to get full details on these 5 high-yield funds and start your no-risk trial to CEF Insider today.

One quick final note: you do need to act quickly here. Because these are smaller funds, we need to keep our CEF Insider membership small and nimble. Don’t miss out. Get the full story now.

Source: Contrarian Outlook