The beer industry has seen a huge disruption in 2020, Anheuser-Busch (NYSE:BUD) included. While many are bullish on the at-home alcohol trends, BUD stock has not responded in the same manner.

Shares are still down 35% from the 2020 high, which was hit on the first day of trading this year (ouch).

From the 2019 high, Anheuser is down almost 50%, and from the five-year high, shares are down 60%.

So why the attraction here? BUD stock represents value.

The stock kicks out a 2% dividend yield at a time where the 10-year Treasury yield sits at 0.65%.

Aside from a dividend yield that’s more than triple the 10-year, we’re talking about a long-term value play.

This name — for the right investor — could be a strong out-performer over the years, even though it has been a big under-performer over the last couple of years.

Pandemic Pains

Let’s address the novel coronavirus situation. While alcohol sales have been strong at big-box grocery stores, that hasn’t translated to success for beer makers. Why? Because restaurants, stadiums and venues remain closed or with only minimal attendance.

Think about it. There are hardly any pro-sports beer sales at the stadium. Restaurant occupation is still low, causing alcohol sales to dip there, too. No large format concerts taking place. While the at-home sales are a silver lining, the group simply can’t replace the commercial buyers.

Net-net, the pandemic has been a thorn in the side of beer makers. Like many industries, it’s stunted growth and disrupted supply chains.

However, investors need to realize that this new reality is not forever. In fact, the worst of it is (likely) in the rearview mirror. If that’s the case, companies like Anheuser-Busch only have one direction to go — and that’s up.

Breaking Down Anheuser-Busch

Because of this year’s disruptions, analysts expect sales to dip 12.3% in 2020. All things considered, a 12% haircut to revenue isn’t that bad. However, earnings are the real pain point. Consensus expectations call for a 50% decline in profit.

That is the painful, somber situation as BUD stock and many other companies work through our new reality.

There is a bright spot though, which is that the worst of the situation seems to be behind us. While coronavirus cases persist and there is concern that the virus will linger, other positives are developing. The sports world is back in action and biotech companies continue to make headway on a vaccine. They’re even developing a test-andtrack app that may allow larger events and activities to take place.

All of this could and should help re-accelerate the economy, which would be a big plus for Anheuser-Busch and its peers. Even if things cool back off, at least these companies will have better control over their supply chains.

Based on next year’s earnings estimate of $3.23 per share — which would be 60% growth if this year and next year’s estimates are in-line with the end results — BUD stock trades at about 16 times forward earnings.

The valuation is becoming compelling even though Anheuser and the industry clearly face short-term headwinds. While the company struggled in the first six months of the year, it still churned out positive operating cash flow.

Admittedly, there is a lot of debt here. But that debt will allow the company to expand the brands it offers and hopefully create synergies across the board. For instance, on Sept. 30, it received clearance on its acquisition of Craft Brew Alliance (NASDAQ:BREW).

Bottom Line on BUD Stock

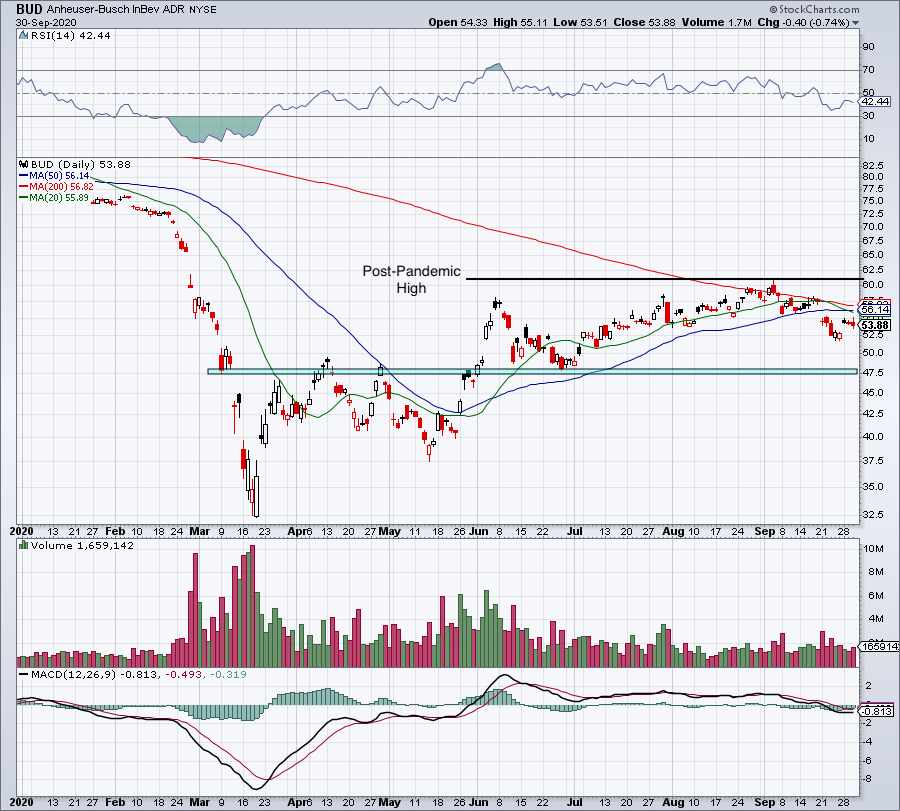

Source: Chart courtesy of StockCharts.com

Source: Chart courtesy of StockCharts.com

Keep in mind, this isn’t a short-term turnaround. BUD stock has been beaten down for years and still faces plenty of headwinds. However, this story isn’t going away. Global consumers are still going to drink beer. One day even, they will head back to the pub without a mask and line up to pack stadiums for sporting events and concerts.

Admittedly, BUD stock has already bounced from the March lows. At this point though — with the markets hitting new all-time highs this summer — there’s something seriously wrong with a stock if it’s still at or below its March low.

Thankfully, Anheuser isn’t one of them.

Still, if investors wait for the comeback to come to life, they will have waited too long with this one. As hard as it may be at times, one has to buy when there is pain in these names. Right now, BUD stock has plenty of pain, although I believe its business has seen the worst of the situation.

On the charts, the 200-day moving average continues to act as resistance. In fact, the stock is below all three major moving averages. Reclaiming them puts a rally up toward the post-pandemic high in play. Above that and this name can gain some mojo.

On the downside, a break of the September lows near $52 could trigger a move toward the $47 to $48 area. For those that plan on accumulating BUD stock, a dip back into the $40s would be a great opportunity.

— Matt McCall

Millionaire Investor Says Second Boom in AI Begins Now [sponsor]Louis Navellier has been ahead of the AI market at every turn. He picked Nvidia way back in May 2019. It's up 2,011% since. He made 372% on Cadence Design and 1,810% on Super Microcomputer. Now he says a second boom in AI is about to begin.

Source: Investor Place