Worried about a 2018 (or worse, a 2009) repeat?

Good news: I’ve got a closed-end fund (CEF) that should be on your list no matter what happens: it carries a special “insurance” policy if markets head south; it’s nicely positioned to gain when markets rise; and—the cherry on top—it pays a massive 10.3% dividend.

But before we get to this all-weather fund, I have something I need to tell you about those pullback worries: they’re way overblown.

Because despite fear-mongering headlines, my latest research shows there’s every reason to expect stocks to hit all-time highs again—and soon. Here are three reasons why.

Reason #1: More Houses Changing Hands

Home sales were a big worry in 2018, with some markets dipping as interest rates rose (and pricey spots like Seattle showing signs of a 2008-style crash). That raised fears of a domino effect, tipping the whole economy into recession.

Well, those worries are over.

Cheap Mortgages Return

With interest rates plunging, home sales are up, and real-estate fears are subsiding.

Lower Rates Keep Buyers Bidding

While sales aren’t yet where they were at a couple years ago, the trend is positive—and it shows no sign of stopping, thanks to another big economic driver.

Reason #2: Jobs, Jobs, Jobs

Americans are buying more houses because they have more money. The trend here is indisputable, and it hasn’t slowed, no matter what scary trade-war headlines say.

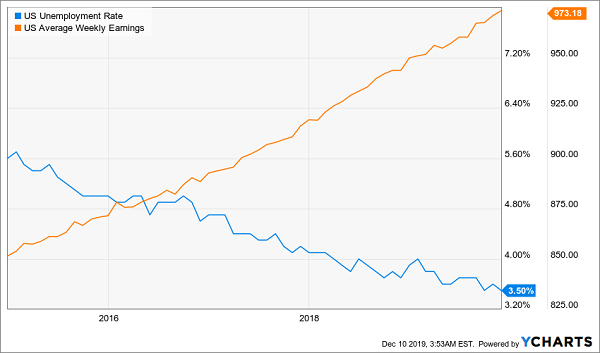

2 Ironclad Trends

In short, wages have been rising for years, and gains have sped up as the unemployment rate dives. At 3.5% unemployment, America is technically at full employment, where anyone who wants a job can get one. While this trend will have to end eventually, there’s no evidence we’re anywhere near that point.

Reason #3: The Economy: A Straight Line Up

The big headline is that GDP growth is still strong, with the most recent reading of 2.1% in line with growth trends over the last five years.

Economic Growth Still Solid

Some headlines have tried to stoke fear by noting that the growth rate has decelerated. While that’s true, growth has slowed many times since 2009, in which time stocks have risen over 200%. Unless we see two quarters of growth below 1.5%, there’s little reason to fear.

And that’s unlikely, thanks to what two lesser-known indicators are saying.

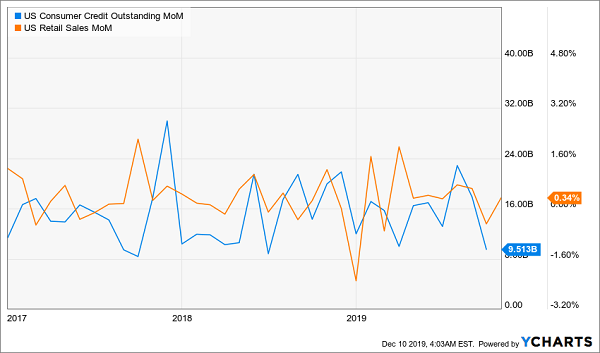

2 Reliable Signals Paint a Placid Picture

Consumer credit and retail sales are rarely looked at together, but they should be. Over the last few years, credit has stayed range-bound, showing that consumers aren’t overindulging. But they aren’t shying away from stores, either, with retail-sales growth positive for almost all of 2019 and at a steady pace similar to the earlier years of this expansion.

In short, the economy is still on the healthy, steady-growth path we’ve seen for years, with neither bubble nor collapse likely soon.

