The spread of the novel coronavirus continues to cause volatility. In fact, investors are concerned about the possibility that the coronavirus will slow economic growth, despite stocks’ record-breaking earnings reports.

While this fear pulled down stocks across every industry last week, [Monday] saw a spirited market rally.

What’s driving the market right now is emotion.

And if we know anything, it’s that emotions change.

The moment the fear dissipates, stocks that survived the coronavirus’s economic effects will rise.

So you need to know the best way to meet this movement head-on and find out where the opportunities lie without trading on emotion.

Those of you who have followed me know that’s exactly how I trade. I look at stocks’ proven market performance using the powerful, predictive tool that I’m going to show you in a minute.

If anything is reliable in this current fear-driven market, it’s proven historical data. And according to the patterns I’m seeing, there’s one stock that heads skyward around this time of year, with a chance for you to collect a nice profit by March 4…

How the Market’s Most Powerful Predictor Delivered a 200% Return

My Money Calendar tool has predictive power unlike any other tool out there.

It scrutinizes billions of data points every single day in order to reveal a sequence that not one in a million people have ever seen – helping me deliver a trade opportunity designed to give you the best shot at extraordinary payouts.

In order to identify simple, low-risk, high-reward options trades, the Money Calendar tracks stock moves that have repeated 90% to 100% of the time… for the last DECADE.

That means we’re looking for reliable stock movements that have occurred in at least nine of the last 10 years.

And that’s just what I have for you today…

Pharmaceutical company Bristol-Myers Squibb Co. (NYSE: BMY) performs consistently well over the 22 days following Feb. 3.

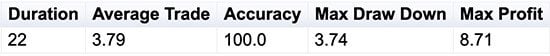

That’s been a proven fact for the past 10 years. One-hundred percent of the time, BMY has produced an average stock profit of $3.79, with a max profit of $8.71, over this 22-day time frame:

(For those not yet familiar with the Money Calendar, “Max Draw Down” is the reduction in account equity as a result of a trade or series of trades.)

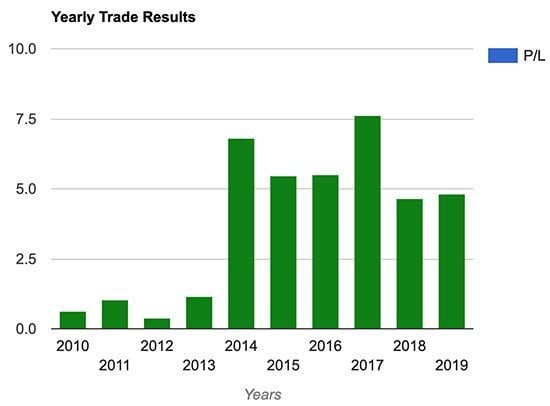

The individual yearly trade results are below, clearly indicating that over the past 10 years (from 2010 to 2019), BMY has risen over this 22-day time period, with the green bars showing how high the stock rose (in dollars):

In fact, just a few months ago, my readers were able to turn a similar bullish move from BMY into an almost 200% return.

Now, let’s look at a past pattern to further reinforce that my Money Calendar patterns really work. On Sept. 5, 2019, the Money Calendar alerted me of a potential trade on the pharmaceutical company.

This chart showed me that over the past 10 years, BMY had gone up over a particular period of time. So, I recommended my readers purchase a call option on the stock for $1.69, or $169 for control over 100 shares.

At the time, BMY was trading around $48. But only a little over three weeks later, on Sept. 30, the stock had risen to $51 – just as the Money Calendar predicted. So, my readers sold half of their position for $3.38, doubling their money on a 5% jump.

But the profit-taking wasn’t over yet. They still had half the position open – and on Oct. 18, the stock rose yet again. This time, it was trading around $53, making for a 9% increase.

My readers were able to sell the rest of their calls for $5.06, a 199.41% gain. They nearly tripled their money on a 9% stock gain, and it was all thanks to the Money Calendar.

Now, this predictive tool has identified a pattern on BMY with 100% accuracy. And today is your time to get in.

— Tom Gentile

Source: Money Morning