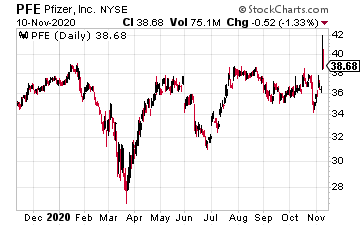

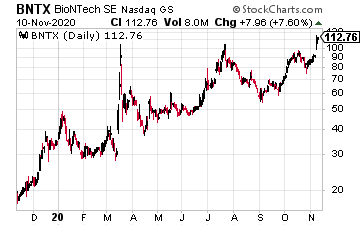

There was great news this week about the novel coronavirus vaccine being developed by Pfizer (PFE) and Germany’s BioNTech (BNTX).

The vaccine has been found to be more than 90% effective, and, if approved, it will be the first vaccine ever that uses novel mRNA technology.

These results (although early and not independently vetted) far exceed the Food and Drug Administration’s (FDA) criteria for approving a coronavirus vaccine. The FDA mandates an efficacy of at least 50% in placebo-controlled trials. No vaccine is 100% effective, of course, but 90% is incredible.

Assuming the FDA gives it the green light, the vaccine will be available for use on a limited basis by the end of the year.

Assuming the FDA gives it the green light, the vaccine will be available for use on a limited basis by the end of the year.

The two companies said that the drug would be submitted to the FDA for emergency approval (EUA) within a matter of weeks.

Pfizer and BioNTech said that up to 50 million doses of the vaccine could be manufactured before the end of the year, and a further 1.3 billion doses could be produced in 2021.

This blockbuster news brings up an intriguing investing question:

This blockbuster news brings up an intriguing investing question:

how big of an investment opportunity is the global vaccine market?

The Vaccine Investing Opportunity

A couple of major Wall Street firms attempted to answer that question recently.

The analysts—from Morgan Stanley and Credit Suisse–assumed that people will need to get a coronavirus vaccine every year, just like with the flu.

Based their forecasts on a projected cost for the vaccine of about $20 a dose, the analysts calculated that the future coronavirus vaccine market could be worth more than $10 billion a year.

This is equivalent to the annual revenue from ten blockbuster drugs!

This estimate actually seems reasonable. The analysts took a conservative approach saying that only people who get a flu vaccine would also get a vaccination to ward off the coronavirus that causes COVID-19. They also only considered the “developed” economies in their analysis.

It is likely that the revenues generated could be much higher. One of the analysts, Evan Seigerman of Credit Suisse, told the Financial Times he estimated the market could be worth $10 billion in the United States alone.

COVID Isn’t Going Anywhere

Don’t be fooled into thinking that the virus will soon be gone and the demand for coronavirus vaccines will quickly disappear. Many scientists and pharmaceutical companies believe this virus is now endemic, meaning it is going nowhere fast and will likely circulate for many, many years.

In the real world, the large number of anti-vaxxers in the global population, including here in the U.S., means the virus will continue to spread. This will insure long-term need for coronavirus vaccines.

However, the market for the vaccines is unlikely to be a winner-take-all market in which only one or two drug companies will benefit. It is likely every vaccine approved by the FDA will be needed. Companies will then have to compete over how effective each particular vaccine is and for what population(s) they work best. For example, one vaccine may work better in elderly populations. Another may work better with overweight people, whose weight can hinder a vaccine’s effectiveness.

Still Many Known Unknowns

Former U.S. Defense Secretary Donald Rumsfeld once famously said: “…there are known unknowns; that is to say we know there are some things we do not know.” And that’s where we are at right now—there is still so much that is unknown about the virus and possible vaccines to tame it: How long will a vaccine-triggered immunity last? Will booster shots be needed? Only time can answer these and other questions.

Directly ahead of us will be the logistics problem. Many of the vaccines will be mRNA vaccines like Pfizer and BioNTech’s. These vaccines must be kept at much lower temperatures than, say, a flu vaccine to retain their effectiveness—in Pfizer and BioNTech’s case, at -94° Farenheit—and can only be kept for up to 24 hours at standard refrigerated temperatures.

There are very few of the ‘ultra-cold’ freezers out there. And they are certainly not at your local pharmacy or doctor’s office.

So for now, the best way to invest in vaccines is with a very broad ‘brush’. Buy a pharma company ETF or buy a handful stocks like Pfizer, Moderna, Johnson & Johnson and AstraZeneca.

— Tony Daltorio

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: Investors Alley