About That “Safety-First” Fund I Mentioned Earlier …

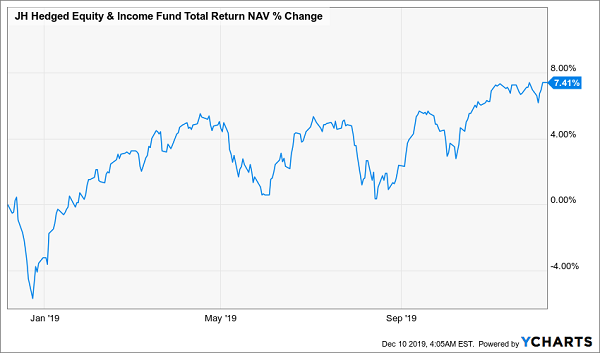

But if you’re still hesitant, there’s one way to get into the market while hedging your bets: the John Hancock Hedged Equity & Income Fund (HEQ).

Solid Returns in All Weather

HEQ buys mid-cap and large-cap stocks from around the world. Familiar names among its top 10 holdings include Verizon Communications (VZ), Enbridge (ENB), Bank of America (BAC) and Philip Morris International (PM).

If you’re worried about the American economy, HEQ gives you instant diversification, with exposure to Japan and Europe, its largest holdings outside of America (which is 41% of the fund), plus some small investments in Russia (2%), China (1.8%) and other emerging markets.

In addition, the fund uses options as a kind of insurance in volatile markets, helping lower your exposure to a big drop. The way this works is simple: the fund will sell contracts offering buyers the chance to buy the fund’s assets at today’s prices, even if they go down in the future, essentially locking in value before a crash.

The real payoff? Dividends. Since those options result in a cash income stream for the fund, HEQ yields a massive 10.3%. And when markets are more volatile, the income it gets from those options will just go up.

Forget HEQ: This 9.1% Yielder Skyrocketed 193% (and that’s just Act 1!)

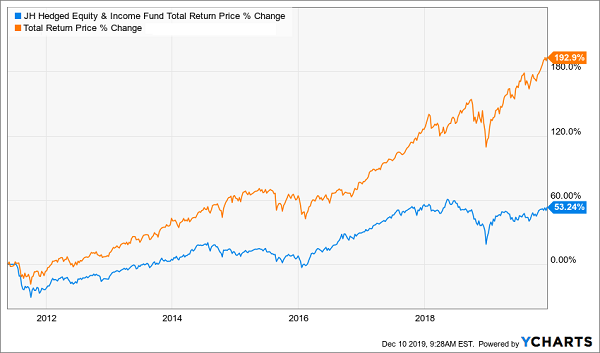

Even though it’s tempting to go with a “safety-first” option like HEQ, I’d urge you to stick with “plain vanilla” CEFs that simply hold stocks directly. That’s because these “plain-vanilla” options tend to beat funds with other strategies.

So even though HEQ might keep you from having to break out the Rolaids every now and then, it could leave you short in the long run, compared to one of my favorite “straight stock” CEFs:

“Plain Vanilla” Fund Outruns HEQ

— Michael Foster

Sponsored Link: Here’s something else I think you’ll like: unlike HEQ, which trades at just a 3% discount to NAV (another way of saying the fund trades for 3% less than the value of its portfolio), my pick trades at a ridiculous 11% discount.

That sets us up for some nice upside as more investors discover my pick’s outsized dividend (a 9.1% yield today) and make their way in, driving my pick’s market price up, and whittling away its 11% discount.

You do not want to miss this pick. It’s part of an exclusive 5-fund “mini-portfolio” that I see as perfect for 2020. Together, these funds yield an eye-popping 8%—enough to hand you $8,000 in dividend cash by this time next year. Plus, all of these funds trade at big discounts, like the 11% I just showed you.

Bottom line? I expect 20% price upside from each of them by Christmas 2020, so you could be looking at another $20,000 in upside, in addition to your $8,000 in dividend income.

Don’t let these dividend-paying bargains slip by: discover all the details on these 5 funds for yourself—names, tickers, dividend histories, best-buy prices and everything else I have them—right here.

Source: Contrarian Outlook