The Dow Jones fell 3.05% after the yield curve inversion saw the two-year yield rise above 1.628% and the 10-year yield go below 1.619% on Aug. 14, the signal that’s predicted every recession. But it’s not time to panic. It’s actually good news for one sector.

We’ll show you why this signal has been historically good for tech stocks; plus, we’ll even show you the best one to own right now.

A yield curve inversion happens any time long-dated Treasury yields drop below short-term yields.

But the inversion that predicts a recession is when the 10-year yield drops below the two-year yield, which is exactly what happened on Aug. 14 and again on Aug. 21.

According to FactSet, the 10-year yield briefly dipped to 1.619%, while the two-year yield went above 1.628%.

It was the first time since 2005 that the two-year yield curve rose above the 10-year yield.

A mere two years after the 2005 inversion, the economy entered what would become the Great Recession.

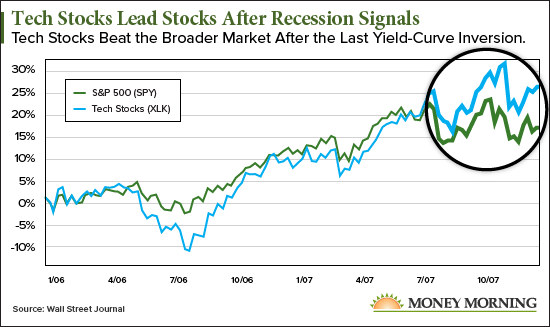

But what many investors might not realize is tech stocks soared between the yield curve inversion in 2005 and 2008. In fact, Bank of America Merrill Lynch says tech stocks have a history of beating the broader market after a yield-curve inversion going all the way back to 1965.

Take a look at how it played out after the 2005 inversion in the chart below – tech stocks outpaced the S&P 500 by more than 10%…

As you can see, this is no time to panic.

As you can see, this is no time to panic.

That’s why we’re bringing you one of the best tech stocks to buy right now. We found this tech stock using our Money Morning Stock VQScore™ system – and it’s an absolute buy.

In fact, it could pop by as much as 65% over the next 12 months…

One of The Top Tech Stocks to Buy Right Now

HealthEquity Inc. (NASDAQ: HQY) is an Arizona-based health insurance and savings account company. And while it’s down following the yield-curve inversion, it’s a breakout star in the making.

But that’s not the only thing making this one of the top tech stocks to buy right now. In fact, the stock has performed very well in spite of a few key factors. And it still has experts in the field – like Money Morning Defense and Tech Specialist Michael A. Robinson – bullish on it even after its 25.5% dip.

That’s because it’s defying the odds in the current political landscape. Between 2018 and 2019, its revenue grew 25% to $287.24 billion while its net income grew 56% to $47.36 billion.

And that trend has continued into 2019. Its revenue between January and April grew 15% while its net income rocketed 219% to $41.82 billion, as health insurance has become a hot debate once again.

During almost every election, candidates talk about health insurance reform and ending private insurance. And this year is no different. In fact, several candidates like Bernie Sanders and Elizabeth Warren have “healthcare for all” at the forefront of their campaign messaging.

While some investors may have fears investing in private insurance companies with talks of universal healthcare around the corner, they’re forgetting one thing: HealthEquity’s increased success comes from its health savings accounts (HSAs).

These have become crazy popular among consumers since it gives patients a variety of choices for their healthcare spending.

HealthEquity has over 4.8 million HSAs and roughly $9.7 billion in assets. Plus, between 2016 and now, the company’s earnings per share have grown on average 49% – that’s basically doubling every year and a half, according to Michael A. Robinson.

In fact, the company’s forecast to beat its $0.35 earnings estimate for Sept. 9 – marking it as the fifth quarter in a row where the company has outperformed projections.

Plus, HealthEquity is making moves to continue its growth. HealthEquity bought out WageWorks with a $2 billion deal, uniting two of the United States’ biggest HSA companies.

Now, HealthEquity has 115,000 company clients – two-thirds of which are Fortune 500 firms. Because of this, Michael A. Robinson thinks HealthEquity’s earnings could grow another 45% in the next three years.

HealthEquity stock currently trades for $60.75, but it has a target high price of $100. That’s a potential 65% growth in share value over the next 12 months. And it even has a VQScore of 4.3 – meaning it’s an absolute buy right now.

So, taking all that into account, this is one of the best tech stocks to own right now to avoid all the market panic. And it’s why HQY is definitely a tech stock to buy.

— Daniel Smoot

Source: Money Morning